Get the free va residual income calculator excel form

Show details

Va residual income calculator excel Mar 29, 2017. VA Loan Residual Income Requirements mean that we must. So, they use the following formula to determine your VA Loan Residual Income. VA Form 266393.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your va residual income calculator form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your va residual income calculator form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing va residual income calculator excel online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit va residual income calculation worksheet form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

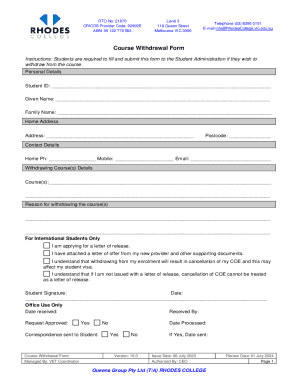

How to fill out va residual income calculator

How to fill out VA residual income calculator:

01

Visit the official website of the Department of Veterans Affairs (VA) or the lender's website that provides the calculator.

02

Look for the VA residual income calculator tool on the website.

03

Input your monthly gross income in the specified field. This includes income from all sources such as employment, self-employment, retirement benefits, and any other regular income.

04

Enter your monthly housing expenses, which include mortgage or rent payments, property taxes, homeowners insurance, and any homeowner association fees.

05

Include your monthly debts, including credit card payments, car loans, student loans, and any other outstanding debts.

06

Add any qualifying child care expenses you incur on a monthly basis.

07

Enter the number of family members you financially support.

08

Lastly, click on the "Calculate" or "Submit" button to obtain the results.

Who needs VA residual income calculator:

01

Veterans or active-duty service members who are applying for a VA home loan.

02

Lenders or loan officers who are determining the eligibility of a borrower for a VA loan.

03

Individuals who want to assess their residual income to understand their financial capabilities and eligibility for a VA loan.

Fill form : Try Risk Free

People Also Ask about va residual income calculator excel

How much can you gross up on VA disability income?

How do I calculate residual income for VA?

How do you calculate residual income?

Can you use residual income on a VA loan?

How do you calculate residual income on a calculator?

Does VA residual income use gross or net income?

How do I calculate residual income on a VA loan?

What is the residual income requirement for VA loans 2023?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is va residual income calculator?

A VA (Veterans Affairs) residual income calculator is a tool used by the Department of Veterans Affairs to determine the residual income requirement for veterans when applying for a VA loan. Residual income refers to the amount of disposable income remaining after subtracting all monthly debt obligations from the applicant's gross monthly income.

The calculator takes into account various variables such as the loan amount, interest rate, family size, and geographic location to calculate the required residual income. This residual income requirement is used to ensure that veterans have enough income to cover their living expenses after accounting for monthly debts.

The VA residual income calculator helps determine if a veteran meets the residual income requirement set by the VA for loan qualification purposes.

Who is required to file va residual income calculator?

The VA residual income calculator is typically used by mortgage lenders and loan underwriters during the loan approval process for Veterans Affairs (VA) loans. It helps determine if a borrower meets the residual income requirements set by the VA.

How to fill out va residual income calculator?

To fill out a VA residual income calculator, you will need to gather some financial information and follow these steps:

1. Start by visiting the official VA website and accessing their residual income calculator tool.

2. Enter your state of residence. This is necessary as different states may have varying rates and requirements for residual income.

3. Provide your marital status by selecting whether you are single, married, or have dependents.

4. Input your gross monthly income, which refers to your total income before any deductions or taxes.

5. Enter your monthly expenses, including housing costs (mortgage or rent payments), utility bills, property taxes, insurance premiums, car loans or lease payments, credit card payments, and any other recurring debt obligations you may have.

6. Fill in your monthly child care expenses if applicable.

7. Input your monthly healthcare expenses, including insurance premiums, out-of-pocket costs, and other healthcare-related costs.

8. Specify any other monthly obligations or expenses you may have, such as student loan payments, personal loans, or other debts.

9. Provide information on any additional income you receive, such as rental income or part-time job earnings.

10. Once you have entered all the necessary information, submit the form to calculate your residual income.

The VA residual income calculator will then determine whether your residual income meets the required standards set by the Department of Veterans Affairs. If your calculated residual income is above the specified limit for your area and family size, you will likely meet the requirements for a VA loan. However, if your calculated residual income falls below the required limit, further evaluation may be necessary to determine your eligibility for a VA loan.

What is the purpose of va residual income calculator?

The purpose of the VA (Veterans Affairs) residual income calculator is to determine the ability of a borrower to repay a VA loan. Residual income refers to the amount of money left over after all major expenses (such as mortgage payments, taxes, insurance, and living expenses) have been deducted from the borrower's gross monthly income. This calculation helps lenders assess the borrower's financial stability and ability to meet the loan repayment requirements. It is an important factor in the VA loan approval process, as it ensures that borrowers have sufficient income to cover their expenses and not be at a high risk of defaulting on the loan.

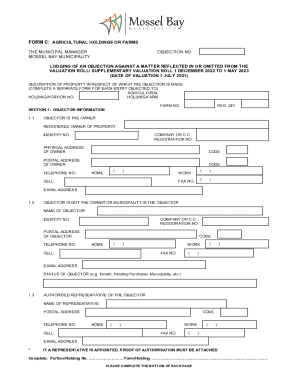

What information must be reported on va residual income calculator?

When using a VA residual income calculator, the following information must be reported:

1. Monthly Income: This includes combined gross income from all sources, including salary, wages, bonuses, commissions, retirement benefits, and other recurring sources of income.

2. Monthly Housing Expenses: This includes the total monthly expenses related to the VA loan, such as the principal and interest payment, property taxes, homeowners insurance, mortgage insurance premiums, and association fees (if applicable).

3. Other Monthly Expenses: This includes all other monthly debts and obligations, such as credit card payments, car loans, student loans, personal loans, child support, alimony, and any other recurring debts.

4. Monthly Family Member Deduction: This includes the amount deducted from the total monthly income for each dependent family member. The VA has specific guidelines and allowances based on the number of dependents.

5. Monthly Utility Expenses: This includes the estimated monthly cost of utilities, such as electricity, water, gas, and any other necessary services related to maintaining the property.

6. Monthly Residual Income Requirement: The VA has specific guidelines regarding the minimum residual income required for borrowers. This requirement varies based on factors such as family size, location, and loan amount.

By providing all of the above information, the VA residual income calculator can accurately calculate the borrower's residual income, which is a key factor in determining their eligibility for a VA loan.

What is the penalty for the late filing of va residual income calculator?

The specific penalty for the late filing of a VA residual income calculator may vary depending on the specific circumstances and individual case. It is advisable to consult with a tax professional or the relevant authorities to determine the specific penalties or consequences for late filing of the VA residual income calculator.

How can I modify va residual income calculator excel without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including va residual income calculation worksheet form. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I fill out the va residual income worksheet form on my smartphone?

Use the pdfFiller mobile app to complete and sign va residual income calculator on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit va loan residual income calculator on an iOS device?

Create, modify, and share residual income calculator va form using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Fill out your va residual income calculator online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Va Residual Income Worksheet is not the form you're looking for?Search for another form here.

Keywords relevant to residual income worksheet form

Related to va income calculation worksheet

If you believe that this page should be taken down, please follow our DMCA take down process

here

.