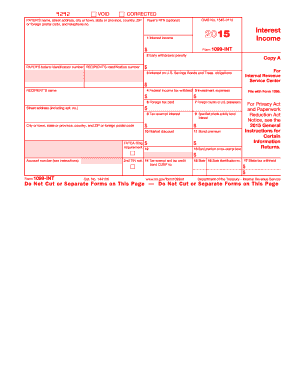

Get the free 1099 form pdf

Get, Create, Make and Sign

How to edit 1099 form pdf online

How to fill out 1099 form pdf

How to fill out the 1099 form 2015 PDF:

Who needs the 1099 form 2015 PDF?

Video instructions and help with filling out and completing 1099 form pdf

Instructions and Help about 1099 form pdf

Laws dot-com legal forms guide form 1099 — are is a United States Internal Revenue Service tax form used for reporting employment income other than salary and wages it is primarily used for payments from pension funds annuities retirement or profit sharing the form 1099 — are can be obtained through the IRS s website or by obtaining the documents through a local tax office the form is to be filled out and submitted by the employer on behalf of the employee receiving the income there are three copies of the form a red form which is to be submitted to the IRS and a copy for both the employer and employee the employer or payee must put their name and contact information in the upper left box below the contact information the payee must put their federal identification number as well as the identification number of the employee receiving the benefits below put the recipient of the funds name and contact information in the appropriate boxes for box one at the top of the form put in the gross distribution of funds covered by the form 1099 — are and the amount that is taxable if any in box two if the amount includes any capital gains enter the amount in box three if any federal income tax has already been withheld from the amount stated enter the amount withheld in box 4 if the employee has contributed to a qualified Roth IRA enter the amount contributed in box 5 if the employee has unrealized gain in the employer securities enter this amount in box 6 enter the distribution codes in box 7 and any additional income in box eight enter the total distributions percentage and employee contributions in box nine for box is 12 13 15 and 16 enter the state and local taxes withheld for the payments covered by your form 1099 — are put the state and local distribution amounts in both boxes 14 and 17 once the form 1099 — are is complete it is ready for submission to the IRS submit the red copy while retaining one copy for yourself and providing the employee the third copy to watch more videos please make sure to visit laws com

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 1099 form pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.