FL F-1120A 2014 free printable template

Show details

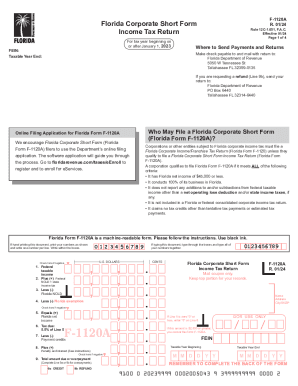

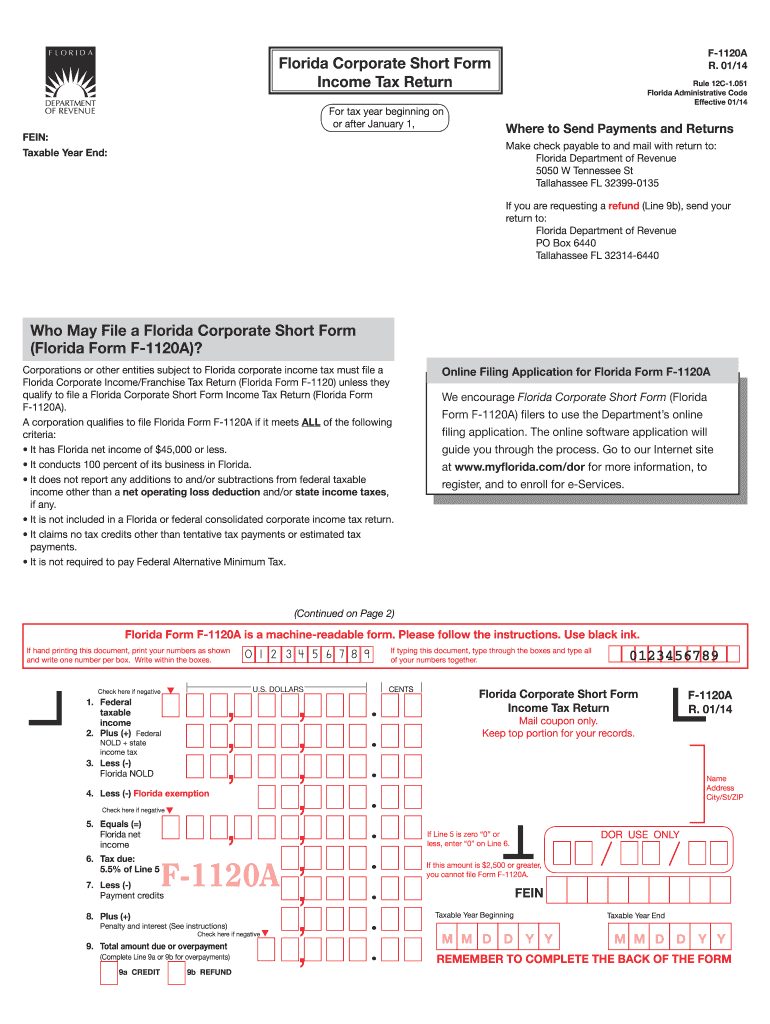

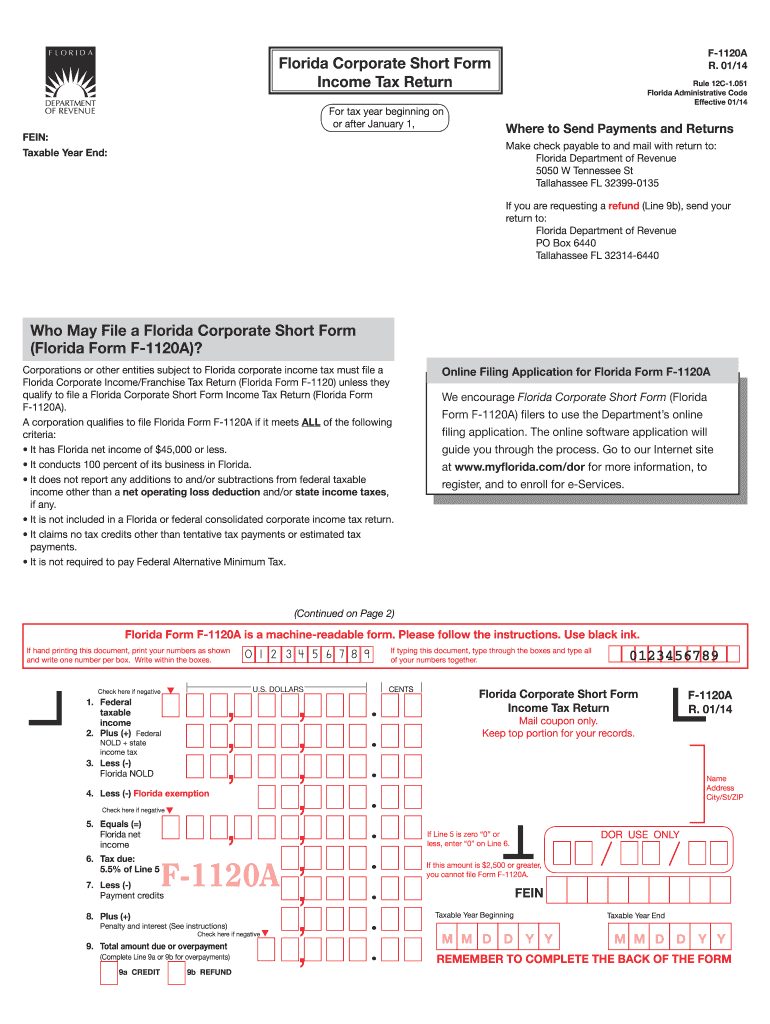

F-1120A R. 01/14 Florida Corporate Short Form Income Tax Return For tax year beginning on or after January 1, 2013, VEIN: Taxable Year End: Rule 12C-1.051 Florida Administrative Code Effective 01/14

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your f-1120a r 01-14 finalpdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your f-1120a r 01-14 finalpdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit f-1120a r 01-14 finalpdf online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit f-1120a r 01-14 finalpdf. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents.

FL F-1120A Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out f-1120a r 01-14 finalpdf

How to fill out f-1120a r 01-14 finalpdf:

01

Start by downloading the f-1120a r 01-14 finalpdf form from the official website of the relevant tax authority.

02

Read the instructions carefully before filling out the form to ensure you understand the requirements and have all the necessary information.

03

Begin by entering the relevant identification information, such as the name of the business, address, and employer identification number (EIN).

04

Fill in Part I of the form, which includes details about the organization's income, deductions, and tax liability calculations. Be sure to accurately report all the required financial information.

05

Proceed to complete Part II of the form, where you will calculate the adjustments and modifications to your taxable income. This section may include items like depreciation, net operating loss deductions, and other such adjustments.

06

If applicable, move on to Part III of the form, which deals with apportionment and allocation of income for businesses operating in multiple jurisdictions. Provide the necessary information according to the instructions.

07

Next, complete Part IV if your business is a member of a controlled group. This section requires providing details about other businesses within the group.

08

If necessary, complete Part V, which pertains to tax credits and any payments made throughout the year.

09

Review the completed form thoroughly, checking for any errors or omissions. Ensure all the required fields have been filled out and all calculations are correct.

10

If required, attach any supporting documentation or schedules as instructed.

11

Sign and date the form, certifying that the information provided is true and accurate to the best of your knowledge.

12

Make a copy of the completed form for your records before submitting it to the appropriate tax authority.

Who needs f-1120a r 01-14 finalpdf:

01

Corporations: The f-1120a r 01-14 finalpdf form is typically required for filing taxes by corporations, including C corporations and S corporations.

02

Businesses operating in the United States: If your business operates in the United States and is subject to federal income tax, you may need to file the f-1120a r 01-14 finalpdf form.

03

Businesses meeting the specific criteria: The need for this form may depend on factors such as the size of the business, the type of business entity, and the amount of taxable income.

It is essential to consult with a tax professional or refer to the official guidelines provided by the tax authority to determine if the f-1120a r 01-14 finalpdf form is required for your specific business situation.

Fill form : Try Risk Free

People Also Ask about f-1120a r 01-14 finalpdf

Do I need to file a Florida corporate tax return?

How do I file a Florida corporate tax return?

What is Florida Form F-1120A?

What is the penalty for filing corporate taxes late in Florida?

What is the 3 factor apportionment in Florida?

Does Florida have a corporate tax return?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

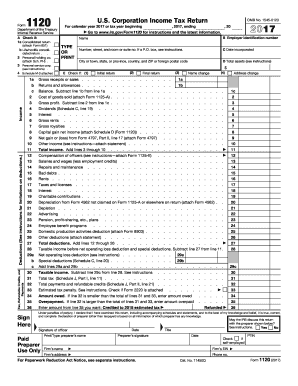

What is f-1120a r 01-14 finalpdf?

F-1120A R 01-14 finalpdf refers to an IRS tax form utilized by corporations in Florida. The form is specifically known as Form F-1120A, which is used for the purpose of filing the Florida Corporate Short Form Income Tax Return. The "R" in the form number denotes that it is a revision of the original form. The "01-14" in the form number indicates that it is the version released in January 2014. Finally, "finalpdf" suggests that it is the final version of the form in PDF format.

Who is required to file f-1120a r 01-14 finalpdf?

The form F-1120A R-01/14 is required to be filed by corporations or partnerships who are subject to Florida's corporate income tax.

How to fill out f-1120a r 01-14 finalpdf?

To fill out the Form F-1120A, follow these steps:

1. Obtain the form: Download the Form F-1120A from the official website of the Internal Revenue Service (IRS). Ensure you have the latest version, which is currently the 01-14 finalpdf.

2. Identification: Enter the employer identification number (EIN), the business name, and the address in the designated fields at the top of the form.

3. Filing status: Check the appropriate box that represents the filing status. The choices include Initial Return, Amended Return, Final Return, or Address Change Only.

4. Income and deductions: Provide all requested details regarding income and deductions in the relevant sections of the form. This includes information about gross income, cost of goods sold, gross profit, overall deductions, and net operating loss.

5. Tax computation: Complete the tax computation section, which determines the amount of tax owed. This involves calculating the applicable tax rate based on the taxable income and applying any credits or payments already made.

6. Schedule of apportionment: If your business operates in multiple states, you may need to fill out additional schedules for apportioning income and calculating tax liabilities separately for each state. Enter the necessary information on these schedules if applicable.

7. Sign and date: At the bottom of the form, sign and date it to certify that the information provided is accurate to the best of your knowledge.

8. Attachments: If there are any required attachments or supporting documents specific to your situation, ensure they are included with the form before submitting it.

9. Submission: Mail the completed Form F-1120A to the appropriate IRS address based on your location. Double-check the address, as it may differ from the general Form 1120 mailing address.

Remember to retain a copy of the filled-out form for your records. It is advisable to consult with a tax professional or refer to the instructions provided by the IRS for specific guidance related to your business circumstances.

What is the purpose of f-1120a r 01-14 finalpdf?

F-1120A R 01-14 Finalpdf is a file format of a form used for filing the Florida Corporate Income/Franchise Tax Return. The purpose of this form is to report the corporation's income and calculate the tax owed to the state of Florida. It allows corporations to fulfill their tax obligations and ensure compliance with state tax laws.

What information must be reported on f-1120a r 01-14 finalpdf?

The information that must be reported on the F-1120A R 01-14 Form (Florida Corporate Income/Franchise Tax Return) includes:

1. Legal name and identification number of the corporation.

2. Mailing address and contact information of the corporation.

3. Dates of incorporation and fiscal year-end.

4. Information about the corporation's federal tax return, including the type of return filed.

5. Explanation of any changes made to the federal tax return for Florida purposes.

6. Calculation of net income/loss, adjustments, and taxable income.

7. Information about apportionment and allocation of income for multi-state corporations.

8. Calculation of the corporate income/franchise tax due based on the taxable income.

9. Information about prior years' tax credits and refunds.

10. Calculation of current year tax credits and refunds.

11. Calculation of estimated tax payments made during the year.

12. Information about other taxes and fees, including the emergency excise tax.

13. Calculation of total tax due, including any penalties and interest.

14. Signature of the corporate officer authorized to sign the return, along with their title and date signed.

It is important to note that the specific reporting requirements may vary depending on the state and year of the form.

Can I create an electronic signature for the f-1120a r 01-14 finalpdf in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your f-1120a r 01-14 finalpdf.

How do I edit f-1120a r 01-14 finalpdf straight from my smartphone?

You can do so easily with pdfFiller’s applications for iOS and Android devices, which can be found at the Apple Store and Google Play Store, respectively. Alternatively, you can get the app on our web page: https://edit-pdf-ios-android.pdffiller.com/. Install the application, log in, and start editing f-1120a r 01-14 finalpdf right away.

Can I edit f-1120a r 01-14 finalpdf on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign f-1120a r 01-14 finalpdf. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

Fill out your f-1120a r 01-14 finalpdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.