Get the free 2012 Form NYS CHAR500 - Grape Discovery Center

Show details

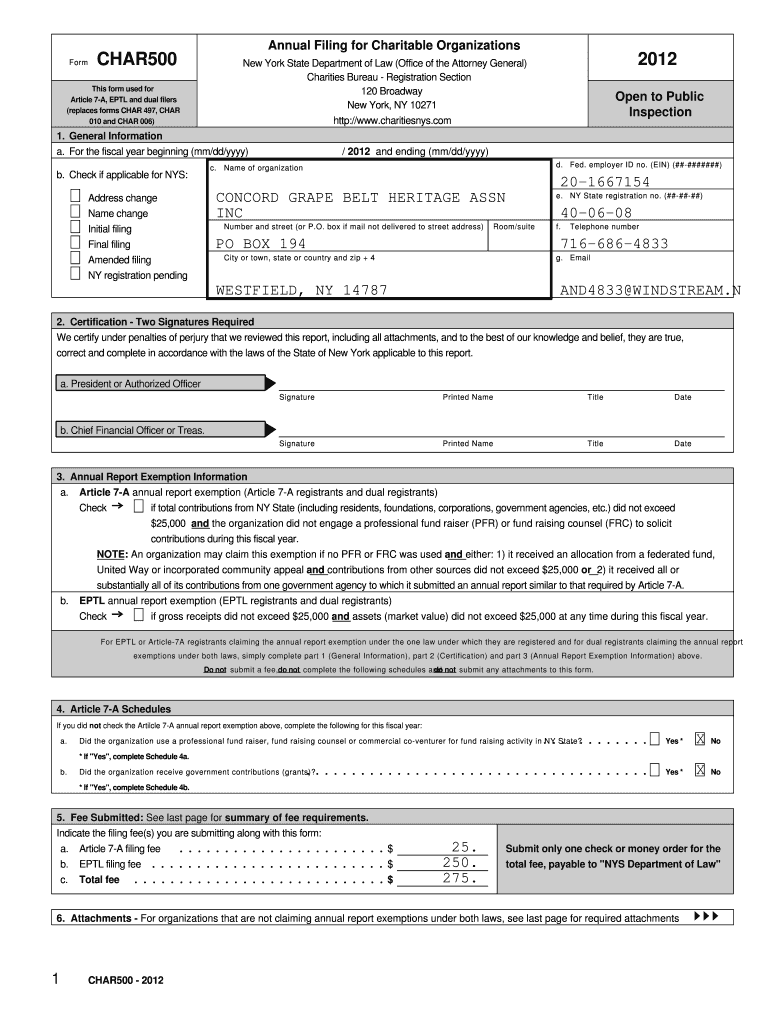

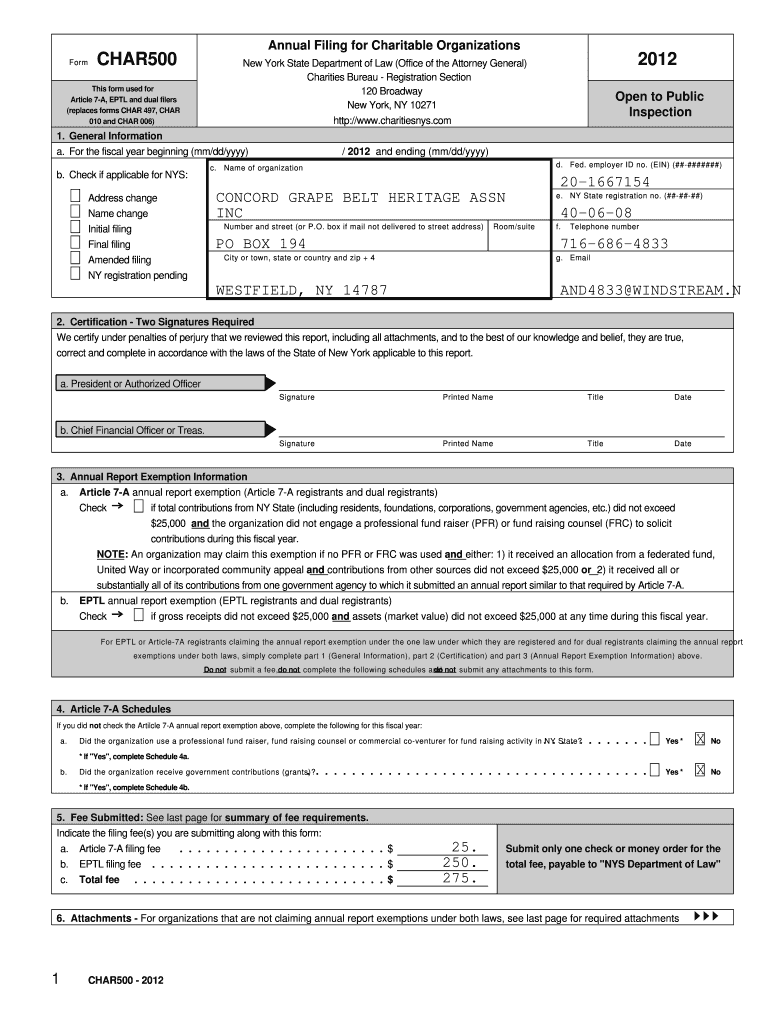

Form Annual Filing for Charitable Organizations CHAR500 2012 New York State Department of Law (Office of the Attorney General) Charities Bureau Registration Section 120 Broadway New York, NY 10271

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your 2012 form nys char500 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012 form nys char500 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012 form nys char500 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2012 form nys char500. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You may try it out for yourself by signing up for an account.

How to fill out 2012 form nys char500

How to fill out 2012 form nys char500:

01

Start by carefully reading the instructions provided with the form. Familiarize yourself with the requirements and gather all necessary documents and information.

02

Begin by entering your organization's name, address, and federal employer identification number (EIN) in the appropriate sections of the form.

03

Provide details about your organization's structure, including whether it is a corporation, trust, unincorporated association, or other entity.

04

Indicate the primary activities your organization engages in and provide a brief description of its mission and purpose.

05

If applicable, report any compensation paid to officers, directors, trustees, or key employees.

06

In the next section, summarize your organization's financial activity for the year, including revenue, expenses, assets, and liabilities.

07

Provide details about any unrelated business income if applicable.

08

If your organization received grants or contributions, report the amount and provide a breakdown of the sources.

09

If your organization engages in lobbying or political campaign activities, disclose the related information.

10

Complete all necessary schedules and attachments, ensuring they are accurately filled out and properly attached to the form.

11

Review the completed form for any errors or omissions before submitting it to the appropriate authority.

12

Keep a copy of the completed form for your records.

Who needs 2012 form nys char500:

01

Nonprofit organizations based in New York State that are exempt from federal income tax under section 501(c)(3) of the Internal Revenue Code.

02

Organizations that have not been granted an exemption from filing annual information returns with the IRS.

03

Nonprofit organizations that need to report their financial activities and comply with the regulations of the New York State Department of Taxation and Finance.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is form nys char500?

Form NYS CHAR500 is the New York State Annual Report for Charitable Organizations.

Who is required to file form nys char500?

Charitable organizations registered with the New York State Attorney General's Charities Bureau are required to file Form NYS CHAR500.

How to fill out form nys char500?

Form NYS CHAR500 can be filled out online through the New York State Charities Bureau website or by submitting a paper form.

What is the purpose of form nys char500?

The purpose of Form NYS CHAR500 is to provide the State with an update on the activities and finances of charitable organizations operating in New York.

What information must be reported on form nys char500?

Form NYS CHAR500 requires information such as the organization's mission, activities, financial statements, and details on fundraising activities.

When is the deadline to file form nys char500 in 2023?

The deadline to file Form NYS CHAR500 in 2023 is typically 4 months after the organization's fiscal year end.

What is the penalty for the late filing of form nys char500?

The penalty for late filing of Form NYS CHAR500 is a $25 late fee for each month the form is overdue, up to a maximum of $250.

How can I edit 2012 form nys char500 on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing 2012 form nys char500.

How do I edit 2012 form nys char500 on an iOS device?

Use the pdfFiller mobile app to create, edit, and share 2012 form nys char500 from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

How can I fill out 2012 form nys char500 on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your 2012 form nys char500. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

Fill out your 2012 form nys char500 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.