Get the free GOODS AND SERVICES TAX RULES, 20-RETURN FORMATS

Show details

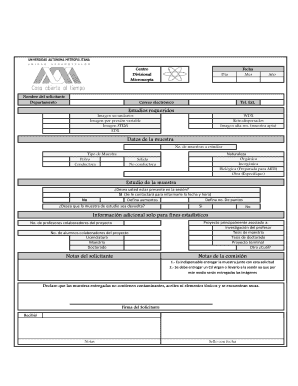

AUTO DRAFTED DETAILS 3. Gross Turnover of the Taxable Person in the previous FY. different from attracts reverse No. Date GSTIN No. location Shall be auto populated from counterparty GSTR1 and GSTR5 Debit/Cr Debit Note/credit Revised Debit This auto drafted form is generated by the GST system. FORM GSTR-2 DETAILS OF INWARD SUPPLIES/PURCHASES RECEIVED 1. GSTIN. 2. Name of Taxable Person 4. From Registered Taxable Persons including supplies received from unregistered person in case of reverse...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your goods and services tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your goods and services tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit goods and services tax online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit goods and services tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

How to fill out goods and services tax

How to fill out goods and services tax

01

Gather all the necessary documents, such as invoices, receipts, and financial records.

02

Determine your GST registration status. If you are required to register for GST, proceed to the next steps.

03

Access the online GST portal or obtain a physical GST form from the relevant taxation authority.

04

Fill out the GST form accurately and completely. Provide all the required information, including your business details, turnover, and applicable tax rates.

05

Double-check all the provided information to ensure its accuracy. Any mistakes or missing information can lead to delays or penalties.

06

Calculate the GST amount by applying the appropriate tax rate to your taxable sales or services.

07

Enter the calculated GST amount in the relevant field of the GST form.

08

Submit the filled-out GST form online or physically submit it to the taxation authority.

09

Keep copies of all submitted documents for your records and future reference.

10

Ensure timely payment of any GST liabilities and fulfill your obligations as per the taxation laws and regulations.

Who needs goods and services tax?

01

Businesses involved in the manufacture, trade, or provision of services are generally required to register for Goods and Services Tax (GST).

02

Individuals or entities with an annual turnover above a certain threshold, as defined by the relevant taxation authority, are also required to register for GST.

03

GST registration may be mandatory for businesses engaged in interstate or international trade, even if their turnover falls below the threshold.

04

Some jurisdictions may exempt certain goods or services from GST, but it is advisable to check with the specific taxation authority for accurate information related to your business or circumstances.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit goods and services tax online?

The editing procedure is simple with pdfFiller. Open your goods and services tax in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for the goods and services tax in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out the goods and services tax form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign goods and services tax and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your goods and services tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.