Get the free Donation Receipt Form - Relay for Life - relay acsevents

Show details

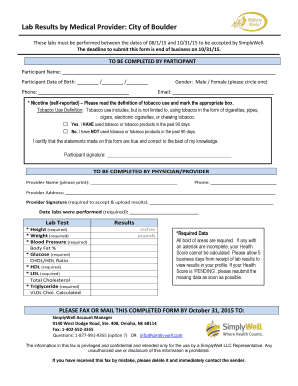

Donation Receipt Form 2010 Relay For Life of Lake County In September 2008, the IRS changed several procedures in regard to non-profits (501 c3) holding raffles and games of chance. In addition, they

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your donation receipt form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your donation receipt form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing donation receipt form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit donation receipt form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller.

How to fill out donation receipt form

How to fill out a donation receipt form:

01

Start by entering the date of the donation. This is usually located at the top of the form and may be labeled as "Date of Donation" or something similar.

02

Provide the name and contact information of the organization or individual making the donation. This includes the name, address, phone number, and email address. Ensure this information is accurate and up to date.

03

Include the name and contact information of the recipient organization or individual who will be receiving the donation. This includes the name, address, phone number, and email address of the recipient.

04

Describe the donation in detail. Include the type of donation, such as cash, goods, or services, and provide a brief description of the donated items or the value of the donated services.

05

Specify whether the donation is a one-time gift or a recurring donation. If it is a recurring donation, provide the frequency and duration of the donations.

06

Indicate any conditions or restrictions that may apply to the donation. For example, if the donation is to be used for a specific project or program, mention it in this section.

07

Sign and date the form. Both the donor and the recipient should sign the form to acknowledge the donation and confirm their agreement with the information provided.

08

Make copies of the completed donation receipt form for both the donor and the recipient. This ensures that both parties have a record of the transaction for future reference.

Who needs a donation receipt form:

01

Nonprofit organizations: Nonprofits often require donation receipt forms to provide proof of the donations they receive for their financial records and to issue appropriate acknowledgments to donors for tax purposes.

02

Individuals making large donations: Individuals who make significant donations, either in cash or in-kind, may need a donation receipt form to claim tax deductions or to maintain proper documentation for their personal financial records.

03

Business owners: Business owners who donate to nonprofit organizations or charitable causes may use donation receipt forms for tax purposes, as the donations can be considered as a deductible business expense.

04

Grantors and sponsors: Grantors and sponsors who provide financial support to nonprofit organizations or individuals may request donation receipt forms as evidence of the contributions they have made.

It is important to keep in mind that specific requirements for donation receipt forms may vary depending on the country and jurisdiction. It is advisable to consult with a tax professional or legal expert to ensure compliance with applicable laws and regulations.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is donation receipt form?

Donation receipt form is a document provided to donors as proof of their charitable contribution.

Who is required to file donation receipt form?

Non-profit organizations are required to file donation receipt forms for all charitable contributions they receive.

How to fill out donation receipt form?

Donation receipt forms should include the donor's name, amount of donation, date of donation, and a description of any goods or services received in exchange for the donation.

What is the purpose of donation receipt form?

The purpose of a donation receipt form is to acknowledge a donor's contribution and provide them with documentation for tax purposes.

What information must be reported on donation receipt form?

The donation receipt form must report the donor's name, amount of donation, date of donation, and a description of any goods or services received in exchange for the donation.

When is the deadline to file donation receipt form in 2023?

The deadline to file donation receipt forms in 2023 is typically the end of the organization's fiscal year, which is usually December 31st.

What is the penalty for the late filing of donation receipt form?

The penalty for late filing of donation receipt forms can vary, but organizations may face fines or other consequences for not meeting the deadline.

How do I make edits in donation receipt form without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing donation receipt form and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I sign the donation receipt form electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your donation receipt form in seconds.

How do I fill out the donation receipt form form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign donation receipt form. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

Fill out your donation receipt form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.