UT USTC TC-721 2017 free printable template

Show details

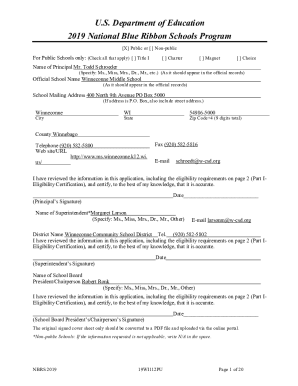

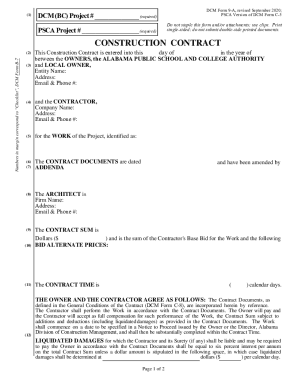

Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84137 Form Print Exemption Certificate Clear form Sales Use Tourism and Motor Vehicle Rental Tax Name of business or institution claiming exemption purchaser Rev. 5/17 Telephone number Street address City Authorized signature TC-721 State Name please print ZIP Code Title Date Name of Seller or Supplier Sales Tax License Number Required for all exemptions marked with an asterisk The signer of this certificate MUST check the box showing...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-721

Edit your UT USTC TC-721 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-721 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-721 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit UT USTC TC-721. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-721 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-721

How to fill out UT USTC TC-721

01

Obtain form UT USTC TC-721 from the appropriate authority or website.

02

Fill in the applicant's details in the designated sections, including name and contact information.

03

Provide necessary identification information as required by the form.

04

Specify the purpose of the application clearly.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form in the appropriate section.

07

Submit the form via the specified method, whether online or by mail.

Who needs UT USTC TC-721?

01

Individuals or businesses applying for a specific license or permit as outlined on the form.

02

Those who are required by regulation to submit UT USTC TC-721 for compliance purposes.

03

Anyone seeking to apply for services related to the item governed by the form.

Instructions and Help about UT USTC TC-721

Fill

form

: Try Risk Free

People Also Ask about

Does Utah have a reseller permit?

A Utah resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

What is the difference between a w9 and resale certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

How do I verify a Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.” Vermont – Online verification is not available. You may call in and verify the status based on the information provided in Form S-3.

Does Utah sales tax license expire?

Do you have to renew a Utah sales tax license? The sales tax license is a one-time registration, and no renewals are needed.

Does a resale certificate expire in Utah?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

How long is Utah exemption certificate good for?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

Does Utah have sales tax on clothing?

The state of Utah levies a 4.65% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1.3% and 3.4%.

Do you need a resale license in Utah?

DO I NEED A RESALE CERTIFICATE IN UTAH? If your business is a retail or wholesale operation that does not want to be responsible for collecting sales tax on resold items and does not want to have any exposure to any future tax liability, then a Utah resale certificate will be required.

How do I get a reseller ID in Utah?

The first step you need to take in order to get a resale certificate, is to apply for a Utah Sales Tax License. This license will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

How do I verify my Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT USTC TC-721 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your UT USTC TC-721 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I complete UT USTC TC-721 online?

Easy online UT USTC TC-721 completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I complete UT USTC TC-721 on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your UT USTC TC-721, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is UT USTC TC-721?

UT USTC TC-721 is a tax form used in the state of Utah for reporting certain financial information related to transactions or entities as required by the state tax authority.

Who is required to file UT USTC TC-721?

Individuals or businesses that meet specific thresholds or criteria set by the Utah state tax authorities are required to file UT USTC TC-721.

How to fill out UT USTC TC-721?

To fill out UT USTC TC-721, you need to gather the required financial information, follow the instructions on the form to input this information accurately, and ensure to sign and date the form before submission.

What is the purpose of UT USTC TC-721?

The purpose of UT USTC TC-721 is to provide the state of Utah with a detailed report of financial transactions and information, aiding in tax assessment and compliance.

What information must be reported on UT USTC TC-721?

The information that must be reported on UT USTC TC-721 includes details about income, expenses, tax liability, and other relevant financial data as required by the form's instructions.

Fill out your UT USTC TC-721 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-721 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.