Get the free CS Tax return for year 2011 - Solid Rock Climbers for Christ - srcfc

Show details

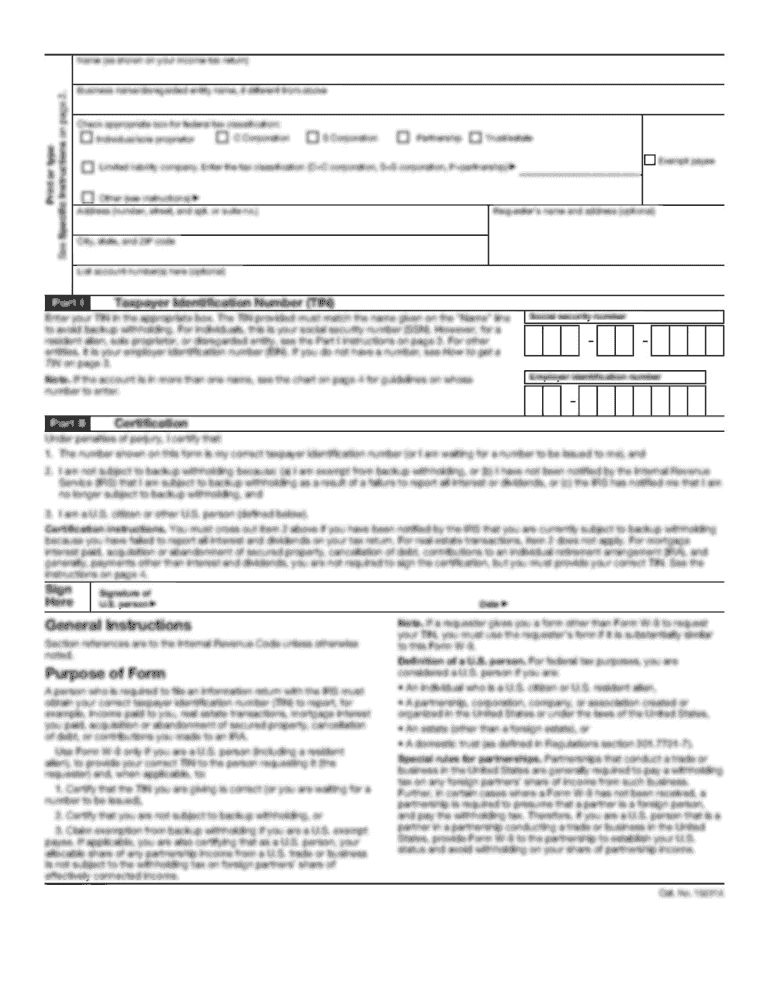

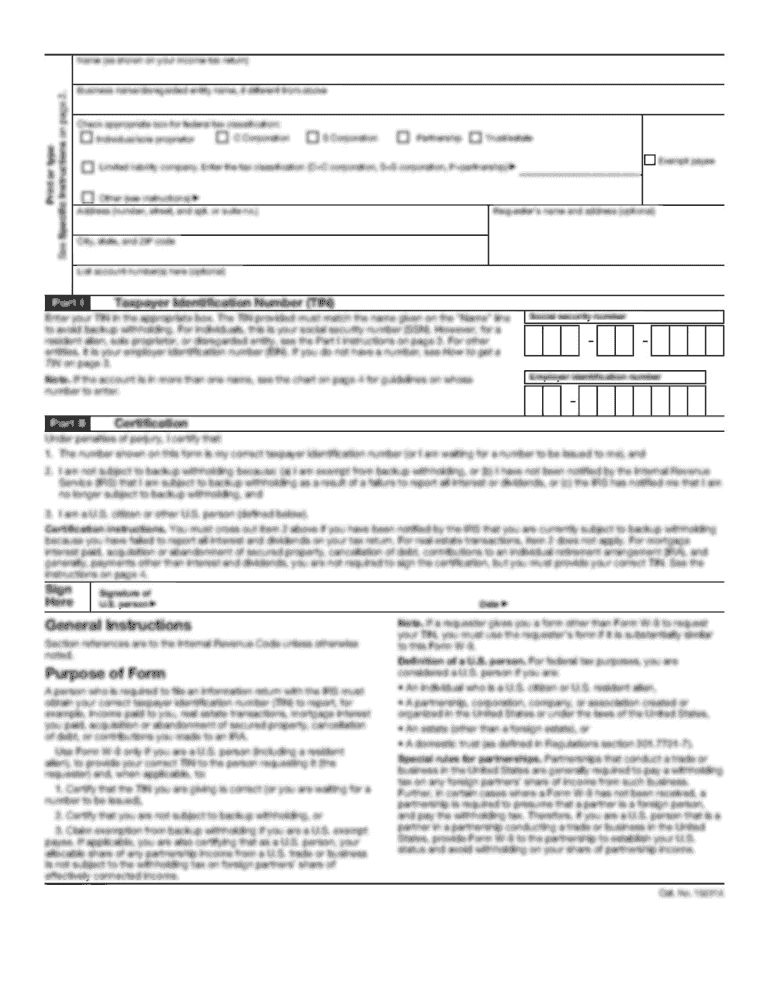

Form IRS e-file Signature Authorization for an Exempt Organization 8879-EO OMB No. 1545-1878 For calendar year 2011, or fiscal year beginning. . . . . . . . . . . . . . . . . . . . , 2011, and ending.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your cs tax return for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cs tax return for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cs tax return for online

Follow the guidelines below to benefit from a competent PDF editor:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit cs tax return for. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

How to fill out cs tax return for

How to fill out a CS tax return:

01

Gather all necessary documents and information. This includes your personal identification information, income statements, expense receipts, and any other relevant financial records.

02

Review the instructions provided by the tax authority carefully. Understand the requirements and forms needed for completing the CS tax return.

03

Begin by entering your personal details such as your name, address, social security number, and marital status.

04

Move onto reporting your income. Include all sources of income, such as wages, self-employment earnings, rental income, investment gains, or any other applicable income types. You may need to attach supporting documents to confirm these income sources.

05

Deduct eligible expenses. Look for deductions available in the CS tax system that you qualify for, such as medical expenses, education expenses, or charitable contributions. Make sure to keep all supporting documentation for these deductions.

06

Calculate your taxable income by subtracting the deductions from your total income.

07

Determine the tax owed by using the tax rate schedule or tax brackets provided by the tax authority. This will depend on the CS tax system in place.

08

If you have any tax credits available, note them down and apply them accordingly to reduce the amount of tax owed.

09

Complete any additional forms or sections required by the CS tax return, such as reporting foreign income or claiming specific tax benefits.

10

Double-check all the information entered, ensuring its accuracy. Any mistakes or omissions can lead to delays or penalties.

11

Sign and date the tax return and submit it to the designated tax authority. Keep a copy of the filed return for your records.

Who needs a CS tax return:

01

Individuals with taxable income: Anyone who has earned income that falls under the CS tax system's taxable threshold or bracket must file a CS tax return. This includes wage earners, freelancers, self-employed individuals, and those with investment income.

02

Property owners: If you own properties and receive rental income, you may need to file a CS tax return to report this rental income and claim any applicable deductions.

03

Individuals with foreign income: If you live in CS but have income from foreign sources, you may be required to file a CS tax return to report and pay taxes on this income. Certain tax treaties or agreements may also impact your tax obligations.

04

Business owners: Individuals who operate their own businesses, whether as a sole proprietor or through a corporation, will likely need to file a CS tax return to report their business income and expenses separately from their personal income.

05

Individuals eligible for tax benefits: Some CS tax systems offer various tax benefits or credits for specific situations, such as education expenses, healthcare costs, or certain deductions. If you qualify for any of these benefits, you may need to file a CS tax return to claim them.

06

Individuals instructed by tax authorities: In certain situations, tax authorities may require specific individuals or groups to file a CS tax return, even if they do not meet the usual criteria. This can be due to audits, investigations, or specific regulations applicable to certain industries or professions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is cs tax return for?

The cs tax return is for individuals to report their income, expenses, and calculate their tax liability for the year.

Who is required to file cs tax return for?

Individuals who meet the income threshold set by the government are required to file cs tax return.

How to fill out cs tax return for?

You can fill out cs tax return by gathering all your financial documents, filling in the required information accurately, and submitting it to the tax authorities.

What is the purpose of cs tax return for?

The purpose of cs tax return is to ensure that individuals are paying the correct amount of taxes based on their income and expenses.

What information must be reported on cs tax return for?

On cs tax return, individuals must report their income sources, deductions, credits, and any other relevant financial information.

When is the deadline to file cs tax return for in 2023?

The deadline to file cs tax return for in 2023 is April 15th.

What is the penalty for the late filing of cs tax return for?

The penalty for late filing of cs tax return is usually a percentage of the unpaid taxes, increasing the longer the return is overdue.

How can I modify cs tax return for without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including cs tax return for. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I complete cs tax return for online?

pdfFiller has made it simple to fill out and eSign cs tax return for. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I make changes in cs tax return for?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your cs tax return for to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Fill out your cs tax return for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.