Get the free Gift Acceptance Policy for St

Show details

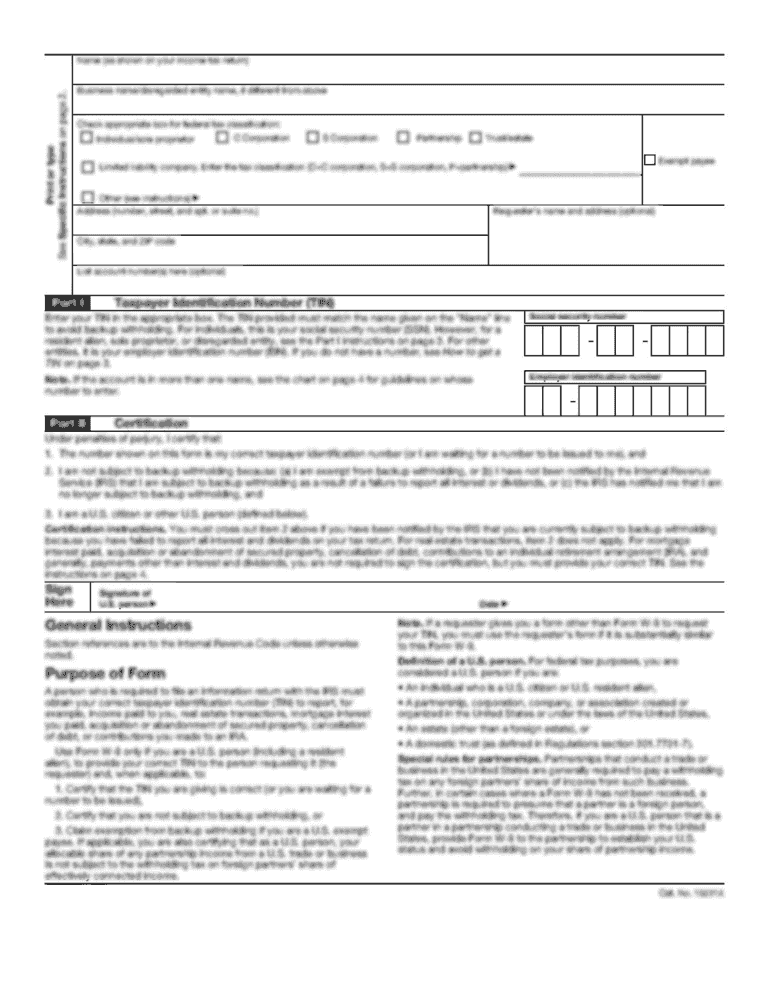

FINAL 07/01/2017Gift Acceptance Policy for St. Marks Episcopal Church

Purpose: The purpose of the gift acceptance policy is to ensure that donations accepted by St.

Marks are in compliance with IRS

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your gift acceptance policy for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift acceptance policy for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing gift acceptance policy for online

Follow the steps down below to use a professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit gift acceptance policy for. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

How to fill out gift acceptance policy for

How to fill out gift acceptance policy for

01

Start by including a clear and concise title for the policy, such as 'Gift Acceptance Policy'.

02

Provide an overview of the policy's purpose and importance in the introduction section.

03

Outline the scope of the policy, including the types of gifts covered and any exclusions.

04

Specify who is responsible for reviewing and approving gifts, such as the board of directors or a designated committee.

05

Include guidelines for accepting or declining gifts, considering factors like legality, ethics, and alignment with the organization's mission.

06

Provide a section on documentation and record-keeping requirements for gift acceptance.

07

Address conflicts of interest and potential risks associated with accepting certain types of gifts.

08

Clearly state any restrictions or conditions on gift acceptance, such as donation size limits or prohibited sources.

09

Include a process for acknowledging and recognizing donors.

10

Conclude the policy with a statement on periodic review and updates, emphasizing the need for ongoing compliance.

11

It's important to consult legal counsel or experts in nonprofit governance when developing the gift acceptance policy.

Who needs gift acceptance policy for?

01

Nonprofit organizations, charities, and foundations can benefit from having a gift acceptance policy.

02

Educational institutions, religious organizations, and healthcare organizations may also find a gift acceptance policy necessary.

03

Any organization that receives or intends to receive gifts, including monetary donations, assets, or other contributions, should have a gift acceptance policy in place.

04

Having a policy helps ensure that gifts are processed and evaluated consistently, reduces legal and ethical risks, and promotes transparency in the donation process.

05

It also provides guidance to staff, board members, and donors, ensuring a clear understanding of the organization's expectations and limitations regarding gift acceptance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the gift acceptance policy for in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your gift acceptance policy for in seconds.

How do I fill out gift acceptance policy for using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign gift acceptance policy for and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I fill out gift acceptance policy for on an Android device?

Use the pdfFiller mobile app to complete your gift acceptance policy for on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

Fill out your gift acceptance policy for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.