Get the free GST RATE INCREASE ARE YOU PREPARED

Show details

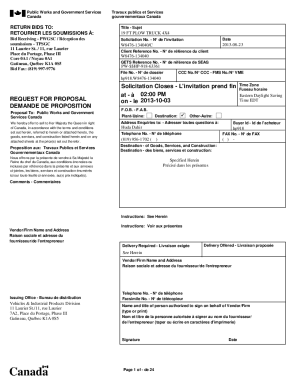

GST RATE INCREASE ARE YOU PREPARED? Basic InformationCalculating the new rate of GST? When does the new rate start? The new tax fraction for calculating the GST component of prices will change to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gst rate increase are form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gst rate increase are form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gst rate increase are online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gst rate increase are. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out gst rate increase are

How to fill out gst rate increase are

01

Gather all the necessary information related to the GST rate increase, including the new rate, effective date, and any specific guidelines or instructions provided by the tax authority.

02

Identify the goods or services to which the GST rate increase applies. This can be done by referring to the notification or circular issued by the tax authority.

03

Update your accounting or invoicing system to reflect the new GST rate. This may involve modifying existing tax codes or creating new ones for the increased rate.

04

Communicate the GST rate increase to your customers or clients, especially if it affects the prices of your products or services. This can be done through email notifications, updated price lists, or any other suitable means of communication.

05

Revise any contracts or agreements that include GST-related terms to reflect the new rate. This may involve renegotiating prices or updating terms and conditions.

06

Train your employees or staff members on the changes in the GST rate and how it impacts their roles and responsibilities. This will ensure smooth implementation and compliance with the new rate.

07

Regularly review and reconcile your GST transactions to ensure accurate reporting and compliance with applicable laws and regulations.

08

Stay updated with any further developments or changes related to the GST rate increase through official announcements or notifications from the tax authority.

Who needs gst rate increase are?

01

Businesses and individuals who engage in the sale or provision of goods or services that are subject to GST.

02

Suppliers or vendors who need to collect and remit GST to the tax authority on behalf of their customers or clients.

03

Tax consultants or professionals who provide advisory services related to GST and assist their clients in complying with the tax requirements.

04

Government agencies or departments responsible for monitoring and enforcing GST compliance.

05

Individuals or entities involved in cross-border transactions or import/export activities, as GST rate increase may have implications on the customs duty and tax calculations.

06

Consumers or end-users who need to be aware of the GST rate increase to accurately calculate the final price of goods or services they purchase.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gst rate increase are directly from Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your gst rate increase are along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How can I get gst rate increase are?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific gst rate increase are and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I make changes in gst rate increase are?

The editing procedure is simple with pdfFiller. Open your gst rate increase are in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Fill out your gst rate increase are online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.