Efficient Solution Tax Client Intake Form 2014-2024 free printable template

Show details

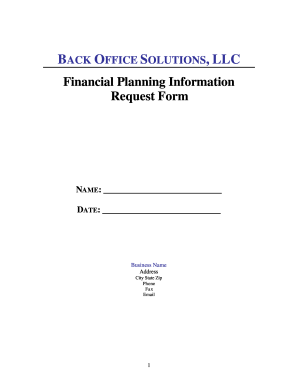

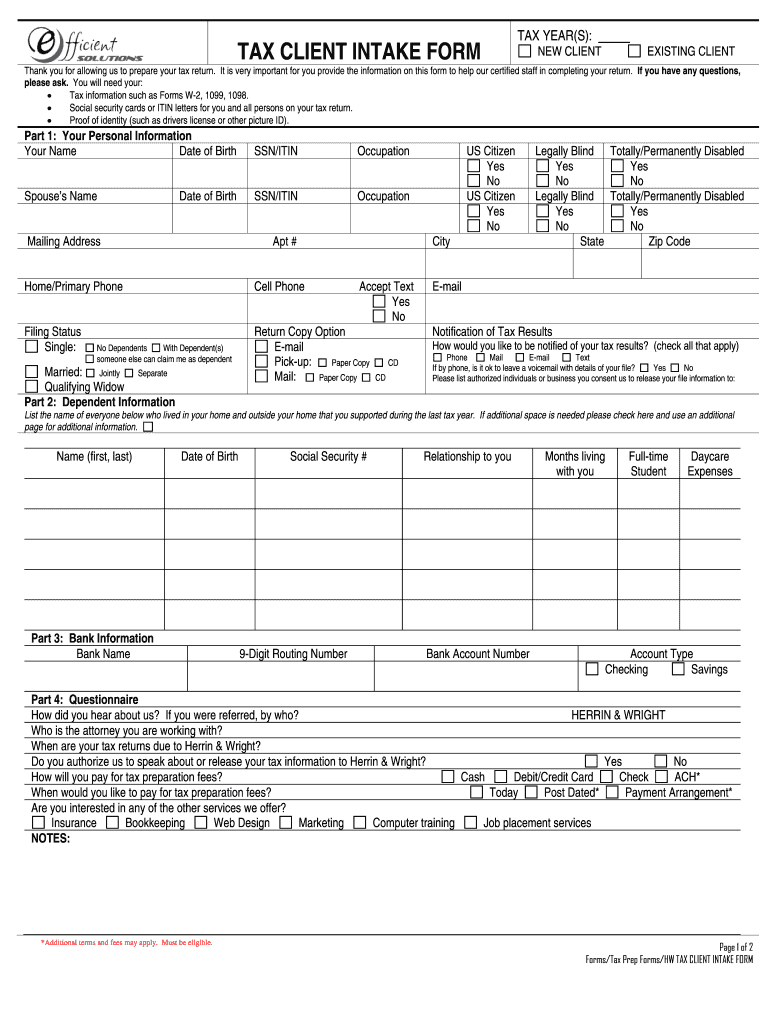

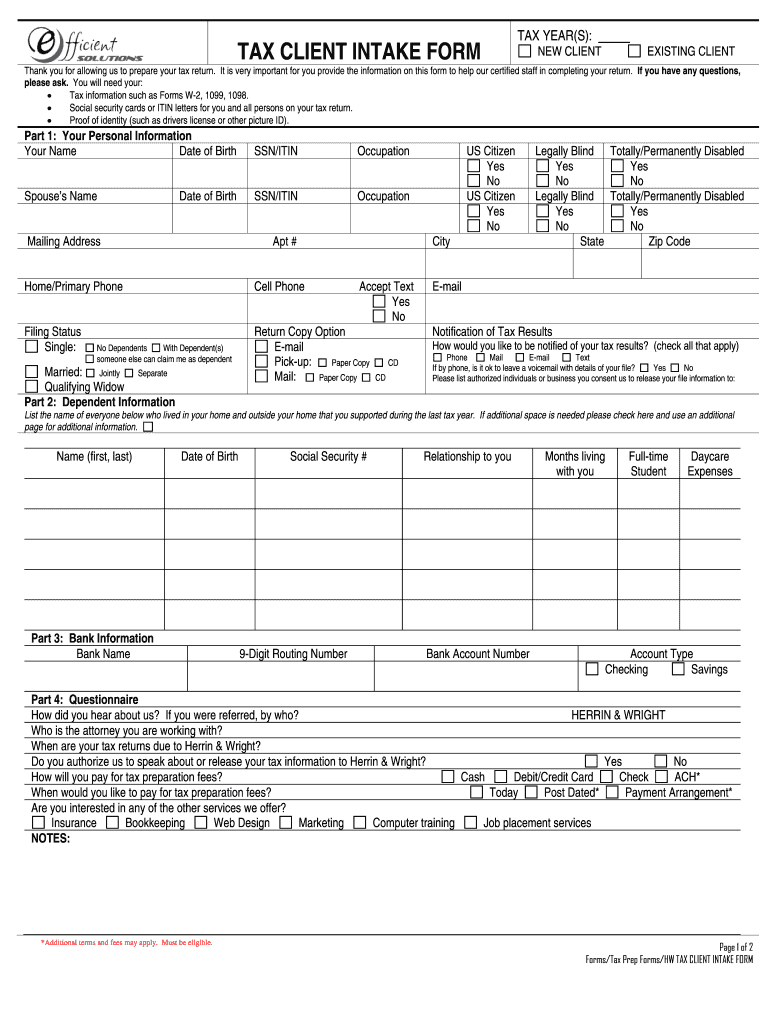

TAX CLIENT INTAKE FORMAT YEAR(S): NEW CLIENTEXISTING CLIENTThank you for allowing us to prepare your tax return. It is very important for you provide the information on this form to help our certified

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your tax client intake form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax client intake form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax client intake form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax client intake form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out tax client intake form

How to fill out tax client intake form:

01

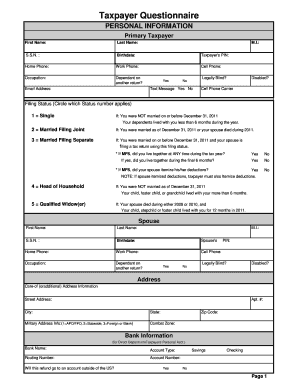

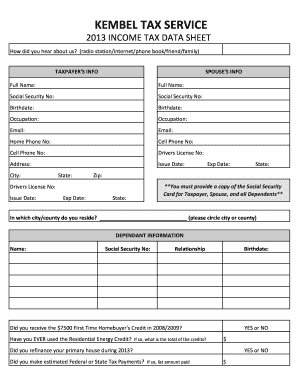

Start by providing your personal information such as your name, address, and contact details.

02

Indicate your employment status, including any additional sources of income or self-employment.

03

Declare your marital status and provide information about your spouse if applicable.

04

Clearly state your Social Security number or taxpayer identification number.

05

Fill in information about your dependents, including their names, ages, and relationship to you.

06

Provide details about your financial accounts, including bank accounts, investments, and any debts.

07

Answer questions regarding your tax history, including any previous tax returns filed or audits conducted.

08

Disclose any relevant deductions or credits that may apply to your tax situation.

09

Sign and date the form to certify the accuracy of the information provided.

Who needs tax client intake form:

01

Individuals who are seeking professional assistance with their tax preparation.

02

Small business owners who want to ensure accurate reporting of their business income and expenses.

03

Taxpayers who have experienced significant life events, such as marriage, divorce, or the birth of a child, that may impact their tax situation.

04

Individuals with complex financial situations, such as multiple sources of income or extensive investment portfolios, that require expert advice and guidance.

05

Anyone who wants to ensure compliance with tax laws and minimize the risk of errors or penalties when filing taxes.

Fill form : Try Risk Free

People Also Ask about tax client intake form

What is form 13614 C for?

What is client intake form?

What is the purpose of the client intake form?

What does client intake include?

Does the client have to fill out a intake form?

How do I fill out a client intake form?

Why is it necessary for every client to fill out a client intake form?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is tax client intake form?

A tax client intake form is a document used by tax professionals to collect information from their clients in order to provide services. It typically asks for basic information such as name, address, contact information, as well as more detailed information like the client’s income, deductions, and other financial information. This form is often the starting point for the professional-client relationship.

What is the purpose of tax client intake form?

A tax client intake form is used by accountants and tax professionals to gather important information about the client’s financial situation and goals. This form serves as a way to create an accurate profile of the client, helping the professional provide tailored advice and services that best suit the client’s needs. It also helps the professional to determine the correct tax filing status and deductions for the client.

What information must be reported on tax client intake form?

1. Personal Information – Name, address, telephone number, Social Security Number, and date of birth.

2. Taxpayer Status – Whether the client is an individual, an estate, a partnership, a corporation, or other.

3. Filing Status – Married filing joint, head of household, etc.

4. Employer Information – Name, address, telephone number, and employer identification number.

5. Income Sources – Wages, self-employment, interest, dividends, rental income, royalties, etc.

6. Assets – Bank accounts, investments, real estate, etc.

7. Liabilities – Debts, mortgages, student loans, etc.

8. Other Information – Any additional information relevant to the client’s tax situation, such as a previous year’s return, estimated tax payments, etc.

What is the penalty for the late filing of tax client intake form?

The penalty for the late filing of a tax client intake form will depend on the specific laws and regulations of the jurisdiction in which the form is being filed. Generally, there are financial penalties associated with late filing, such as fines and/or interest, which can be assessed. Additionally, any late filing can potentially impact the taxpayer's audit risk, which could result in additional penalties.

Who is required to file tax client intake form?

The tax client intake form is typically required to be filed by individuals or businesses seeking the services of a tax professional or preparing their taxes through a tax preparation software. This includes individuals who need assistance in filing their personal income taxes, self-employed individuals, small business owners, freelancers, and corporations. The form helps capture the necessary information and details about the taxpayer's financial situation and assists in accurately preparing their tax returns.

How to fill out tax client intake form?

When filling out a tax client intake form, follow these steps:

1. Gather necessary information: Collect all the required documents and information such as Social Security number, W-2 forms, receipts, previous year's tax return, and any supporting documents related to deductions or credits.

2. Personal information: Complete the section that asks for personal details such as your name, address, phone number, email, and marital status.

3. Dependents: If you have any dependents, provide their names, Social Security numbers, and relationship to you.

4. Filing status: Indicate your filing status, choosing from options like single, married filing jointly, married filing separately, head of household, or qualifying widow(er) with dependents.

5. Income information: Enter the details of your income sources, which may include wages/salaries, self-employment income, interest, dividends, rental property income, retirement distributions, or any other income.

6. Deductions: Provide information regarding any deductions you plan to claim, such as mortgage interest, medical expenses, contributions to retirement accounts, or education-related expenses.

7. Credits: Specify any tax credits you anticipate claiming, such as child tax credit, earned income credit, education credits, or dependent care expenses.

8. Other relevant information: Fill in additional sections related to specific situations, such as foreign accounts/assets, itemizing deductions, healthcare coverage, or any unusual circumstances.

9. Include signatures: Sign and date the form at the appropriate spaces, ensuring both the taxpayer and tax preparer (if applicable) sign as required.

10. Review and double-check: Before submitting the form, review all the information provided, making sure it is accurate and complete. Keep a copy of the filled-out form for your records.

Note: It is recommended to seek professional tax advice or assistance from a qualified tax preparer if you have complex tax situations or require specific guidance.

How can I modify tax client intake form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tax client intake form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

Where do I find tax client intake form?

With pdfFiller, an all-in-one online tool for professional document management, it's easy to fill out documents. Over 25 million fillable forms are available on our website, and you can find the tax client intake form in a matter of seconds. Open it right away and start making it your own with help from advanced editing tools.

How do I edit tax client intake form on an iOS device?

Use the pdfFiller mobile app to create, edit, and share tax client intake form from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your tax client intake form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.