My Credit Matters Enrollment Agreement 2011-2024 free printable template

Show details

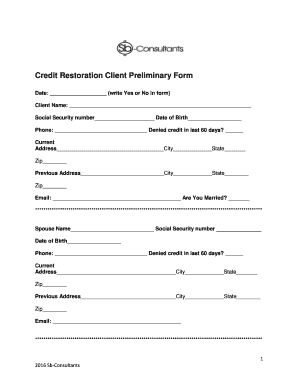

ENROLLMENT AGREEMENT first name middle last jr. Sr. physical address city state zip home phone work phone mobile dob / / social security# drivers LIC# state of issue date signature method of payment:

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your credit repair agreement form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit repair agreement form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit repair agreement form online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit credit repair agreement form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out credit repair agreement form

How to fill out credit repair agreement form:

01

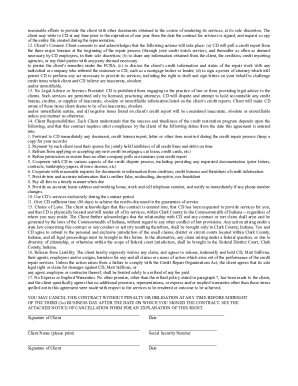

Start by reading the instructions provided on the form carefully. Ensure that you understand all the terms and conditions mentioned.

02

Fill in your personal information accurately, including your full name, address, contact information, and social security number. Provide any additional details required by the form.

03

Make sure to include all the necessary details about your credit history and the specific issues you are seeking to address through credit repair.

04

If the form requires you to attach any supporting documents, gather all the necessary paperwork, such as credit reports, letters from creditors, or any other relevant evidence.

05

Review the form for any errors or omissions before signing it. Ensure that all the information provided is correct and complete.

06

Sign the form where indicated and provide the date of signing. If required, have a witness or notary public present during the signing process.

07

Keep a copy of the completed form for your records.

Who needs credit repair agreement form:

01

Individuals with a history of poor credit or negative items on their credit reports may need a credit repair agreement form.

02

People who have experienced identity theft or fraud may require this form to dispute fraudulent accounts and restore their credit.

03

Individuals looking to improve their credit scores or repair their credit history can benefit from using a credit repair agreement form.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

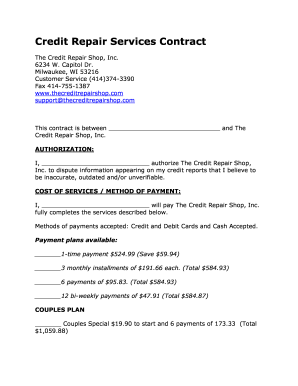

What is credit repair agreement form?

A credit repair agreement form is a legally binding document that outlines the terms and conditions between a credit repair company and a client. This form typically includes details such as the scope of services to be provided by the credit repair company, the fees and payment terms, the duration of the agreement, and the rights and responsibilities of both parties. The purpose of the credit repair agreement form is to ensure that both the credit repair company and the client have a clear understanding of the services to be provided and the expectations for the credit repair process.

Who is required to file credit repair agreement form?

The credit repair agreement form is typically required to be filed by individuals or companies who provide credit repair services to consumers.

How to fill out credit repair agreement form?

To appropriately fill out a credit repair agreement form, follow these steps:

1. Obtain the form: You can typically find credit repair agreement forms online on websites like legal or document template platforms. Make sure you download or print the form in a format that is easy to complete.

2. Read the instructions: Carefully go through the instructions provided on the form. This will help you understand how to complete the various sections properly.

3. Fill in personal information: Enter your personal details accurately in the designated sections. This may include your full name, address, contact information, social security number, and date of birth. Ensure your details are up to date and consistent with official documents.

4. Review the terms and conditions: Read through the terms and conditions section attentively. Make sure you understand the agreement's provisions and obligations before proceeding.

5. Provide the necessary financial information: The credit repair agreement form could require details about your current credit status like outstanding debts, credit utilization ratio, and any collections or charge-offs. Ensure you provide this information accurately.

6. Specify credit repair services: Indicate the specific credit repair services you are seeking assistance with. This may include items like credit report analysis, dispute assistance, credit counseling, debt negotiation, or other related services.

7. Agree to the terms: If you agree to the terms and conditions outlined in the agreement, sign and date the document accordingly. Some forms may also require a witness or a notary public to witness and authenticate your signature.

8. Keep a copy: Make a copy of the completed credit repair agreement form for your records. It's essential to have a copy for future reference.

9. Submit the form: Depending on the instructions provided, you may need to send the form electronically or physically. Follow the specified submission guidelines to ensure your agreement is received successfully.

It's highly recommended to consult with a legal professional or credit repair agency if you have any concerns or questions while filling out the credit repair agreement form.

What is the purpose of credit repair agreement form?

The purpose of a credit repair agreement form is to outline the terms and conditions between a credit repair company and a client who seeks their services to improve or repair their credit score. This agreement form typically includes details about the services provided, fees and payment terms, responsibilities of both parties, duration of the service, and other relevant provisions. It serves as a legally binding document that helps protect the rights and interests of both the credit repair company and the client.

What information must be reported on credit repair agreement form?

The specific information that must be reported on a credit repair agreement form may vary depending on the country or jurisdiction. However, here are some common details that are typically included:

1. Names and contact information: The form should include the names, addresses, and contact details of both the credit repair company or individual providing the service and the client seeking credit repair assistance.

2. Services provided: The agreement should outline the specific credit repair services that will be provided, such as credit report analysis, dispute resolution with creditors or credit bureaus, counseling or education on credit management, etc.

3. Fees and payment terms: The form should clearly state the fees for the credit repair services and how they will be charged (e.g., one-time fee, monthly fees, etc.). It should also specify the accepted forms of payment and any refund policies.

4. Duration of the agreement: The agreement should mention the start and end dates, or the period of time for which the services will be provided. It should also state the circumstances under which the agreement can be terminated by either party.

5. Client's rights and obligations: The form should include a section that outlines the client's rights and responsibilities, such as providing accurate and complete information, cooperating with the credit repair process, maintaining communication, etc.

6. Disclosures and disclaimers: The agreement form may include legally required disclosures or disclaimers, such as statements about guaranteed results, limitations on liability, legal compliance, and any potential risks or limitations of credit repair services.

It is important to note that credit repair laws and regulations may differ between jurisdictions, so it is advisable to consult local regulations or seek legal advice to ensure compliance and to include any additional required information.

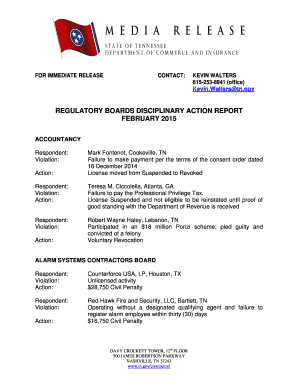

What is the penalty for the late filing of credit repair agreement form?

The penalty for the late filing of a credit repair agreement form can vary depending on the specific laws and regulations of the country or state. Generally, late filing can result in fines, penalties, or other repercussions. It is advisable to consult with a legal professional or regulatory authority to determine the exact penalty for late filing in a particular jurisdiction.

How do I make changes in credit repair agreement form?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your credit repair agreement form to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I fill out credit repair agreement form on an iOS device?

Install the pdfFiller iOS app. Log in or create an account to access the solution's editing features. Open your credit repair agreement form by uploading it from your device or online storage. After filling in all relevant fields and eSigning if required, you may save or distribute the document.

How do I edit credit repair agreement form on an Android device?

The pdfFiller app for Android allows you to edit PDF files like credit repair agreement form. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your credit repair agreement form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.