Get the free Page 2 Form 990 (2012) Part III 1 2 3 Statement of Program Service Accomplishments C...

Show details

Page 2 Form 990 (2012) Part III 1 2 3 Statement of Program Service Accomplishments Check if Schedule O contains a response to any question in this Part III. . . . . . . . . . . . . . Briefly describe

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your page 2 form 990 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your page 2 form 990 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit page 2 form 990 online

Follow the guidelines below to use a professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit page 2 form 990. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

How to fill out page 2 form 990

How to fill out page 2 form 990:

01

Start by reviewing the instructions provided by the IRS for form 990. This will give you a clear understanding of the specific requirements and details for filling out page 2.

02

Begin by entering the organization's name, employer identification number (EIN), and the tax period at the top of the form. Double-check that the information entered is accurate and up-to-date.

03

Next, you will need to provide a brief description of the organization's mission or purpose. This should be a concise statement that accurately represents the core objectives of your organization.

04

Proceed to complete Part II, which focuses on key information about the organization's governance, management, and policies. This includes details such as the board composition, conflicts of interest policies, and compensation practices.

05

Part III of the form requires you to report specific details about your organization's program services, accomplishments, and activities. Provide a comprehensive overview of the services your organization offers and the impact it has on the community it serves.

06

In Part IV, you will need to provide detailed financial information, including revenue and expenses. You will also be required to report on specific items such as loans, grants, and contributions received, along with any fundraising activities conducted.

07

Ensure that all the financial information provided is accurate and backed up by supporting documentation. The IRS may request additional documentation for verification purposes, so it's important to maintain organized records.

08

Complete the remaining sections of the form, ensuring that all required fields are filled in accurately. Carefully review the information before finalizing the form.

09

Sign and date the form to certify its accuracy and completeness. If the form is being completed by an authorized representative, ensure they provide their name and title.

10

Keep a copy of the completed form for your records before submitting it to the IRS. Remember to retain all supporting documentation as well.

Who needs page 2 form 990:

01

Nonprofit organizations that are tax-exempt under section 501(c) of the Internal Revenue Code are required to file Form 990 on an annual basis.

02

The IRS requires certain organizations, such as charitable organizations, social welfare organizations, and educational institutions, to submit this form to maintain their tax-exempt status.

03

Page 2 of Form 990 specifically focuses on providing essential information about an organization's governance, policies, and programs. Therefore, organizations that fall under the aforementioned categories and meet the reporting thresholds set by the IRS will need to complete page 2 of Form 990. These organizations include nonprofits with significant financial activity or those that receive substantial contributions.

It's important to note that the specific requirements for filing Form 990 may vary depending on the size and nature of the organization. Consulting with a tax professional or referring to the IRS instructions can provide additional clarification and guidance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

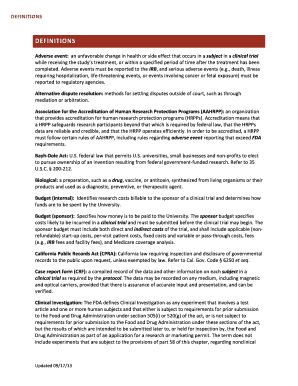

What is page 2 form 990?

Page 2 of Form 990 is the part of the tax return filed by tax-exempt organizations and non-profit organizations to provide additional financial details.

Who is required to file page 2 form 990?

Organizations classified as tax-exempt under section 501(c) of the Internal Revenue Code are required to file Page 2 of Form 990.

How to fill out page 2 form 990?

Page 2 of Form 990 should be filled out by providing detailed financial information and related schedules as required by the IRS instructions.

What is the purpose of page 2 form 990?

The purpose of Page 2 of Form 990 is to provide transparency regarding the financial activities and operations of tax-exempt organizations.

What information must be reported on page 2 form 990?

Page 2 of Form 990 requires organizations to report detailed financial information, including revenue, expenses, assets, and liabilities.

When is the deadline to file page 2 form 990 in 2023?

The deadline to file Page 2 of Form 990 in 2023 is typically May 15th, unless an extension is obtained.

What is the penalty for the late filing of page 2 form 990?

The penalty for late filing of Page 2 of Form 990 is $20 for each day the return is late, up to a maximum of $10,000 or 5% of the organization's gross receipts, whichever is less.

How do I make changes in page 2 form 990?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your page 2 form 990 to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the page 2 form 990 form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign page 2 form 990 and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I complete page 2 form 990 on an Android device?

Use the pdfFiller app for Android to finish your page 2 form 990. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

Fill out your page 2 form 990 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.