Get the free S I T E S - Military and Veteran Benefits, News, Veteran Jobs ...

Show details

STANDARD INSTALLATION TOPIC EXCHANGE SERVICE SITES Version 3 RELOCATION INFORMATION FOR Insect (Rose Barracks) Germany Information Date March 15, 2000, Visit the SITES Website at http://www.dmdc.osd.mil/sites

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your s i t e form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your s i t e form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit s i t e online

Follow the steps below to benefit from a competent PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit s i t e. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out s i t e

How to fill out s i t e:

01

Start by accessing the website or portal where you need to fill out the form.

02

Look for the specific form you need to fill out on the website. It could be a registration form, application form, or any other type of form.

03

Read any instructions or guidelines provided on the website regarding how to fill out the form. Make sure to follow any specific formatting or input requirements mentioned.

04

Begin by entering your personal information, such as your full name, contact details, and any other necessary identification details.

05

Fill in the required fields or sections of the form step by step. This may include providing information about your address, occupation, educational background, or any other relevant details.

06

Take your time to carefully review and double-check all the information you have entered before submitting the form. Make sure there are no typos or mistakes in your details.

07

If there are any optional sections or fields in the form, decide whether you want to fill them out or leave them blank based on your preferences or requirements.

08

If there are any supporting documents or attachments needed to accompany the form, make sure to upload or attach them as instructed on the website.

09

Once you have completed all the necessary sections of the form and reviewed your information, click on the submit button or follow the specified method to send the form electronically.

10

After submitting the form, you may receive a confirmation message or email acknowledging your submission. Keep a record of this confirmation for future reference if needed.

Who needs s i t e:

01

Individuals who want to apply for membership or registration to access certain services or resources provided by the website or portal.

02

Organizations or businesses that require users or customers to fill out specific forms for various purposes, such as job applications, surveys, or feedback submissions.

03

Government agencies or institutions that use online forms for various administrative procedures, such as applying for permits, licenses, or benefits.

Please note that the actual steps to fill out a form and the target audience may vary depending on the specific context or website you are referring to.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

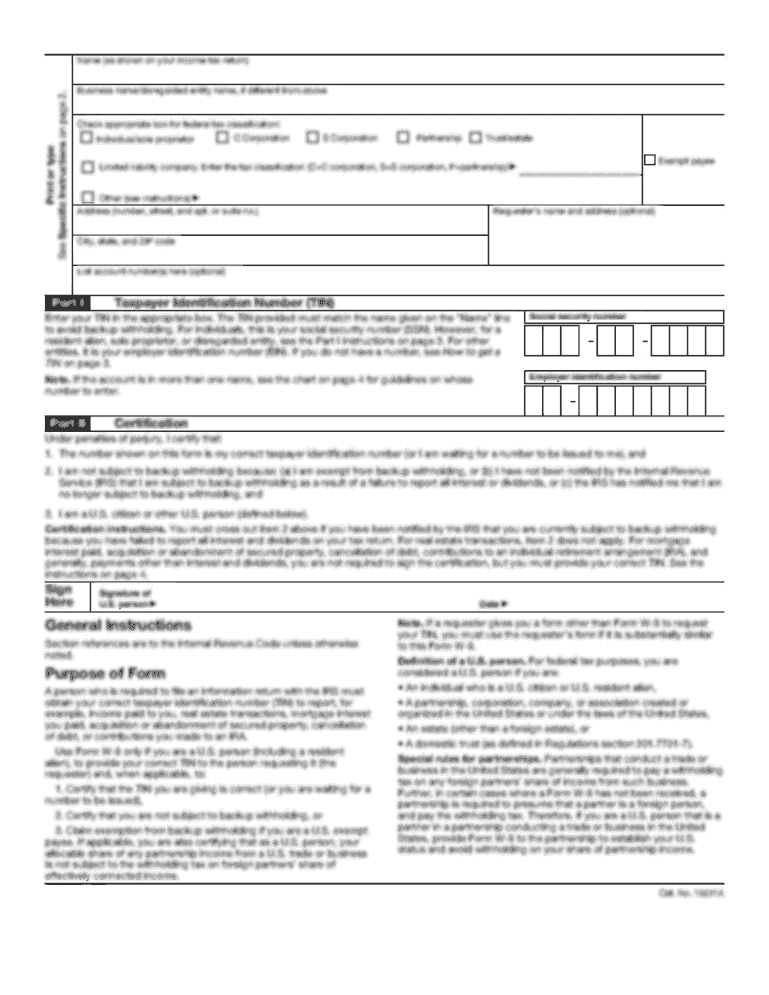

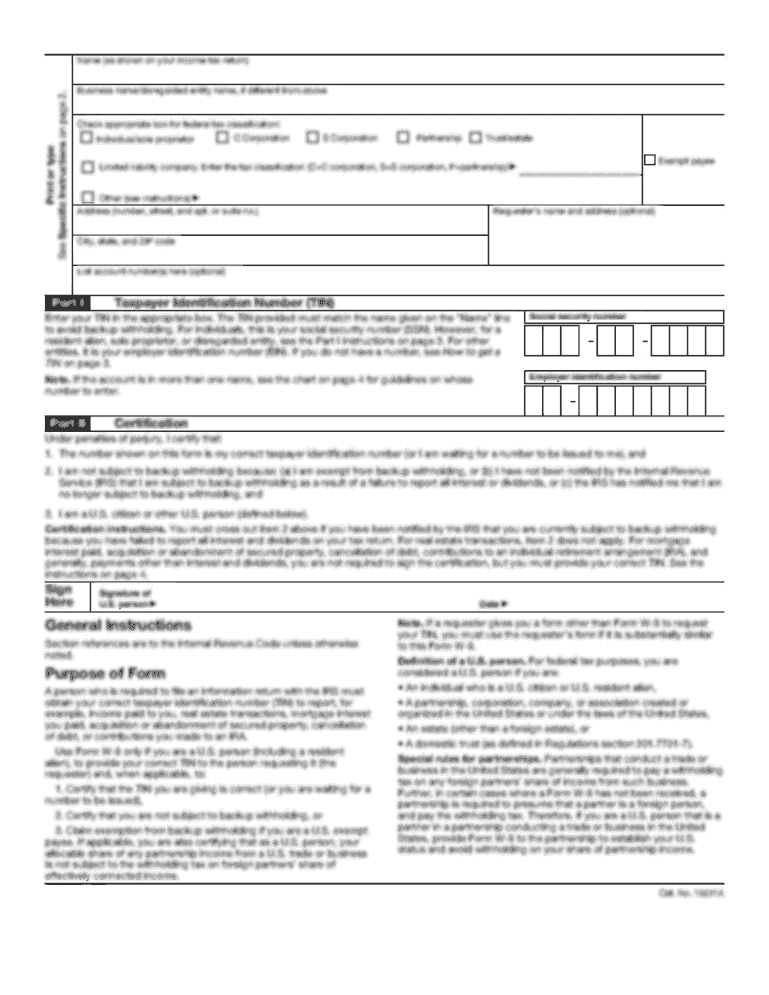

What is s i t e?

SITE stands for Statement of Information for Tax Exempt Organizations.

Who is required to file s i t e?

Tax exempt organizations recognized under section 501(c) of the Internal Revenue Code are required to file SITE.

How to fill out s i t e?

SITE can be filled out electronically using the IRS website or by submitting a paper form.

What is the purpose of s i t e?

The purpose of SITE is to provide the IRS with updated information about the tax exempt organization's activities, governance, and financial status.

What information must be reported on s i t e?

Information such as the organization's mission, programs, finances, and key employees must be reported on SITE.

When is the deadline to file s i t e in 2023?

The deadline to file SITE in 2023 is typically due by the 15th day of the 5th month after the organization's fiscal year ends.

What is the penalty for the late filing of s i t e?

The penalty for late filing of SITE can range from $20 to $100 per day, depending on the size of the organization's budget.

Where do I find s i t e?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific s i t e and other forms. Find the template you want and tweak it with powerful editing tools.

How do I execute s i t e online?

Filling out and eSigning s i t e is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit s i t e on an iOS device?

You certainly can. You can quickly edit, distribute, and sign s i t e on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Fill out your s i t e online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.