UT USTC TC-721 2017 free printable template

Show details

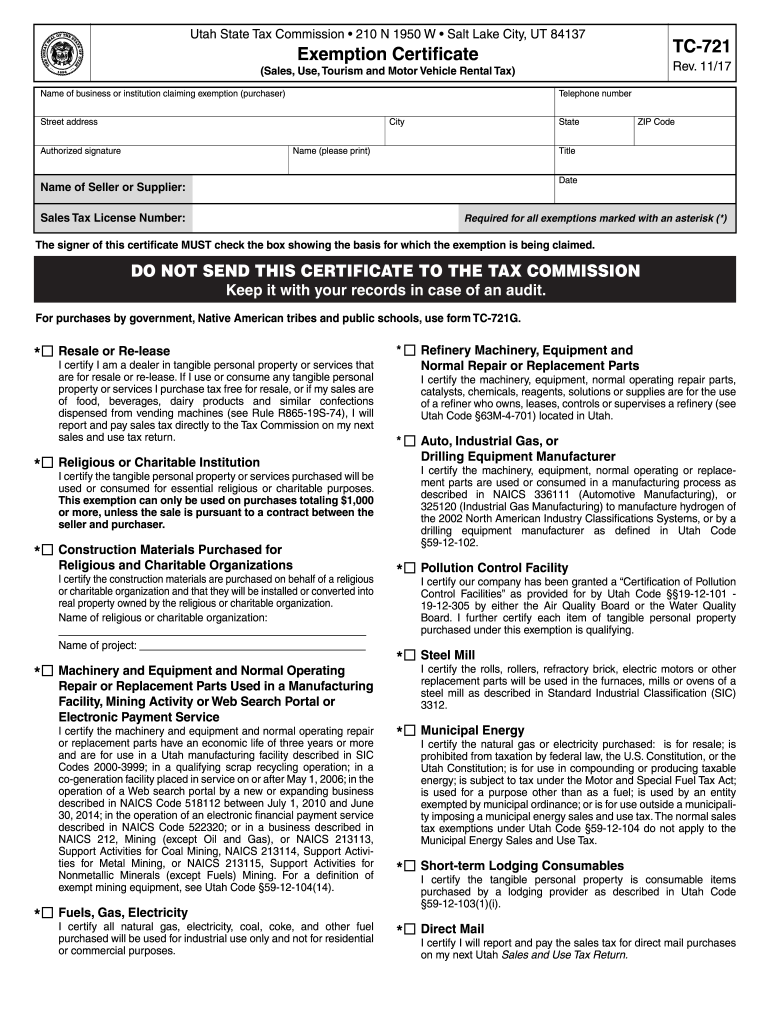

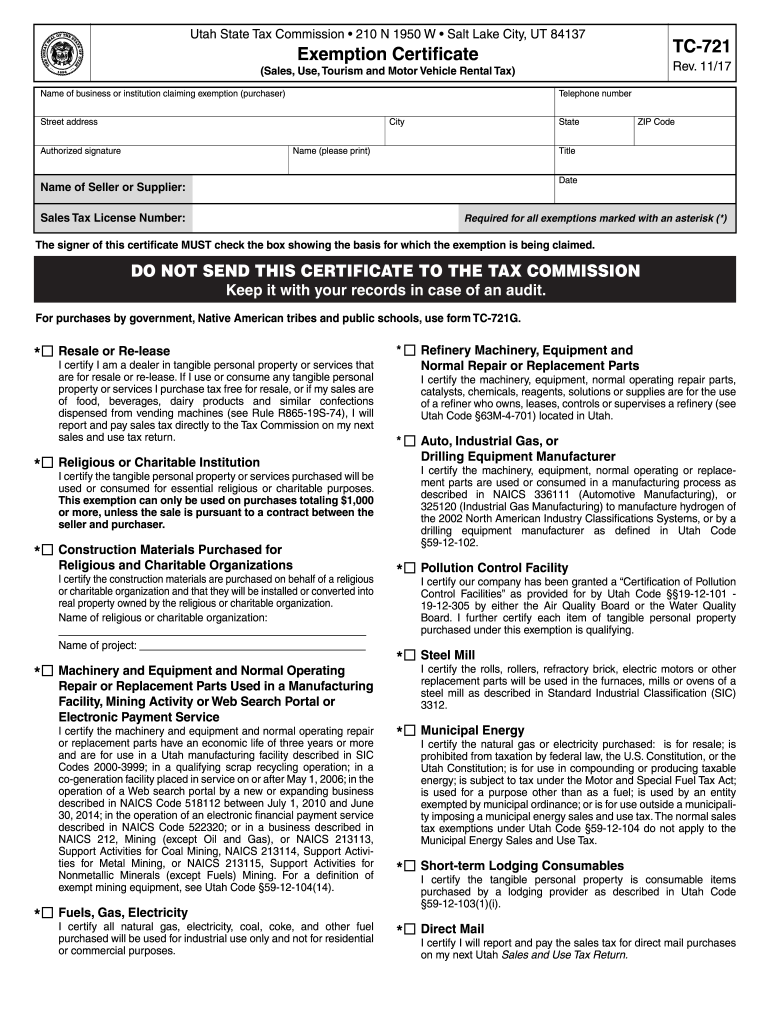

Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84137 Form Print Exemption Certificate Clear form Sales Use Tourism and Motor Vehicle Rental Tax Name of business or institution claiming exemption purchaser Rev. 11/17 Telephone number Street address City Authorized signature TC-721 State Name please print ZIP Code Title Date Name of Seller or Supplier Sales Tax License Number Required for all exemptions marked with an asterisk The signer of this certificate MUST check the box...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-721

Edit your UT USTC TC-721 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-721 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-721 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UT USTC TC-721. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-721 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-721

How to fill out UT USTC TC-721

01

Obtain the UT USTC TC-721 form from the official website or relevant office.

02

Fill in your personal information at the top of the form, including name and contact details.

03

Provide details regarding the transaction or purpose for which the form is being filled out.

04

Include any required identifiers, such as account numbers or reference numbers.

05

Ensure all information is accurate and complete to avoid delays.

06

Review the completed form for any errors before submission.

07

Submit the form as instructed, either electronically or at the designated office.

Who needs UT USTC TC-721?

01

Individuals or businesses needing to report specific transactions to the UT USTC.

02

Taxpayers who are required to provide documentation for auditing purposes.

03

Anyone involved in financial activities that fall under the jurisdiction of the UT USTC regulations.

Instructions and Help about UT USTC TC-721

Fill

form

: Try Risk Free

People Also Ask about

Who is exempt from Utah sales tax?

Sales of goods, other than motor vehicles and boats, purchased in Utah and shipped (including drop-shipping) by the seller or their agent to another state are not subject to Utah sales and use taxes.

How to fill out Texas tax exempt certificate?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

How to fill Wyoming resale certificate?

Common details listed on the Wyoming resale certificate include the name (company or individual) and address of the buyer, a descriptive detail of the goods being purchased, a reference that this merchandise is intended to be resold and the accurate Wyoming sales tax number.

How do I get a reseller certificate in Nevada?

A seller's permit can be obtained by registering through SilverFlume (State of Nevada Business Portal) or by mailing in Nevada a Business Registration Form.

How to fill out Nevada resale certificate?

How to fill out the Nevada Resale Certificate Step 1 – Begin by downloading the Nevada Resale Certificate. Step 2 – Enter the purchaser's seller's permit number. Step 3 – Indicate the general line of business of the buyer. Step 4 – Add the name of the seller. Step 5 – Describe the property that will be purchased.

Does NV accept out of state resale certificates?

The certificate must contain a general description of the kind of property purchased for resale and the buyer's and seller's name. If delivered electronically it does not have to be signed. Out of State resale certificates are acceptable in Nevada as long as they contain the above mentioned requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in UT USTC TC-721?

With pdfFiller, the editing process is straightforward. Open your UT USTC TC-721 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

How do I edit UT USTC TC-721 in Chrome?

UT USTC TC-721 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out UT USTC TC-721 using my mobile device?

Use the pdfFiller mobile app to fill out and sign UT USTC TC-721 on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

What is UT USTC TC-721?

UT USTC TC-721 is a tax form used for reporting certain types of income and deductions in the United States, particularly for taxpayers in the state of Utah.

Who is required to file UT USTC TC-721?

Taxpayers in Utah who meet specific income thresholds or have certain tax situations may be required to file UT USTC TC-721.

How to fill out UT USTC TC-721?

To fill out UT USTC TC-721, follow the instructions provided on the form, which typically includes entering personal information, income data, and applicable deductions.

What is the purpose of UT USTC TC-721?

The purpose of UT USTC TC-721 is to ensure proper reporting of taxable income and deductions for state tax compliance in Utah.

What information must be reported on UT USTC TC-721?

Information that must be reported on UT USTC TC-721 includes personal identification details, sources of income, and any eligible deductions or credits.

Fill out your UT USTC TC-721 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-721 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.