Get the free IT-20 Schedule E (flat) - forms in

Show details

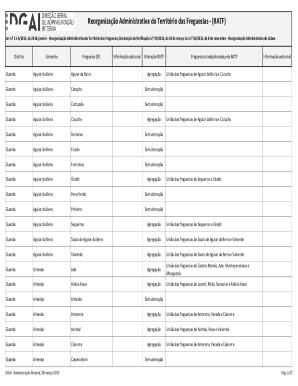

Omit cents - percents should be rounded two decimal places - read apportionment instructions. Part I - Indiana Apportionment of Adjusted Gross Income Column A TOTAL WITHIN INDIANA TOTAL WITHIN and OUTSIDE INDIANA INDIANA PERCENTAGE 1. Enter sum. 4b. c Indiana Apportionment Percentage Divide line 4b by 4 if all three factors are present. Sales between members of an affiliated group filing a consolidated return under IC 6-3-4-14 shall be excluded. The numerator of the receipts factor must...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your it-20 schedule e flat form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-20 schedule e flat form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-20 schedule e flat online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it-20 schedule e flat. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

How to fill out it-20 schedule e flat

How to fill out it-20 schedule e flat

01

To fill out the IT-20 Schedule E flat, follow these steps:

02

Begin by entering the required identification information at the top of the form, including your name, address, and federal employer identification number (FEIN).

03

Provide an overview of your business activities in Part 1, including the type of business and the date it started.

04

In Part 2, report your business income. Include all sources of income related to your business, such as sales revenue, rental income, and interest earned.

05

Deduct any allowable expenses related to your business in Part 3. This may include items like rent, utilities, employee wages, and supplies.

06

Calculate your net income or loss by subtracting your total expenses from your total income.

07

Transfer the net income or loss amount to line 1a of the IT-20 form.

08

If you have any subtractions or additions to your net income, provide the details in Part 4.

09

Complete the remaining sections of the form as necessary, including any applicable credits or deductions.

10

Double-check all the information you have entered and ensure it is accurate and complete.

11

Finally, sign and date the form to certify its accuracy and completeness. Keep a copy for your records and submit the original to the appropriate tax authority.

Who needs it-20 schedule e flat?

01

IT-20 Schedule E flat is needed by businesses that are required to file the IT-20 corporate income tax return in the state of Indiana.

02

It is specifically designed for businesses that have income or loss from rental real estate or royalties earned from patents, copyrights, and other intangible property.

03

If your business is engaged in any of these activities and operates in Indiana, you will need to complete the IT-20 Schedule E flat along with your corporate tax return.

04

It is important to consult with a tax professional or refer to the official guidelines provided by the Indiana Department of Revenue to determine if you are required to file this schedule.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the it-20 schedule e flat electronically in Chrome?

As a PDF editor and form builder, pdfFiller has a lot of features. It also has a powerful e-signature tool that you can add to your Chrome browser. With our extension, you can type, draw, or take a picture of your signature with your webcam to make your legally-binding eSignature. Choose how you want to sign your it-20 schedule e flat and you'll be done in minutes.

How do I edit it-20 schedule e flat on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign it-20 schedule e flat right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How do I edit it-20 schedule e flat on an Android device?

You can make any changes to PDF files, such as it-20 schedule e flat, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

Fill out your it-20 schedule e flat online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.