Get the free Utah State Tax Commission tax

Show details

Original ustc form Clear form Print Form 62001 Utah State Tax Commission tax. utah. gov 210 N 1950 W Salt Lake City UT 84134-0400 Get current sales tax rates at tax. If you need an accommodation under the Americans with Disabilities Act email taxada utah. gov or call 801-297-3811 or TDD 801-297-2020. Utah. gov/sales Sales and Use Tax Return TC-62M Multiple Places of Business Rev. 10/15 Acct. Start below this line. Monthly filers Compute the seller discount by multiplying the amount on line...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your utah state tax commission form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utah state tax commission form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit utah state tax commission online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit utah state tax commission. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

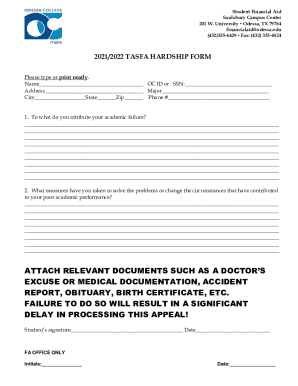

How to fill out utah state tax commission

How to fill out utah state tax commission

01

Gather all necessary documents such as income statements, previous year's tax return, and any relevant deductions or credits information.

02

Download the Utah State Tax Commission form from their official website or obtain a hard copy from their office.

03

Read the instructions provided with the form carefully to understand the requirements and any specific filing instructions.

04

Fill out your personal information section accurately, including your name, address, and social security number.

05

Provide all the requested income information, including wages, dividends, interest, rental income, etc.

06

Determine your eligible deductions and credits and accurately report them on the form.

07

Double-check all the entered information for accuracy and completeness.

08

Sign and date the form before submitting it.

09

Make a copy of the completed form for your records.

10

Submit the filled-out form along with any required supporting documents to the Utah State Tax Commission by mail or electronically as per their instructions.

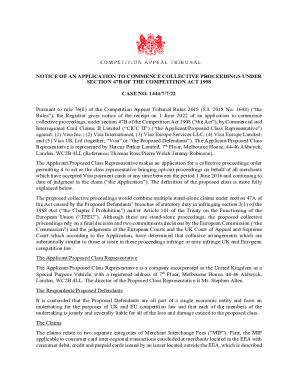

Who needs utah state tax commission?

01

Individuals who are residents of Utah and have income from various sources need to file the Utah State Tax Commission.

02

Businesses operating within Utah boundaries are required to file their taxes with the Utah State Tax Commission.

03

Non-residents who have earned income from Utah sources may also need to file with the Utah State Tax Commission.

04

Anyone who has received a notification or request from the Utah State Tax Commission to file their taxes must comply.

05

Certain exemptions or special cases may be eligible for filing exceptions, but it is advised to consult with a tax professional or the Utah State Tax Commission for clarification.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify utah state tax commission without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including utah state tax commission, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make changes in utah state tax commission?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your utah state tax commission to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete utah state tax commission on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your utah state tax commission, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

Fill out your utah state tax commission online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.