Get the free gov/form1098c

Show details

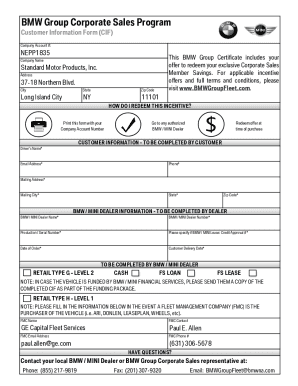

6109-4 all filers of this form may truncate a donor s identification number social security number SSN individual taxpayer identification number ITIN adoption EIN on donee statements. Truncation is not allowed on any documents the filer files with the IRS. A filer s identification number may not be truncated on any form. See part J in the 2016 General Instructions for Certain Information Returns. Provide the donor with Copies B and C of Form 1098-C or your own year 2016 file Copy A by...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your govform1098c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your govform1098c form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit govform1098c online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit govform1098c. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

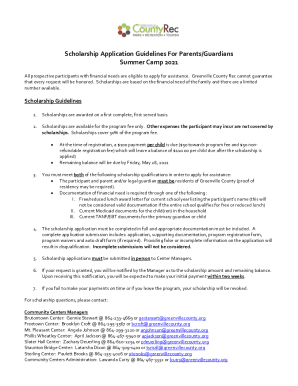

How to fill out govform1098c

How to fill out govform1098c

01

To fill out govform1098c, follow these steps:

1. Obtain the form: Download the govform1098c from the official government website or request a physical copy from the relevant authorities.

2. Read the instructions: Carefully go through the instructions provided with the form to understand the requirements and guidelines.

3. Gather necessary information: Gather all the required information and documentation related to the donor, the recipient organization, and the donated vehicle.

4. Provide donor information: Fill in the donor's name, address, tax identification number, and other requested details.

5. Enter recipient organization information: Include the name, address, tax identification number, and other necessary details of the organization receiving the donated vehicle.

6. Describe the donated vehicle: Provide a detailed description of the vehicle, including its make, model, year, Vehicle Identification Number (VIN), and any additional relevant information.

7. Determine fair market value: Determine the fair market value of the donated vehicle as per the guidelines provided in the instructions.

8. Calculate the deduction: Calculate the deductible amount based on the fair market value and any limitations mentioned in the instructions.

9. Sign and date: Sign and date the form appropriately.

10. Submit the form: Send the completed form to the designated tax authorities as instructed or file electronically if applicable.

Who needs govform1098c?

01

Govform1098c is needed by organizations that received a qualified vehicle donation as described in Section 170(f)(12) of the Internal Revenue Code. These organizations include tax-exempt organizations under section 501(c)(3) and other qualified entities eligible to receive tax-deductible charitable contributions. Individuals who made the qualified vehicle donation may also need govform1098c for tax filing purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in govform1098c without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit govform1098c and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

Can I create an electronic signature for the govform1098c in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your govform1098c in seconds.

How do I fill out govform1098c using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign govform1098c. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your govform1098c online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.