Get the free 2010 MICHIGAN Individual Income Tax Return MI-1040

Show details

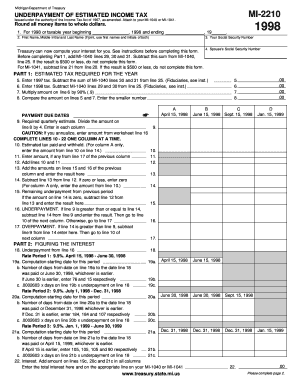

Michigan Department of Treasury (Rev. 10-10), Page 1 Issued under authority of Public Act 281 of 1967. 2010 MICHIGAN Individual Income Tax Return MI-1040 Return is due April 18, 2011. 14 Type or print

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2010 michigan individual income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2010 michigan individual income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2010 michigan individual income online

To use the professional PDF editor, follow these steps below:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2010 michigan individual income. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out 2010 michigan individual income

How to fill out 2010 Michigan individual income:

01

Gather your necessary documents: Before starting to fill out the 2010 Michigan individual income tax form, make sure you have all the required documents, such as W-2 forms, 1099 forms, and any other income-related documents for the tax year 2010.

02

Download the form: Visit the official website of the Michigan Department of Treasury or a reliable tax preparation platform to download the 2010 Michigan individual income tax form. Ensure you are downloading the correct form for the tax year 2010.

03

Provide personal information: Begin filling out the form by providing your personal information, such as your name, address, Social Security number, and any other requested details. Accuracy is essential in order to avoid any processing delays or errors.

04

Calculate your income: The form will have sections where you need to report your income for the tax year 2010. This may include wages, salaries, tips, self-employment income, interest, dividends, and other sources of income. Take your time to accurately calculate and report each source of income.

05

Deductions and credits: The 2010 Michigan individual income tax form may include sections for deductions and credits, such as the Michigan Homestead Property Tax Credit or various exemptions. Carefully review the instructions and guidelines for each deduction or credit to ensure eligibility and complete them accurately.

06

Complete additional sections: The form may have additional sections that require specific information, such as healthcare coverage details or income allocation for non-residents. Read and fill out these sections as necessary, based on your situation.

07

Review and double-check: Before submitting your completed form, carefully review each section to ensure accuracy and completeness. Mistakes or missing information can lead to processing delays or potential penalties, so it is crucial to review your form thoroughly.

08

Submit your completed form: After reviewing and making any necessary corrections, sign and date the form. Make a copy for your records, and then submit the original form to the Michigan Department of Treasury or any designated tax authorities either electronically or through traditional mail.

Who needs 2010 Michigan individual income?

01

Residents of Michigan who earned income in the tax year 2010: The 2010 Michigan individual income tax form is required for individuals residing in Michigan who had income during the tax year 2010. This includes wages, salaries, self-employment income, interest, dividends, and other sources of income.

02

Non-residents with Michigan income: Non-residents who earned income from Michigan sources during the tax year 2010 may also need to file the 2010 Michigan individual income tax form. This applies to individuals who worked in Michigan or received income from Michigan businesses, rental properties, or other sources.

03

Individuals with Michigan-based deductions or credits: Even if you are not a resident of Michigan or did not earn income from Michigan sources, you may still need to file the 2010 Michigan individual income tax form if you are eligible for certain deductions or credits specific to Michigan. Examples include the Michigan Homestead Property Tax Credit or exemptions related to Michigan-based activities.

Please note that this response is based on the assumption that the "2010 Michigan individual income" refers to the income tax form for the tax year 2010 in the state of Michigan. The specific instructions and requirements may vary depending on the jurisdiction and context.

Fill form : Try Risk Free

People Also Ask about 2010 michigan individual income

What is mi1040?

Where can I find my MI-1040?

Where can I get a Michigan state tax form?

What is Form 1040 V for State of Michigan?

How do I get a copy of my Michigan tax return?

What is Michigan income tax form Schedule W?

Does the State of Michigan require you to file a tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is michigan individual income tax?

Michigan individual income tax is a tax levied on the income of individuals who are residents of Michigan.

Who is required to file michigan individual income tax?

Residents of Michigan or individuals who have income sourced from Michigan are required to file Michigan individual income tax.

How to fill out michigan individual income tax?

Michigan individual income tax can be filled out online through the Michigan Department of Treasury website or by mail using the paper forms provided by the department.

What is the purpose of michigan individual income tax?

The purpose of Michigan individual income tax is to generate revenue for the state government to fund public services and programs.

What information must be reported on michigan individual income tax?

Income from all sources, deductions, credits, and any other relevant financial information must be reported on Michigan individual income tax.

When is the deadline to file michigan individual income tax in 2023?

The deadline to file Michigan individual income tax in 2023 is April 15th.

What is the penalty for the late filing of michigan individual income tax?

The penalty for late filing of Michigan individual income tax is a fine of 5% of the tax due per month, up to a maximum of 25%.

How can I send 2010 michigan individual income for eSignature?

Once your 2010 michigan individual income is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make edits in 2010 michigan individual income without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing 2010 michigan individual income and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out 2010 michigan individual income using my mobile device?

Use the pdfFiller mobile app to fill out and sign 2010 michigan individual income. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

Fill out your 2010 michigan individual income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.