Get the free Understanding the control, receipt and storage of stock in a

Show details

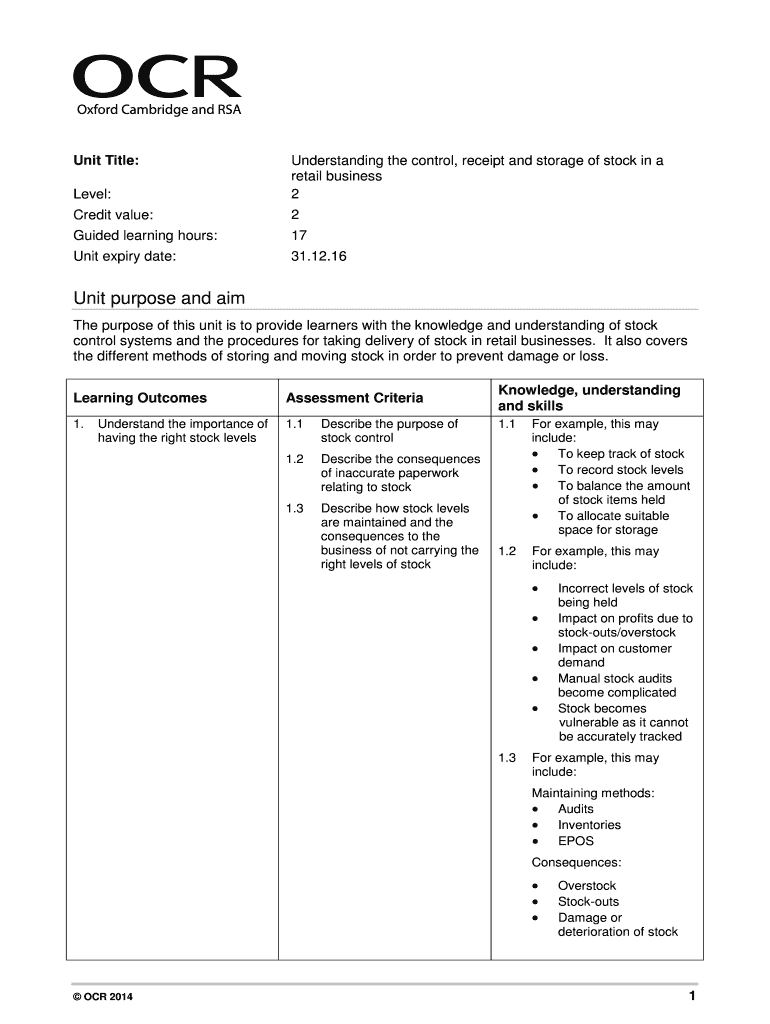

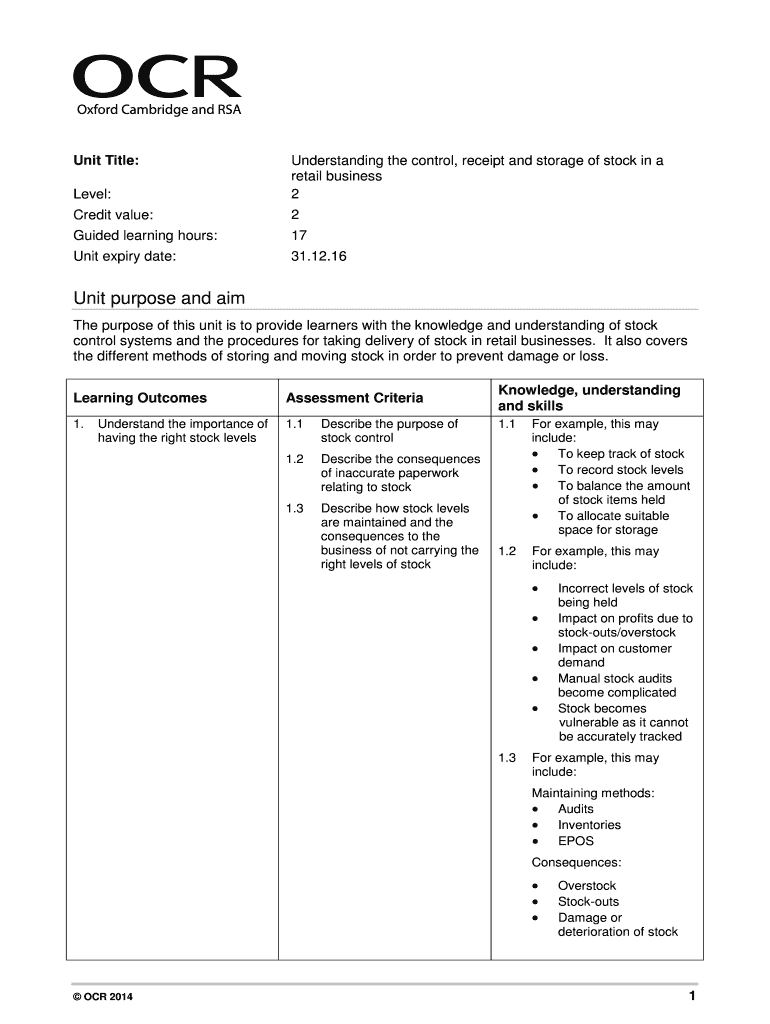

Unit Title:

Level:Understanding the control, receipt and storage of stock in a

retail business

2Credit value:2Guided learning hours:17Unit expiry date:31.12.16Unit purpose and aim

The purpose of this

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your understanding form control receipt form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding form control receipt form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing understanding form control receipt online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit understanding form control receipt. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out understanding form control receipt

How to fill out understanding form control receipt:

01

Begin by entering the date and time of the transaction at the top of the form. This will help keep track of when the receipt was issued.

02

Fill in the name of the individual or company receiving the goods or services. Make sure to accurately spell their name and include any relevant contact information.

03

Provide a description of the goods or services being received. Be detailed and specific, including any relevant quantities, sizes, or specifications.

04

Include the agreed-upon price or cost of the goods or services. This should reflect the amount that has been previously agreed upon by both parties.

05

If applicable, include any additional charges or fees that may be required. This could include taxes, shipping costs, or service charges.

06

Make sure to include any payment details, such as the method of payment (cash, credit card, etc.) and any reference numbers or authorization codes.

07

Provide a space for both the individual or company receiving the goods or services and the individual or company providing them to sign and date the receipt. This will serve as proof that the transaction took place.

Who needs understanding form control receipt:

01

Small businesses: Understanding form control receipts are essential for small businesses as they help keep track of transactions and provide proof of purchase for their records.

02

Service providers: Professionals such as plumbers, electricians, or consultants often need understanding form control receipts to document their services and provide a record of payment for clients.

03

Individuals for personal transactions: Even for personal transactions, understanding form control receipts can be useful to keep track of purchases, especially for high-value items or services.

Note: It is always recommended to consult with a legal or financial professional to ensure that the specific requirements and regulations in your region are being met when filling out understanding form control receipts.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is understanding form control receipt?

Understanding form control receipt is a document that records the details of a controlled transaction to ensure compliance with tax regulations.

Who is required to file understanding form control receipt?

Any taxpayer engaged in controlled transactions is required to file understanding form control receipt.

How to fill out understanding form control receipt?

The understanding form control receipt can be filled out by providing details of the controlled transaction, including the parties involved, transfer pricing methods used, and financial information.

What is the purpose of understanding form control receipt?

The purpose of understanding form control receipt is to document and disclose information related to controlled transactions for tax compliance purposes.

What information must be reported on understanding form control receipt?

The understanding form control receipt must include details of the parties involved, description of the transaction, transfer pricing methods used, and financial information.

When is the deadline to file understanding form control receipt in 2023?

The deadline to file understanding form control receipt in 2023 is typically within a specific time frame after the end of the tax year, usually by March 31st.

What is the penalty for the late filing of understanding form control receipt?

The penalty for the late filing of understanding form control receipt may include fines or interest charges on the amount of tax owed.

How can I send understanding form control receipt for eSignature?

To distribute your understanding form control receipt, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I edit understanding form control receipt online?

The editing procedure is simple with pdfFiller. Open your understanding form control receipt in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I fill out understanding form control receipt using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign understanding form control receipt and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

Fill out your understanding form control receipt online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.