Get the free Instructions for Form 8582, Passive Activity Loss Limitations - achp

Show details

ADVISORY COUNCIL ON HISTORIC PRESERVATION

OFFICE OF FEDERAL AGENCY PROGRAMS

STAFF AGENCY ASSIGNMENT

Reid Nelson, Director (202) 606-8505 Nelson×ACH.gov

Charlene Win Vaughn, Assistant Director (202)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your instructions for form 8582 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instructions for form 8582 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit instructions for form 8582 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit instructions for form 8582. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out instructions for form 8582

Point by point instructions for filling out form 8582:

01

Start by gathering all the necessary information and documents related to your investments for the tax year in question. This may include statements from brokerage accounts, partnership interests, or other investment-related documents.

02

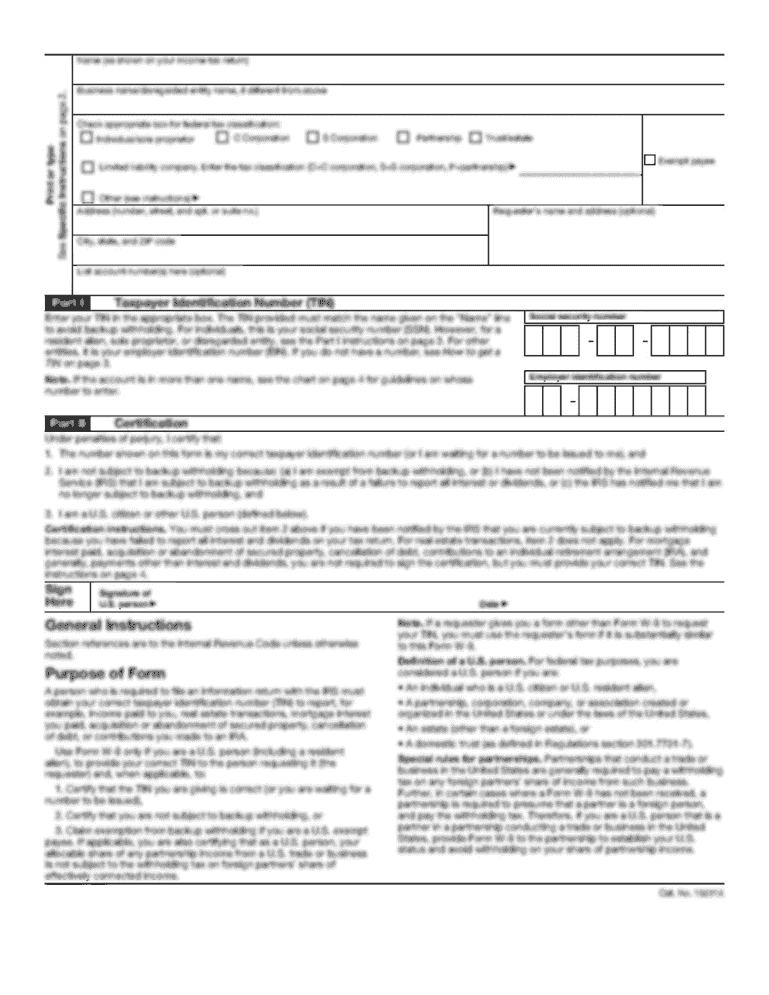

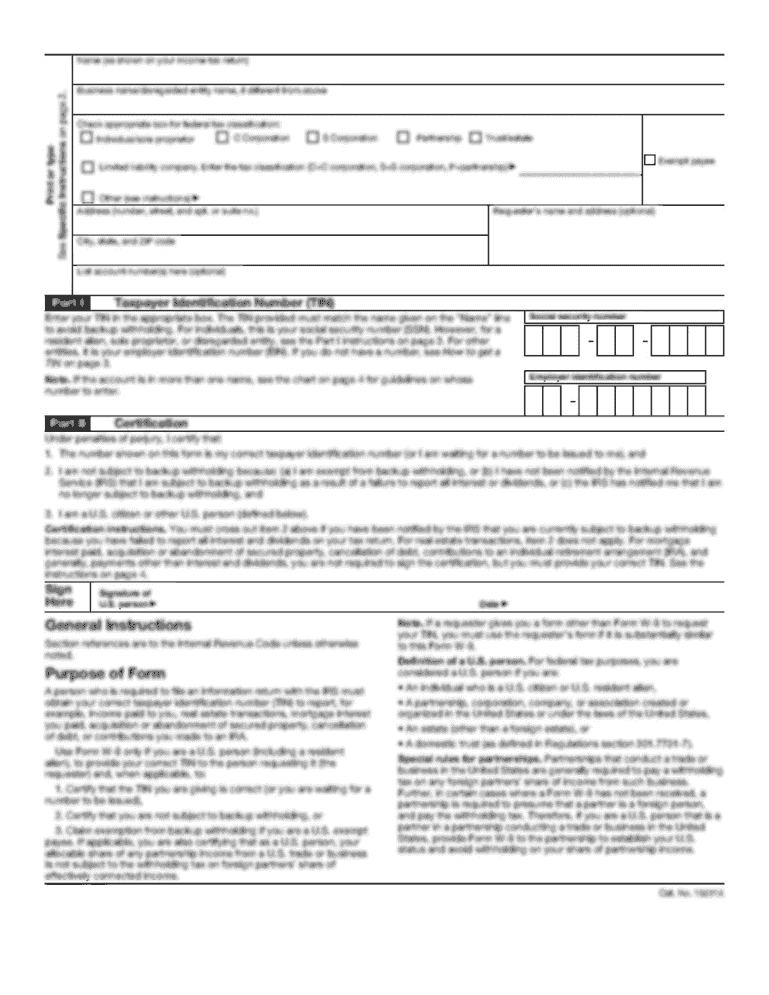

Begin filling out form 8582 by entering your name, Social Security number or taxpayer identification number, and the tax year for which you are filing the form.

03

Next, move on to Part I of the form, which is used to determine if you have any passive activity losses or credits. Follow the instructions provided in this section to report any passive activity income, losses, deductions, and credits that apply to you.

04

If you are required to complete Part II, follow the instructions provided to report any prior year unallowed losses from passive activities.

05

Continue to Part III of the form if you have any current year unallowed losses or credits from passive activities. Complete the necessary sections as instructed to report this information accurately.

06

If you have any suspended prior year or current year passive losses or credits, proceed to Part IV. Provide the relevant details and follow the instructions to report and calculate these amounts correctly.

07

Finally, review the instructions for Part V, which may apply if you have income or losses from rental real estate activities. Complete this section as required, making sure to accurately report all the necessary details.

Who needs instructions for form 8582?

01

Individuals who have engaged in passive activities during the tax year may need instructions for form 8582. Passive activities can include rental real estate, limited partnerships, or other investments in which the taxpayer does not materially participate.

02

Taxpayers who have passive activity losses or credits that need to be reported and calculated accurately should also refer to the instructions for form 8582.

03

Anyone who is unsure about how to properly complete form 8582 or has specific questions regarding their passive activities and their tax implications can benefit from reading and following the instructions provided.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is instructions for form 8582?

Form 8582 is used by taxpayers to calculate and report passive activity losses and credits.

Who is required to file instructions for form 8582?

Taxpayers who have passive activity losses or credits from rental real estate, royalty, limited partnerships, or other passive activities are required to file Form 8582.

How to fill out instructions for form 8582?

Instructions for filling out Form 8582 can be found in the official IRS instructions for the form. Taxpayers need to accurately report their passive activity losses and credits on the form.

What is the purpose of instructions for form 8582?

The purpose of Form 8582 is to allow taxpayers to calculate the amount of passive activity losses or credits that can be used on their tax return.

What information must be reported on instructions for form 8582?

Taxpayers need to report their passive activity losses and credits, as well as any other relevant information related to their passive activities on Form 8582.

When is the deadline to file instructions for form 8582 in 2023?

The deadline to file instructions for Form 8582 in 2023 is typically April 15th, unless an extension is filed.

What is the penalty for the late filing of instructions for form 8582?

The penalty for late filing of Form 8582 can vary depending on the specific circumstances, but it may result in fines or interest charges being assessed by the IRS.

How can I modify instructions for form 8582 without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your instructions for form 8582 into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I make edits in instructions for form 8582 without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit instructions for form 8582 and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I fill out the instructions for form 8582 form on my smartphone?

Use the pdfFiller mobile app to complete and sign instructions for form 8582 on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

Fill out your instructions for form 8582 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.