Get the free Delete Your Debt Promotion OFFICIAL RULES NO PURCHASE ...

Show details

The 104.3 K-HITS/WJMK-FM Delete Your Debt Promotion OFFICIAL RULES NO PURCHASE OR PAYMENT OF ANY KIND IS NECESSARY TO ENTER OR WIN. A PURCHASE OR PAYMENT WILL NOT INCREASE YOUR CHANCE OF WINNING.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your delete your debt promotion form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your delete your debt promotion form via URL. You can also download, print, or export forms to your preferred cloud storage service.

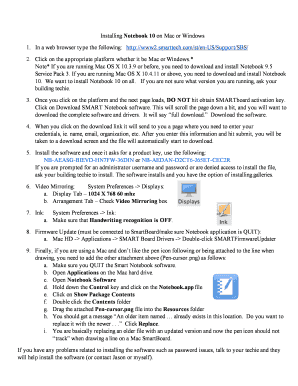

Editing delete your debt promotion online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit delete your debt promotion. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out delete your debt promotion

How to fill out delete your debt promotion:

01

Start by gathering all relevant financial information, including your outstanding debts, interest rates, and minimum monthly payments.

02

Evaluate your current budget and determine how much money you can allocate towards paying off your debts each month. This will help you create a realistic debt repayment plan.

03

Prioritize your debts based on interest rates or outstanding balances. Consider focusing on high-interest debts first to save money on interest payments.

04

Consider debt consolidation or refinancing options if they are available to you. This can help simplify your debt repayment process and potentially lower your interest rates.

05

Create a debt payment plan, outlining how much you will pay towards each debt every month. Stick to this plan as closely as possible to ensure consistent progress.

06

Cut back on unnecessary expenses and find ways to increase your income to free up more money for debt repayment.

07

Communicate with your creditors to negotiate lower interest rates or more favorable repayment terms if needed. Many creditors are willing to work with you to create a repayment plan that suits your financial situation.

08

Stay disciplined and motivated throughout the debt repayment process. Celebrate small victories along the way to keep yourself motivated.

09

Track your progress regularly to see how much you have paid off and how much closer you are to becoming debt-free.

10

Seek professional help if you are struggling to manage your debts. Debt counseling agencies or financial advisors can provide guidance and support during this process.

Who needs delete your debt promotion?

01

Individuals or households struggling with multiple outstanding debts, such as credit card debts, personal loans, or medical bills.

02

People who want to regain control over their finances and become debt-free.

03

Those who are looking for strategies and resources to effectively manage and eliminate their debts.

04

Individuals who are motivated and committed to improving their financial situation and are willing to put in the effort to pay off their debts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is delete your debt promotion?

Delete your debt promotion is a marketing campaign aimed at helping individuals eliminate their debts.

Who is required to file delete your debt promotion?

Individuals who are seeking assistance in getting rid of their debts are required to file delete your debt promotion.

How to fill out delete your debt promotion?

To fill out delete your debt promotion, individuals need to provide their contact information, details of their debts, and any relevant financial information.

What is the purpose of delete your debt promotion?

The purpose of delete your debt promotion is to help individuals become debt-free by providing resources and support.

What information must be reported on delete your debt promotion?

Information such as total debt amount, creditors' names, and payment history must be reported on delete your debt promotion form.

When is the deadline to file delete your debt promotion in 2023?

The deadline to file delete your debt promotion in 2023 is December 31st.

What is the penalty for the late filing of delete your debt promotion?

The penalty for late filing of delete your debt promotion may include fines or penalties imposed by regulatory authorities.

How do I modify my delete your debt promotion in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your delete your debt promotion and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

Can I create an eSignature for the delete your debt promotion in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your delete your debt promotion and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit delete your debt promotion on an iOS device?

Create, edit, and share delete your debt promotion from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Fill out your delete your debt promotion online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.