UT USTC TC-721 2022 free printable template

Show details

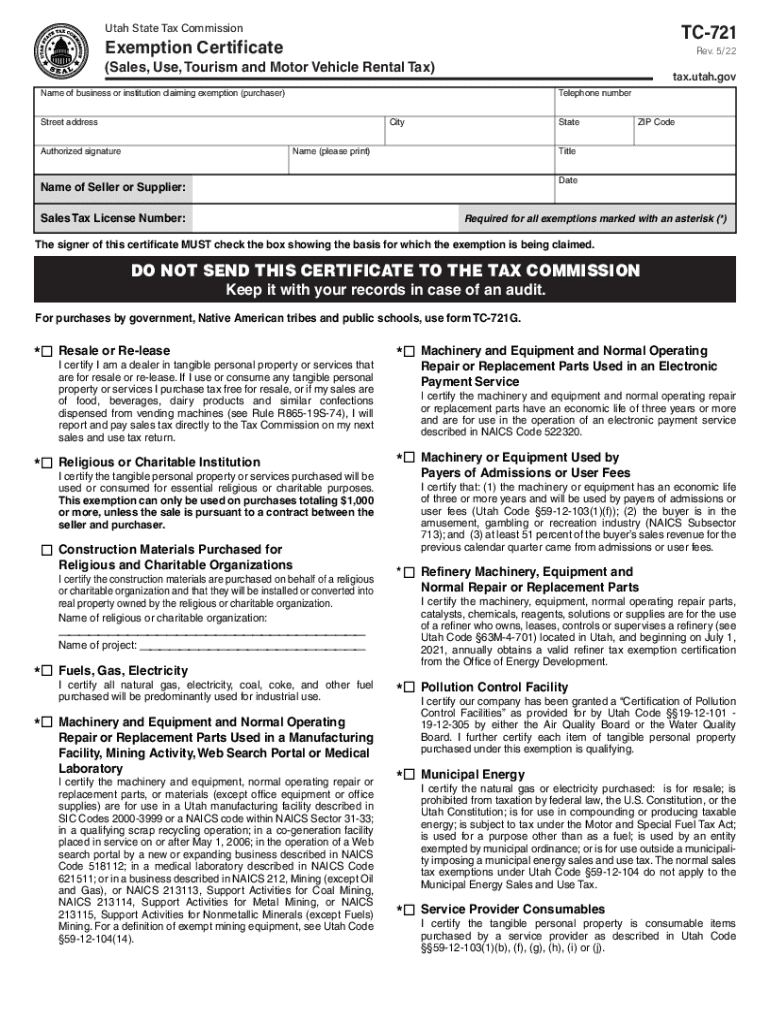

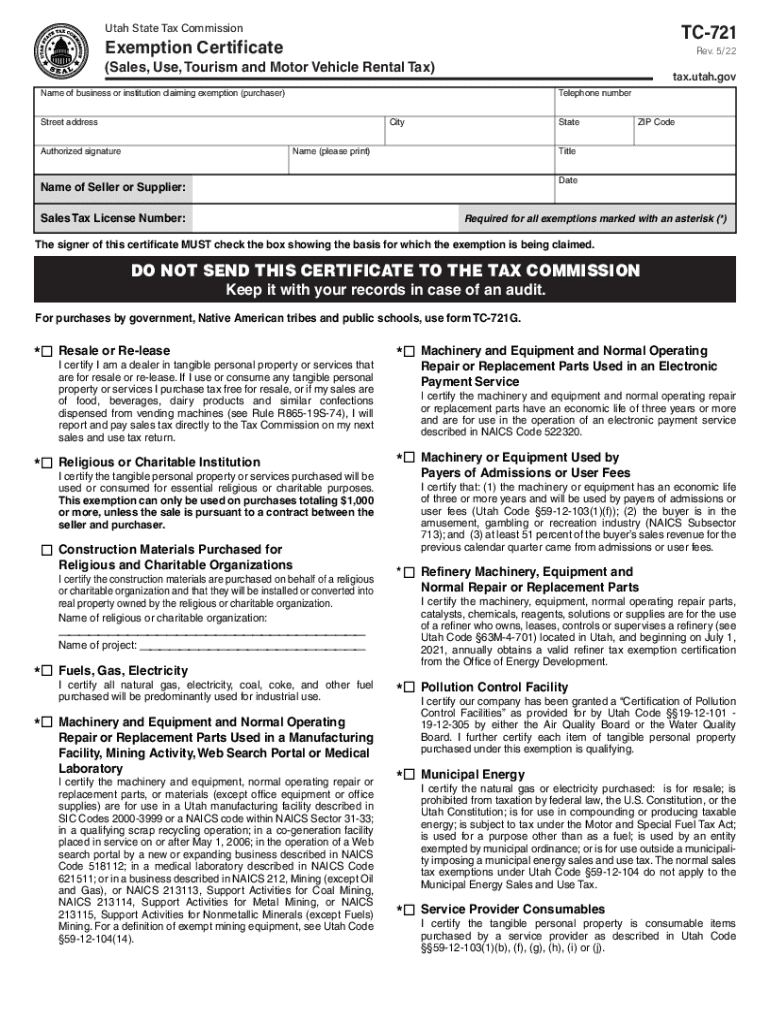

Clear form(Sales, Use, Tourism and Motor Vehicle Rental Tax)

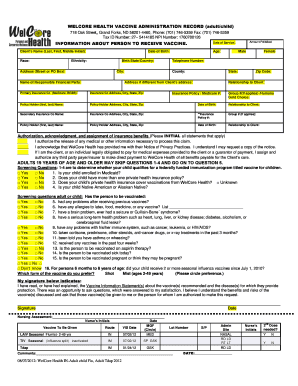

Name of business or institution claiming exemption (purchaser)Telephone numberStreet addressCityAuthorized signaturePrint Form

Statewide

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT USTC TC-721

Edit your UT USTC TC-721 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT USTC TC-721 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT USTC TC-721 online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit UT USTC TC-721. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT USTC TC-721 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT USTC TC-721

How to fill out UT USTC TC-721

01

Download the UT USTC TC-721 form from the official website.

02

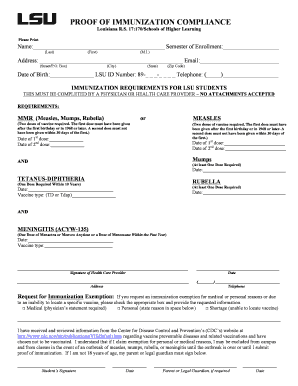

Fill in your personal information in the designated sections, including name, address, and contact details.

03

Provide relevant details regarding your request or application, ensuring accuracy.

04

Attach any required supporting documents as specified in the instructions.

05

Review the form for completeness and accuracy before submission.

06

Submit the completed form through the specified submission method (online, mail, etc.).

Who needs UT USTC TC-721?

01

Individuals or entities applying for a specific program or service offered by UT USTC.

02

Students seeking admission or enrollment-related services.

03

Applicants needing to make changes or updates to their personal information within the UT USTC system.

Fill

form

: Try Risk Free

People Also Ask about

Does Utah have a reseller permit?

A Utah resale certificate (also commonly known as a resale license, reseller permit, reseller license and tax exemption certificate) is a tax-exempt form that permits a business to purchase goods from a supplier, that are intended to be resold without the reseller having to pay sales tax on them.

What is a E 595E form?

North Carolina Form E-595E, Streamlined Sales and Use Tax Certificate of Exemption, is to be used for purchases for resale or other exempt purchases.

What is the difference between a w9 and resale certificate?

Purchasers submit resale certificates to vendors, who typically initiate the request. The person or company making the payment, rather than the person receiving the payment, typically requests the Form W-9. The W-9 relates to federal income tax, while resale certificates relate to state sales tax.

How do I verify a Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.” Vermont – Online verification is not available. You may call in and verify the status based on the information provided in Form S-3.

Does Utah sales tax license expire?

Do you have to renew a Utah sales tax license? The sales tax license is a one-time registration, and no renewals are needed.

Does a resale certificate expire in Utah?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

How long is Utah exemption certificate good for?

Keep the resale certificate for three years – Utah law requires that you keep the resale certificate for 3 years after the non-taxable sale in the case of an audit. For more about Utah resale certificates, you can contact the Utah State Tax Commission.

Does Utah have sales tax on clothing?

The state of Utah levies a 4.65% state sales tax on the retail sale, lease or rental of most goods and some services. Local jurisdictions impose additional sales taxes ranging between 1.3% and 3.4%.

Do you need a resale license in Utah?

DO I NEED A RESALE CERTIFICATE IN UTAH? If your business is a retail or wholesale operation that does not want to be responsible for collecting sales tax on resold items and does not want to have any exposure to any future tax liability, then a Utah resale certificate will be required.

How do I get a reseller ID in Utah?

The first step you need to take in order to get a resale certificate, is to apply for a Utah Sales Tax License. This license will furnish a business with a unique Sales Tax Number, otherwise referred to as a Sales Tax ID Number. Once you have that, you are eligible to issue a resale certificate.

How do I verify my Utah resale certificate?

Utah – There is no online way to verify a resale certificate online. Utah allows merchants to accept resale certificates “in good faith.”

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT USTC TC-721 without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your UT USTC TC-721 into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get UT USTC TC-721?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific UT USTC TC-721 and other forms. Find the template you need and change it using powerful tools.

Can I sign the UT USTC TC-721 electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is UT USTC TC-721?

UT USTC TC-721 is a tax form used in the state of Utah for certain tax reporting purposes, specifically related to the state tax commission.

Who is required to file UT USTC TC-721?

Entities or individuals who engage in activities that require reporting specific financial information to the state of Utah are required to file UT USTC TC-721.

How to fill out UT USTC TC-721?

To fill out UT USTC TC-721, one must provide the required personal and business information, report the relevant financial data, and follow the instructions provided on the form.

What is the purpose of UT USTC TC-721?

The purpose of UT USTC TC-721 is to collect necessary tax information from individuals or businesses for accurate tax assessment and compliance with state tax laws.

What information must be reported on UT USTC TC-721?

Information such as the taxpayer's identification, income details, expenses, and any other relevant financial information must be reported on UT USTC TC-721.

Fill out your UT USTC TC-721 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT USTC TC-721 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.