Get the free SUBCONTRACTOR PAYROLL AND DRAWDOWN FORM - daytonohio

Show details

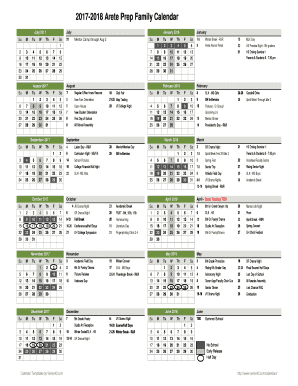

CITY OF DAYTON SUBCONTRACTOR PAYROLL AND DRAWDOWN FORM (Please fill in each blank except for shaded areas which contain formulas) PROJECT NAME PRIME CONTRACTOR'S NAME TOTAL PRIME CONTRACT AWARDED

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign subcontractor payroll and drawdown

Edit your subcontractor payroll and drawdown form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your subcontractor payroll and drawdown form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit subcontractor payroll and drawdown online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit subcontractor payroll and drawdown. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out subcontractor payroll and drawdown

How to fill out subcontractor payroll and drawdown:

01

Gather all necessary information: Start by collecting all the details required for subcontractor payroll and drawdown. This may include the subcontractor's contact information, tax identification number, and payment details.

02

Determine payment frequency: Decide on the frequency of payments to the subcontractor, whether it is weekly, bi-weekly, or monthly. Ensure that you comply with any legal requirements or regulations in terms of payment timelines.

03

Calculate and input hours or work completed: Determine the number of hours or the fixed amount of work completed by the subcontractor during the payment period. This information is necessary for calculating the payment amount accurately.

04

Compute the payment amount: Based on the agreed-upon rate or the established contract terms, calculate the payment amount owed to the subcontractor for the specific payment period. Ensure that this calculation includes any applicable taxes, deductions, or withholdings.

05

Issue payment: Once the payroll has been finalized and the payment amount has been calculated, issue the payment to the subcontractor. This can be done via various methods such as direct deposit, paper check, or electronic transfer.

06

Keep records: Maintain records of all payroll transactions and payments made to subcontractors. This is essential for documentation, record-keeping, and future references.

Who needs subcontractor payroll and drawdown?

01

Construction companies: Construction companies often hire subcontractors to handle specific tasks or projects. They need to maintain subcontractor payroll and drawdown records to ensure accurate and timely payments to subcontractors.

02

Service-based businesses: Businesses that provide services such as IT consulting, marketing, or event planning may engage subcontractors to assist with specific projects or client assignments. These businesses also need to manage subcontractor payroll and drawdown to track payments.

03

Manufacturing companies: Manufacturers often outsource certain components of their production or assembly process to subcontractors. It is crucial for these companies to keep track of subcontractor payroll and drawdown to fulfill their financial responsibilities.

04

Engineering firms: Engineering firms may collaborate with subcontractors for specialized tasks or specific stages of a project. Managing subcontractor payroll and drawdown enables accurate payment and financial accountability within such collaboration.

Overall, any business or organization that engages subcontractors for specific tasks or projects may require subcontractor payroll and drawdown to ensure accurate and timely payment as well as proper financial documentation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my subcontractor payroll and drawdown in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your subcontractor payroll and drawdown as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I modify subcontractor payroll and drawdown without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including subcontractor payroll and drawdown. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I edit subcontractor payroll and drawdown on an iOS device?

You can. Using the pdfFiller iOS app, you can edit, distribute, and sign subcontractor payroll and drawdown. Install it in seconds at the Apple Store. The app is free, but you must register to buy a subscription or start a free trial.

What is subcontractor payroll and drawdown?

Subcontractor payroll and drawdown is a process of paying subcontractors and making withdrawals from a project fund to cover subcontractor costs.

Who is required to file subcontractor payroll and drawdown?

Contractors and project managers are usually required to file subcontractor payroll and drawdown.

How to fill out subcontractor payroll and drawdown?

Subcontractor payroll and drawdown forms can be filled out manually or online, providing details of subcontractor payments and project fund withdrawals.

What is the purpose of subcontractor payroll and drawdown?

The purpose of subcontractor payroll and drawdown is to track subcontractor payments and project expenses to ensure transparency and compliance.

What information must be reported on subcontractor payroll and drawdown?

Subcontractor payroll and drawdown forms typically require information such as subcontractor names, payment amounts, project fund withdrawals, and dates of transactions.

Fill out your subcontractor payroll and drawdown online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Subcontractor Payroll And Drawdown is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.