Get the free DISCLOSURE FORM FORM 114 Name

Show details

DISCLOSURE FORM 114 Name The Book of Discipline of the United Methodist Church (311.3.d.1) states each candidate shall submit on a form provided by the Board of Ordained Ministry, a notarized statement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your disclosure form form 114 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your disclosure form form 114 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit disclosure form form 114 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit disclosure form form 114. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out disclosure form form 114

How to fill out disclosure form form 114:

01

Start by reading the instructions: Before filling out the form, carefully review the instructions provided. These instructions will provide you with important information on how to properly complete the disclosure form form 114. It is crucial to follow these instructions accurately to ensure that your form is completed correctly.

02

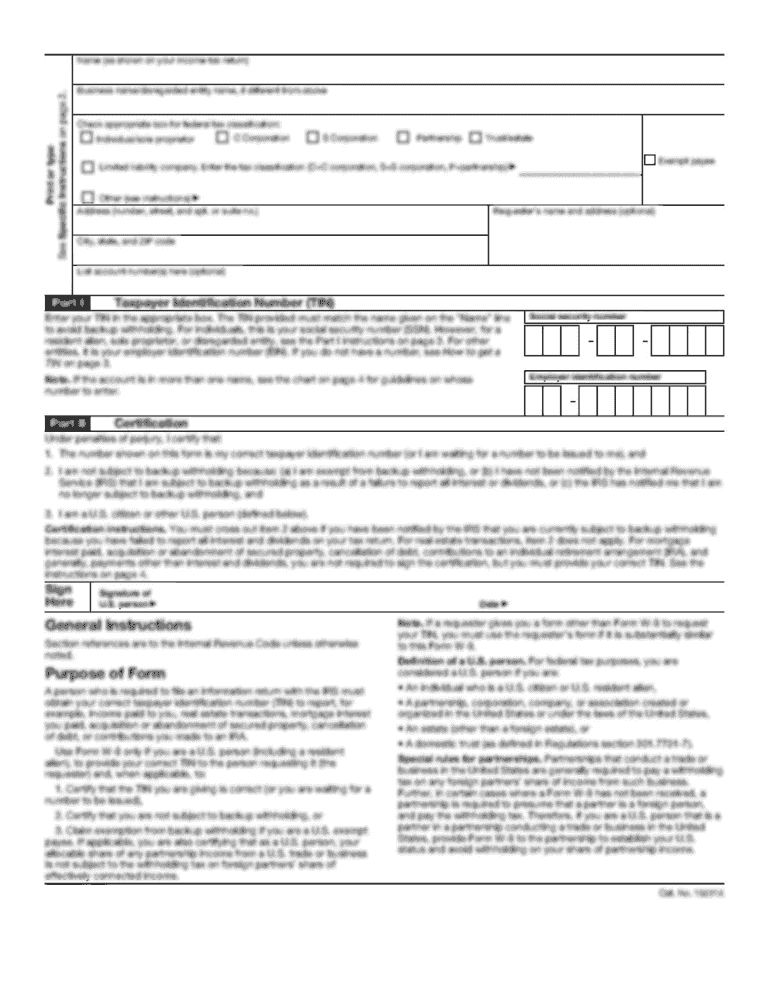

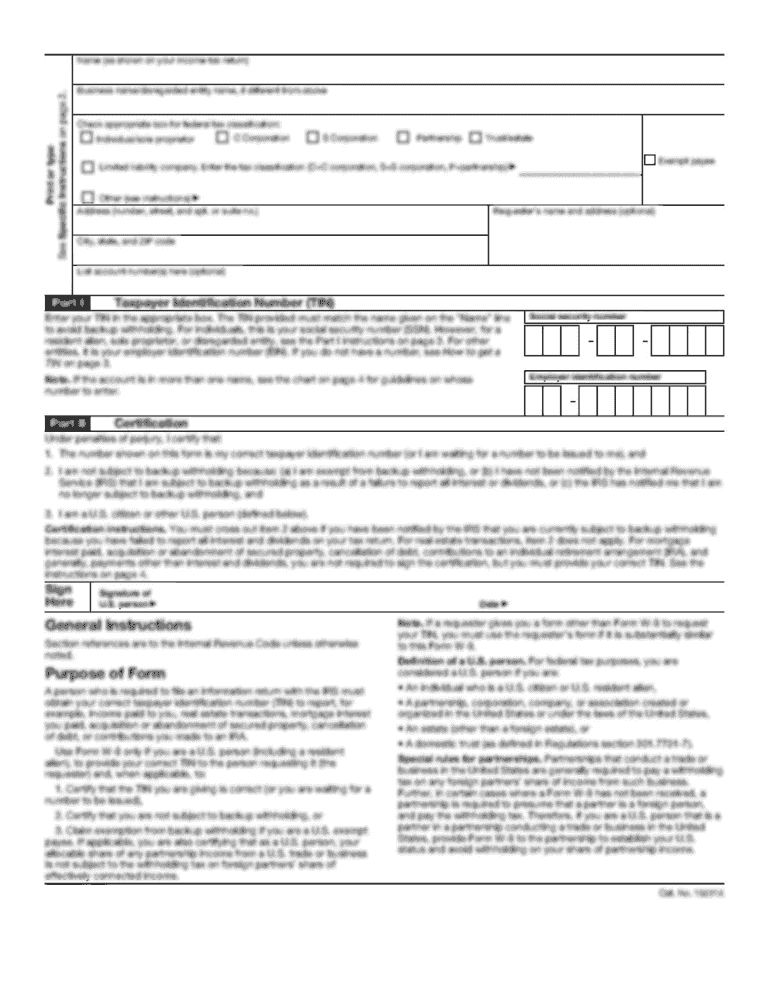

Provide your personal information: Begin by entering your personal information on the disclosure form form 114. This typically includes your full name, address, contact details, and Social Security number. Make sure to double-check the accuracy of the information you provide to avoid any mistakes.

03

Report your financial accounts: The primary purpose of disclosure form form 114 is to report your foreign financial accounts. In this section, you need to provide details about each account you hold outside of the United States. This includes the name of the financial institution, the account number, the highest value of the account during the reporting period, and the type of account (e.g., bank account, investment account).

04

Report other foreign assets: In addition to financial accounts, disclosure form form 114 may also require you to report certain foreign assets. This could include real estate properties, stocks, bonds, or any other significant assets you own outside of the United States. Ensure that you accurately provide the necessary information for each asset you need to report.

05

Review and certify the form: Once you have completed filling out the disclosure form form 114, take the time to review all the information you have provided. Make sure there are no errors or omissions. It is crucial to be thorough and ensure the form is accurate. After reviewing, sign and date the form to certify its accuracy.

Who needs disclosure form form 114?

01

U.S. citizens and resident aliens: A disclosure form form 114 is typically required for U.S. citizens and resident aliens who have financial accounts or significant foreign assets outside of the United States. This includes individuals who hold dual citizenship or Green Card holders.

02

Threshold requirement: The threshold for reporting is met if the combined value of your foreign financial accounts exceeds $10,000 at any point during the year. Even if you do not meet this threshold, it is still important to understand the requirements and determine if you need to file form 114 based on any other criteria.

03

IRS and Treasury Department: The disclosure form form 114 is used by the Internal Revenue Service (IRS) and the Department of the Treasury to track and collect information regarding U.S. citizens and resident aliens' foreign financial accounts. This form helps the government combat tax evasion and money laundering activities.

Note: It is always advisable to consult with a tax professional or seek guidance from the IRS for specific instructions and requirements related to filling out the disclosure form form 114.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is disclosure form form 114?

Form 114 is the Report of Foreign Bank and Financial Accounts (FBAR), also known as FinCEN Form 114. It is used to report a financial interest in or signature authority over foreign financial accounts.

Who is required to file disclosure form form 114?

Any U.S. person who has a financial interest in or signature authority over foreign financial accounts with an aggregate value exceeding $10,000 at any time during the calendar year is required to file Form 114.

How to fill out disclosure form form 114?

Form 114 can be filed electronically through the FinCEN BSA E-Filing System. The form requires information about the filer, the foreign financial accounts, and details on the maximum value of each account.

What is the purpose of disclosure form form 114?

The purpose of Form 114 is to help the U.S. government track and combat tax evasion through the reporting of foreign financial accounts. It is also used to identify potential money laundering activities.

What information must be reported on disclosure form form 114?

Form 114 requires information about the filer's personal details, the name and location of each foreign financial account, the maximum account value during the year, and details about joint accounts.

When is the deadline to file disclosure form form 114 in 2023?

The deadline to file Form 114 for the 2023 tax year is April 15, 2024.

What is the penalty for the late filing of disclosure form form 114?

The penalty for the late filing of Form 114 can be up to $12,921 per violation, or the greater of $129,210 or 50% of the balance in the account at the time of the violation.

How can I edit disclosure form form 114 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your disclosure form form 114 into a dynamic fillable form that can be managed and signed using any internet-connected device.

Where do I find disclosure form form 114?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the disclosure form form 114 in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit disclosure form form 114 online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your disclosure form form 114 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

Fill out your disclosure form form 114 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.