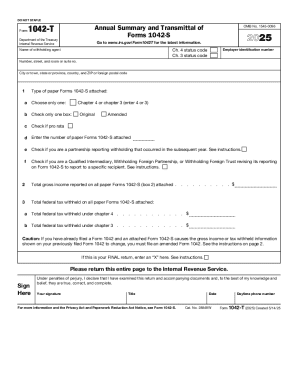

IRS 1042-T 2017 free printable template

Instructions and Help about IRS 1042-T

How to edit IRS 1042-T

How to fill out IRS 1042-T

About IRS 1042-T 2017 previous version

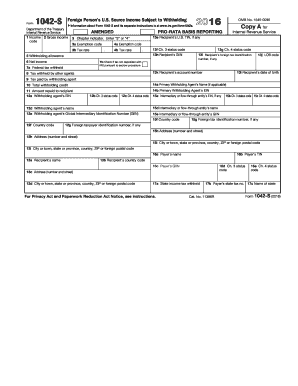

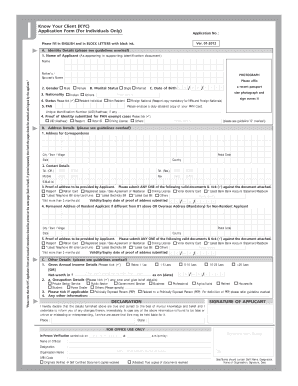

What is IRS 1042-T?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

What is the purpose of this form?

Who needs the form?

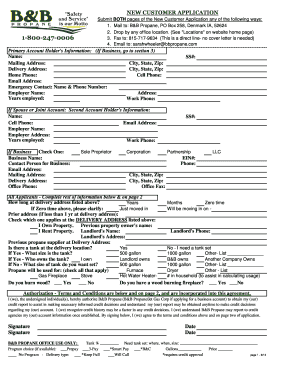

Components of the form

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 1042-T

What should I do if I need to correct an error in my submitted 2017 1042 T form?

If you need to correct an error in your submitted 2017 1042 T form, you should file a corrected version of the form. Indicate that it is a corrected form by checking the appropriate box on the form. Ensure you submit this correction as soon as you identify the mistake to avoid potential penalties or issues.

How can I track the status of my 2017 1042 T form submission?

To track the status of your 2017 1042 T form submission, you can use the IRS tracking services if you filed electronically. Keep an eye out for any notifications from the IRS about your submission, including any rejection codes if applicable. These codes can help you identify any issues that may arise during processing.

Are there any specific legal considerations I should be aware of when filing the 2017 1042 T form for nonresidents?

When filing the 2017 1042 T form for nonresidents, you should be aware of the legal requirements surrounding documentation and identity verification for foreign payees. Also, be mindful of data privacy as you handle sensitive information, ensuring compliance with IRS regulations and applicable data protection laws.

What common mistakes should I avoid when submitting the 2017 1042 T form?

To avoid common mistakes with the 2017 1042 T form, double-check the payee’s information, as errors can lead to processing delays. Make sure to properly classify the type of payment and ensure that any exemptions are accurately reflected. Lastly, verify that you have included all required copies to prevent any rejections.