Get the free Small & Home-Based Business - Packaging for Safe Shipping.doc. Form C I SUBPOENA...

Show details

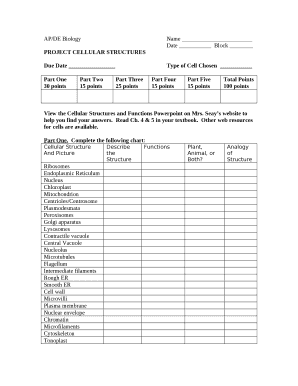

Small and Home-Based Business Packaging for Safe Shipping Kent Wolfe and Sharon Kane AT-13-01 Department of Textile and Apparel Management Online and mail order sales are a major segment of the retail

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your small amp home-based business form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your small amp home-based business form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing small amp home-based business online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit small amp home-based business. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

How to fill out small amp home-based business

How to fill out small amp home-based business:

01

Determine the nature of your business: Start by identifying the products or services you plan to offer. Consider your skills, passions, and market demand when making this decision.

02

Research local regulations and licensing requirements: Depending on your location, there may be specific permits, licenses, or registrations required for operating a home-based business. Research these requirements and ensure you comply with all legal obligations.

03

Create a business plan: Outline your business goals, target market, marketing strategies, and financial projections. A well-thought-out business plan will guide you in making informed decisions and securing funding, if needed.

04

Set up your workspace: Designate a specific area in your home as your workspace. This should be an organized and comfortable environment where you can focus on your business activities.

05

Establish a professional presence: Register a domain name and create a website to showcase your products or services. Set up professional email addresses and consider creating social media profiles to promote your business.

06

Set pricing and payment methods: Determine the pricing structure for your products or services. Research your competitors' pricing and ensure your prices are competitive. Set up efficient payment methods to facilitate smooth transactions with customers.

07

Market your business: Develop a marketing strategy to reach your target audience. Utilize various channels such as social media, online advertising, networking events, and word-of-mouth referrals to promote your business effectively.

08

Track your finances: Implement a reliable accounting system to track your income, expenses, and taxes. Keep accurate records to ensure financial stability and be prepared for any audits or legal requirements.

09

Stay organized and disciplined: Working from home can be challenging, so establish a routine and stick to it. Set clear boundaries between your personal and work life to maintain focus and productivity.

10

Seek advice and support: Join industry associations, attend workshops, and network with other small business owners to gain insights and support. Surround yourself with a community that can provide guidance and motivation.

Who needs small amp home-based business?

01

Aspiring entrepreneurs: Individuals who have a unique business idea or skill set and want to start their own venture from the comfort of their homes.

02

Stay-at-home parents: Individuals who desire to generate income while taking care of their family and managing household responsibilities.

03

Freelancers or remote workers: Professionals who already engage in freelance or remote work and want to transition into running their own business.

04

Individuals seeking flexible working schedules: Those who prioritize work-life balance and wish to have more control over their working hours.

05

Individuals with limited resources: People who face financial constraints and prefer to minimize overhead costs associated with renting or leasing commercial spaces.

06

Creative individuals: Artists, designers, writers, or musicians who want to turn their passion into a profitable business venture.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is small amp home-based business?

Small amp home-based business refers to a business that is operated from a person's home or small office, usually with minimal staff and resources.

Who is required to file small amp home-based business?

Anyone who operates a small amp home-based business and meets certain criteria set by the government may be required to file for this type of business.

How to fill out small amp home-based business?

To fill out a small amp home-based business, you will need to gather information about your business activities, expenses, income, and any relevant documentation. Then, you can use either paper forms or online platforms provided by tax authorities to submit the necessary information.

What is the purpose of small amp home-based business?

The purpose of small amp home-based business is to accurately report the financial activities of the business and fulfill any tax obligations that may arise from operating the business.

What information must be reported on small amp home-based business?

Information such as income, expenses, assets, liabilities, and any other relevant financial data related to the small amp home-based business must be reported.

When is the deadline to file small amp home-based business in 2023?

The deadline to file small amp home-based business in 2023 depends on the tax authority in charge and may vary depending on the jurisdiction. It is recommended to check with the relevant tax authority for specific deadline information.

What is the penalty for the late filing of small amp home-based business?

The penalty for late filing of small amp home-based business may vary depending on the jurisdiction and the specific circumstances of the case. It is important to file on time to avoid any penalties or fines.

How can I edit small amp home-based business from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your small amp home-based business into a dynamic fillable form that can be managed and signed using any internet-connected device.

How can I fill out small amp home-based business on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your small amp home-based business. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I edit small amp home-based business on an Android device?

The pdfFiller app for Android allows you to edit PDF files like small amp home-based business. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your small amp home-based business online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.