UT USTC TC-721 2014 free printable template

Show details

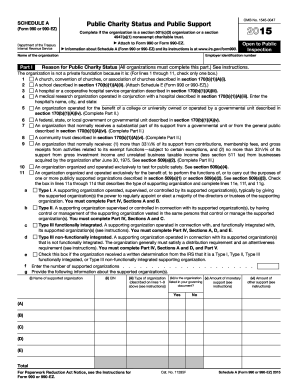

Utah State Tax Commission 210 N 1950 W Salt Lake City, UT 84137 Print Form Exemption Certificate Clear form (Sales, Use, Tourism and Motor Vehicle Rental Tax) Name of business or institution claiming

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-721

Edit your UT USTC TC-721 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-721 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing UT USTC TC-721 online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UT USTC TC-721. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-721 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-721

How to fill out UT USTC TC-721

01

Obtain the UT USTC TC-721 form from the appropriate website or office.

02

Fill in your personal information in the designated sections, including your name, address, and contact details.

03

Detail the purpose of the form in the provided area.

04

Include any relevant supporting documents or information required by the form.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form where indicated.

07

Submit the form to the designated office or department, either in person or electronically as per the instructions.

Who needs UT USTC TC-721?

01

Individuals applying for specific certifications or licenses related to UT USTC.

02

Businesses seeking compliance with local regulations involving UT USTC matters.

03

Students or affiliates of UT USTC requiring official documentation for academic purposes.

Instructions and Help about UT USTC TC-721

Fill

form

: Try Risk Free

People Also Ask about

Does Utah have a reseller permit?

A Utah resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

What is the difference between a w9 and resale certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

How do I verify a Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.” Vermont – Online verification is not available. You may call in and verify the status based on the information provided in Form S-3.

Does Utah sales tax license expire?

Do you have to renew a Utah sales tax license? The sales tax license is a one-time registration, and no renewals are needed.

Does a resale certificate expire in Utah?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

How long is Utah exemption certificate good for?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

Does Utah have sales tax on clothing?

The state of Utah levies a 4.65% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1.3% and 3.4%.

Do you need a resale license in Utah?

DO I NEED A RESALE CERTIFICATE IN UTAH? If your business is a retail or wholesale operation that does not want to be responsible for collecting sales tax on resold items and does not want to have any exposure to any future tax liability, then a Utah resale certificate will be required.

How do I get a reseller ID in Utah?

The first step you need to take in order to get a resale certificate, is to apply for a Utah Sales Tax License. This license will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

How do I verify my Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT USTC TC-721 without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including UT USTC TC-721. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit UT USTC TC-721 straight from my smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit UT USTC TC-721.

Can I edit UT USTC TC-721 on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute UT USTC TC-721 from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is UT USTC TC-721?

UT USTC TC-721 is a form used for reporting certain tax-related information in the United States, specifically for the purpose of tracking contributions and distributions of tax-deferred accounts.

Who is required to file UT USTC TC-721?

Individuals or entities that manage tax-deferred accounts and are responsible for reporting contributions and distributions must file UT USTC TC-721.

How to fill out UT USTC TC-721?

To fill out UT USTC TC-721, you need to gather the necessary account information, including details about contributions and distributions, and enter them into the appropriate fields on the form as directed by the instructions provided.

What is the purpose of UT USTC TC-721?

The purpose of UT USTC TC-721 is to ensure compliance with tax regulations by providing a standardized method for reporting contributions and distributions from tax-deferred accounts.

What information must be reported on UT USTC TC-721?

The information that must be reported on UT USTC TC-721 includes account holder details, types and amounts of contributions, distributions, and any relevant transaction dates.

Fill out your UT USTC TC-721 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-721 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.