UT USTC TC-721 2015 free printable template

Show details

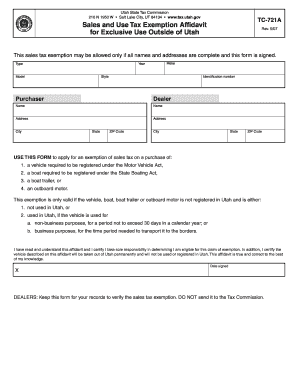

Utah State Tax Commission 210 N 1950 W Salt Lake City UT 84137 Print Form Exemption Certificate Clear form Sales Use Tourism and Motor Vehicle Rental Tax Name of business or institution claiming exemption purchaser Rev. 7/15 Telephone number Street address City Authorized signature TC-721 State Name please print ZIP Code Title Date Name of Seller or Supplier The signer of this certificate MUST check the box showing the basis for which the exemption is being claimed. DO NOT SEND THIS...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-721

Edit your UT USTC TC-721 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-721 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-721 online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit UT USTC TC-721. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-721 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-721

How to fill out UT USTC TC-721

01

Download the UT USTC TC-721 form from the official website.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide the necessary identification information, such as your Social Security number or Tax ID.

04

Indicate the purpose of the application by checking the appropriate box.

05

Attach any required documentation, such as proof of eligibility or additional forms.

06

Review all information for accuracy and completeness.

07

Sign and date the form at the designated section.

08

Submit the completed form as instructed, either online or via mail.

Who needs UT USTC TC-721?

01

Individuals applying for certain benefits or services that require the UT USTC TC-721 form.

02

Employees applying for tax-related matters.

03

Businesses needing to provide specific tax information.

Instructions and Help about UT USTC TC-721

Fill

form

: Try Risk Free

People Also Ask about

Does Utah have a reseller permit?

A Utah resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

What is the difference between a w9 and resale certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

How do I verify a Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.” Vermont – Online verification is not available. You may call in and verify the status based on the information provided in Form S-3.

Does Utah sales tax license expire?

Do you have to renew a Utah sales tax license? The sales tax license is a one-time registration, and no renewals are needed.

Does a resale certificate expire in Utah?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

How long is Utah exemption certificate good for?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

Does Utah have sales tax on clothing?

The state of Utah levies a 4.65% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1.3% and 3.4%.

Do you need a resale license in Utah?

DO I NEED A RESALE CERTIFICATE IN UTAH? If your business is a retail or wholesale operation that does not want to be responsible for collecting sales tax on resold items and does not want to have any exposure to any future tax liability, then a Utah resale certificate will be required.

How do I get a reseller ID in Utah?

The first step you need to take in order to get a resale certificate, is to apply for a Utah Sales Tax License. This license will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

How do I verify my Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in UT USTC TC-721?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your UT USTC TC-721 to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How can I edit UT USTC TC-721 on a smartphone?

You can easily do so with pdfFiller's apps for iOS and Android devices, which can be found at the Apple Store and the Google Play Store, respectively. You can use them to fill out PDFs. We have a website where you can get the app, but you can also get it there. When you install the app, log in, and start editing UT USTC TC-721, you can start right away.

Can I edit UT USTC TC-721 on an Android device?

You can make any changes to PDF files, such as UT USTC TC-721, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is UT USTC TC-721?

UT USTC TC-721 is a tax form used in Utah for reporting certain types of income and expenses for businesses and individuals.

Who is required to file UT USTC TC-721?

Businesses operating in Utah that meet specific income thresholds and individuals who have certain types of income may be required to file UT USTC TC-721.

How to fill out UT USTC TC-721?

To fill out UT USTC TC-721, taxpayers need to provide their identification information, report income and expenses accurately, and ensure all relevant sections are completed as per the instructions provided by the Utah State Tax Commission.

What is the purpose of UT USTC TC-721?

The purpose of UT USTC TC-721 is to report income, claim deductions, and calculate tax liability owed to the state of Utah.

What information must be reported on UT USTC TC-721?

The information that must be reported on UT USTC TC-721 includes personal or business identification details, income generated, itemized deductions, and any applicable tax credits.

Fill out your UT USTC TC-721 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-721 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.