Get the free 10 Year Savings Plan Application Form (B) - metFriendly - mpfs org

Show details

You can either complete this form here on screen or print it off and complete it by hand. Either way you will need to print it off, sign it and physically post it to us through Despatch or via Royal

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 10 year savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 10 year savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 10 year savings plan online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 10 year savings plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

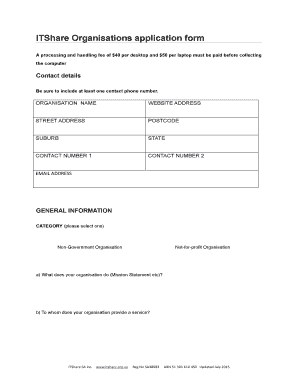

How to fill out 10 year savings plan

How to fill out a 10-year savings plan:

01

Start by setting clear financial goals: Determine why you want to save for the next 10 years, whether it's for retirement, purchasing a home, or funding your child's education.

02

Assess your current financial situation: Take an honest look at your income, expenses, and debt. This will help you determine how much you can realistically save each month.

03

Create a budget: Develop a detailed budget that outlines your income, expenses, and savings goals. Allocate a specific amount each month towards your savings plan and stick to it.

04

Set up automatic transfers: Setting up automatic transfers from your main bank account to a separate savings account can help ensure consistent contributions towards your long-term goals.

05

Explore different investment options: Consider investing a portion of your savings in low-risk instruments such as bonds or mutual funds that can provide higher returns over a 10-year period.

06

Regularly review and adjust your plan: Regularly reassess your financial situation and adjust your savings plan accordingly. Evaluate whether you need to increase your savings rate or make any changes to your investment portfolio.

07

Stay disciplined and committed: Building wealth over 10 years requires discipline and commitment. Avoid impulsive spending and stay focused on your long-term goals.

Who needs a 10-year savings plan?

01

People who want to build wealth: A 10-year savings plan is suitable for individuals who have long-term financial goals and want to accumulate wealth over a substantial period of time.

02

Individuals planning for retirement: A 10-year savings plan can be instrumental in preparation for retirement. It allows you to save consistently and grow your retirement fund over a significant duration.

03

Those saving for significant life events: People saving for major life events such as buying a house, financing higher education, or starting a business can benefit from a 10-year savings plan. It provides them with a structured approach to achieve their goals.

04

Individuals wanting financial security: A 10-year savings plan helps create a financial safety net. It provides peace of mind by ensuring you have funds available for unexpected expenses or emergencies.

05

Preparing for future milestones: Whether you're planning to start a family, take a sabbatical, or embark on a dream vacation, a 10-year savings plan can help you achieve these milestones without facing financial burdens.

Remember, a 10-year savings plan requires consistency, discipline, and adaptability. By following these steps and understanding who would benefit from such a plan, you can navigate your financial journey with confidence.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 10 year savings plan?

A 10 year savings plan is a financial strategy that involves saving money over a period of 10 years to achieve specific financial goals.

Who is required to file a 10 year savings plan?

Anyone who wants to set financial goals and save money over a period of 10 years can create and follow a 10 year savings plan.

How to fill out a 10 year savings plan?

To fill out a 10 year savings plan, you need to set specific financial goals, create a budget, track your expenses, and regularly review and adjust your plan as needed.

What is the purpose of a 10 year savings plan?

The purpose of a 10 year savings plan is to help individuals and families save money over a long period of time to achieve financial goals such as buying a house, saving for retirement, or paying for education.

What information must be reported on a 10 year savings plan?

A 10 year savings plan typically includes information on financial goals, income, expenses, savings targets, and strategies for achieving those targets.

When is the deadline to file a 10 year savings plan in 2023?

The deadline to file a 10 year savings plan in 2023 may vary depending on individual circumstances, but it is typically advisable to start the plan at the beginning of the year to maximize savings potential.

What is the penalty for the late filing of a 10 year savings plan?

There is no specific penalty for the late filing of a 10 year savings plan, but individuals may risk not being able to achieve their financial goals if they delay starting or following their savings plan.

How can I manage my 10 year savings plan directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your 10 year savings plan and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I complete 10 year savings plan online?

Filling out and eSigning 10 year savings plan is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How do I edit 10 year savings plan in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your 10 year savings plan, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Fill out your 10 year savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.