Get the free Retail Installment Sale Contract - Bradford Publishing

Show details

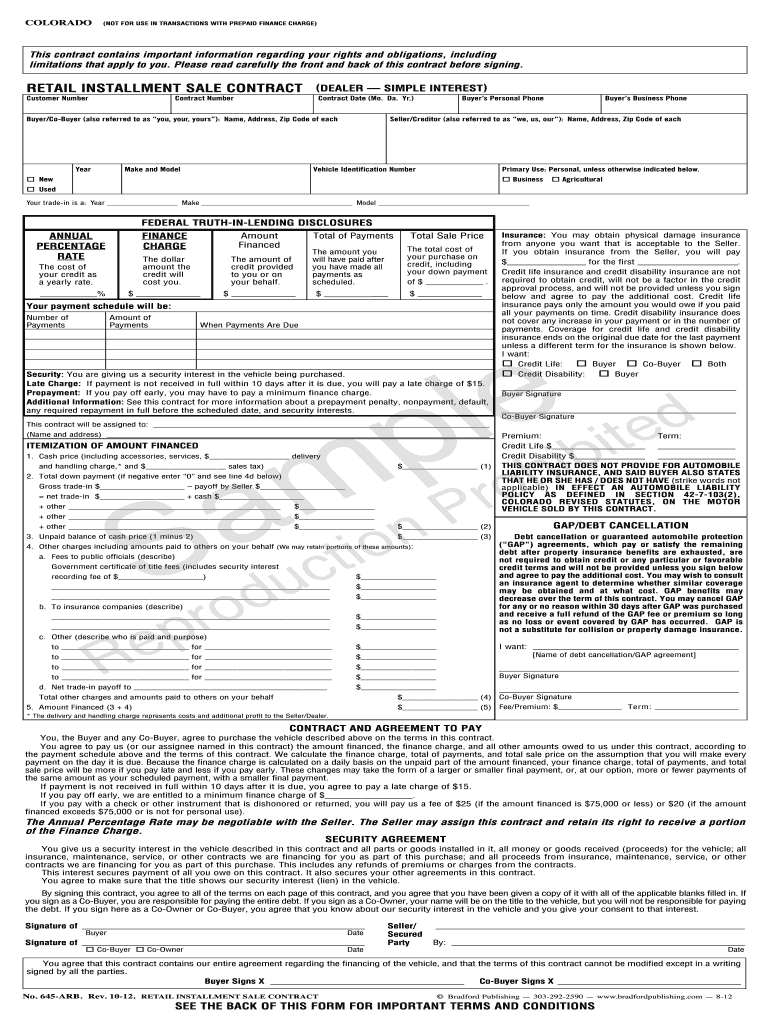

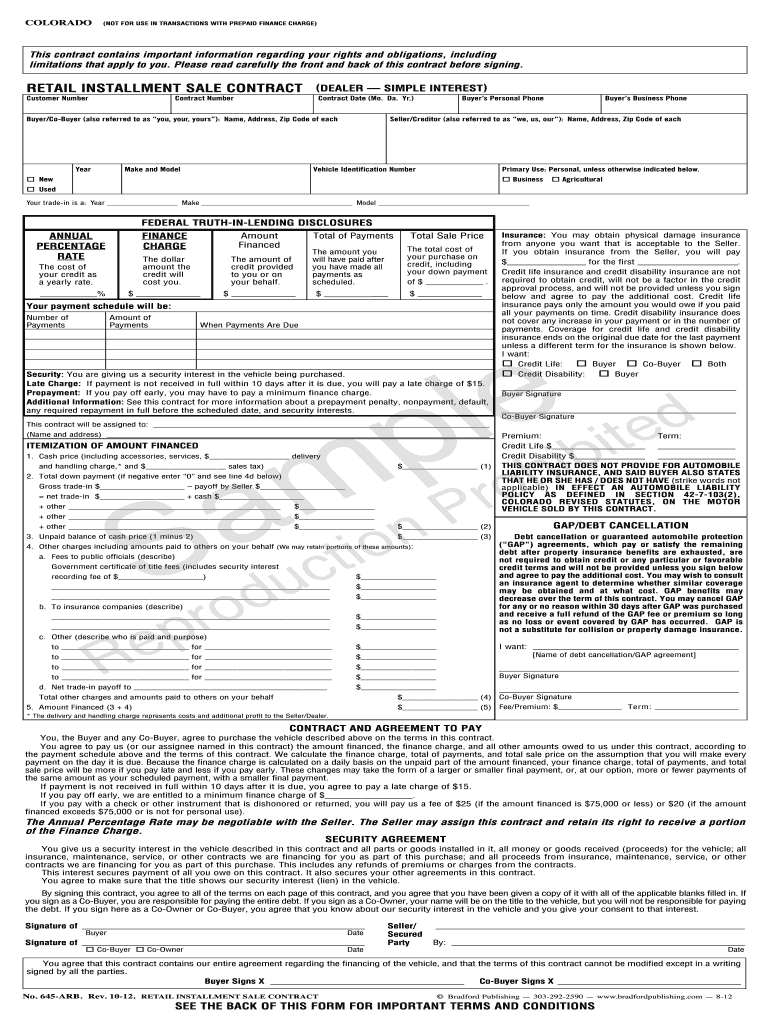

COLORADO (NOT FOR USE IN TRANSACTIONS WITH PREPAID FINANCE CHARGE) This contract contains important information regarding your rights and obligations, including limitations that apply to you. Please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your retail installment sale contract form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retail installment sale contract form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retail installment sale contract online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit retail installment sale contract. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

How to fill out retail installment sale contract

How to fill out a retail installment sale contract:

01

Start by gathering all necessary information: the names and contact information of both the buyer and seller, details of the item being sold, including its description, price, and any applicable warranties or guarantees.

02

Clearly outline the terms of the agreement, such as the payment schedule, interest rates, and any penalties for late payments or defaults. Make sure both parties are aware of their obligations and responsibilities.

03

Include any additional provisions or conditions that both parties have agreed upon, such as a trade-in allowance or the return policy for the item.

04

Review the contract with both parties present and ensure that they understand and agree to all the terms. Any modifications or changes should be made and agreed upon before signing.

05

Sign the contract and have both parties date it. It is recommended to have witnesses or a notary present for added legal protection.

Who needs a retail installment sale contract:

01

Individuals or businesses that are selling goods or services on an installment basis. This could include retailers, car dealerships, or any other entity offering financing options to their customers.

02

Buyers who wish to purchase goods or services through installment payments, ensuring their rights and obligations are clearly defined in a legally binding contract.

03

Lenders or financial institutions that provide financing for retail installment sale transactions, as they need a detailed contract outlining the terms and conditions of the agreement.

Fill form : Try Risk Free

People Also Ask about retail installment sale contract

What is another name for an installment sale contract?

What is the difference between a loan and a retail installment contract?

What is a retail installment contracts?

What is another name for an installment sale contract quizlet?

What is installment purchase also known as?

What is the difference between consumer credit transaction and retail installment contract?

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is retail installment sale contract?

A retail installment sale contract is a legally binding agreement between a buyer and a seller for the purchase of goods or services. In this type of contract, the buyer agrees to make payments over a specific period, usually in regular installments, to the seller or a financing company. The seller retains ownership of the goods until all payments are made, at which point the buyer becomes the owner. This type of contract is commonly used in retail settings for purchasing high-cost items such as automobiles, appliances, furniture, electronics, etc. The terms of the contract typically include the purchase price, payment schedule, interest rate, and any additional fees or charges.

Who is required to file retail installment sale contract?

It is usually the seller of the goods or services who is required to file a retail installment sale contract. This is because the seller is the one providing the financing for the purchase, and the contract outlines the terms and conditions of the installment payments.

How to fill out retail installment sale contract?

To fill out a retail installment sale contract, you will need the following steps:

1. Gather the necessary information: Collect all the required details for the contract, such as the buyer's and seller's names, contact information, and addresses. Also, gather information about the item being sold, including its description, model number, and any serial numbers.

2. Identify the terms and conditions: Determine the terms and conditions of the sale agreement, such as the purchase price, down payment amount, interest rate, and payment due dates. These terms will vary depending on the specific agreement between the buyer and seller.

3. Include financing details: If the buyer is financing the purchase, include information about the lender or financing institution involved. This may include the lender's name, address, and contact information, as well as any specific financing terms agreed upon.

4. Include warranty details: If the item being sold comes with any warranties or guarantees, include the specifics of these in the contract. This may include the duration of the warranty, what it covers, and any conditions or limitations.

5. Review and include disclosures: Check if there are any legal or regulatory requirements specific to your jurisdiction that need to be disclosed in the contract, such as information about the buyer's right to cancel the contract within a certain period or any applicable fees or penalties.

6. Review and sign the contract: Once all the necessary information is included, review the contract carefully to ensure accuracy and clarity. Both the buyer and seller should read and understand the terms before signing the document.

7. Notarize the contract (if required): Depending on your jurisdiction or specific requirements, you may need to have the contract notarized by a notary public. This step verifies the authenticity of the signatures and adds an extra layer of legal validity to the agreement.

8. Keep a copy of the contract: Make sure to give copies of the fully executed contract to both the buyer and the seller. It is essential for both parties to have a record of the agreement for future reference or in case of any disputes.

Note: It is advisable to consult with a legal professional or seek guidance from your local legal authority to ensure compliance with all applicable laws and regulations when filling out a retail installment sale contract.

What is the purpose of retail installment sale contract?

The purpose of a retail installment sale contract is to legally bind a buyer and a seller in a transaction where the buyer agrees to purchase a product or service on credit. This type of contract is commonly used in retail sectors such as automotive, home appliances, electronics, and furniture, where a buyer does not have the immediate funds to make a full cash payment. The contract outlines the terms and conditions of the sale, including the purchase price, financing terms, interest rate, payment schedule, and consequences for default or non-payment. It protects the rights and interests of both parties involved and ensures that the transaction is conducted in a fair and transparent manner.

What information must be reported on retail installment sale contract?

The information that must be reported on a retail installment sale contract may vary depending on local regulations and the specific requirements of the jurisdiction. However, some common information that is typically included in a retail installment sale contract includes:

1. Identification of the buyer and seller: The contract should include the legal names, addresses, and contact information of both the buyer and seller.

2. Description of the goods or services: The contract should provide a detailed and specific description of the goods or services being sold, including any warranties or guarantees associated with them.

3. Purchase price: The contract should clearly state the total purchase price of the goods or services, including any additional fees or charges.

4. Down payment and trade-in details: If there is a down payment or a trade-in involved in the transaction, the contract should include the amount and any terms associated with them.

5. Financing terms: The contract should outline the financing terms, including the annual percentage rate (APR), the amount financed, the total amount of payments, and the payment schedule.

6. Payment terms: The contract should specify the frequency and due dates for the payments, as well as any late fees or penalties for late or missed payments.

7. Security interest or collateral: If the transaction involves a secured loan, the contract should include details about the security interest or collateral being used to secure the loan.

8. Default and repossession: The contract should outline the consequences of defaulting on the loan, including the seller's rights to repossess the goods or enforce other remedies.

9. Applicable laws and jurisdiction: The contract should state the applicable laws and jurisdictions governing the agreement and any dispute resolution processes.

It is important to consult with local regulations and legal professionals to ensure compliance with specific requirements in your jurisdiction.

What is the penalty for the late filing of retail installment sale contract?

The penalty for the late filing of a retail installment sale contract can vary depending on the specific jurisdiction and the terms outlined in the contract. In general, late filing penalties may include financial penalties or fees, additional interest charges, or potential negative impacts on credit scores. It is important to review the terms and conditions of the contract to understand the specific penalties that may apply. Additionally, contacting the lender or creditor to discuss the situation and potential options for resolution may also be advisable.

How do I modify my retail installment sale contract in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your retail installment sale contract and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I edit retail installment sale contract in Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your retail installment sale contract, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I create an eSignature for the retail installment sale contract in Gmail?

Create your eSignature using pdfFiller and then eSign your retail installment sale contract immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

Fill out your retail installment sale contract online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.