Get the free Tax Compliance Guide - Town of Pagosa Springs - Colorado.gov

Show details

PHONE:636.227.1385

FAX:636.227.5438

public works×Manchester.city OF MANCHESTER

14318MANCHESTERRD.

MANCHESTER,MO630112018 SEWER LATERAL REPAIR PROGRAMThispacketcontains:

1. Policy&Procedures

2.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your tax compliance guide form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax compliance guide form via URL. You can also download, print, or export forms to your preferred cloud storage service.

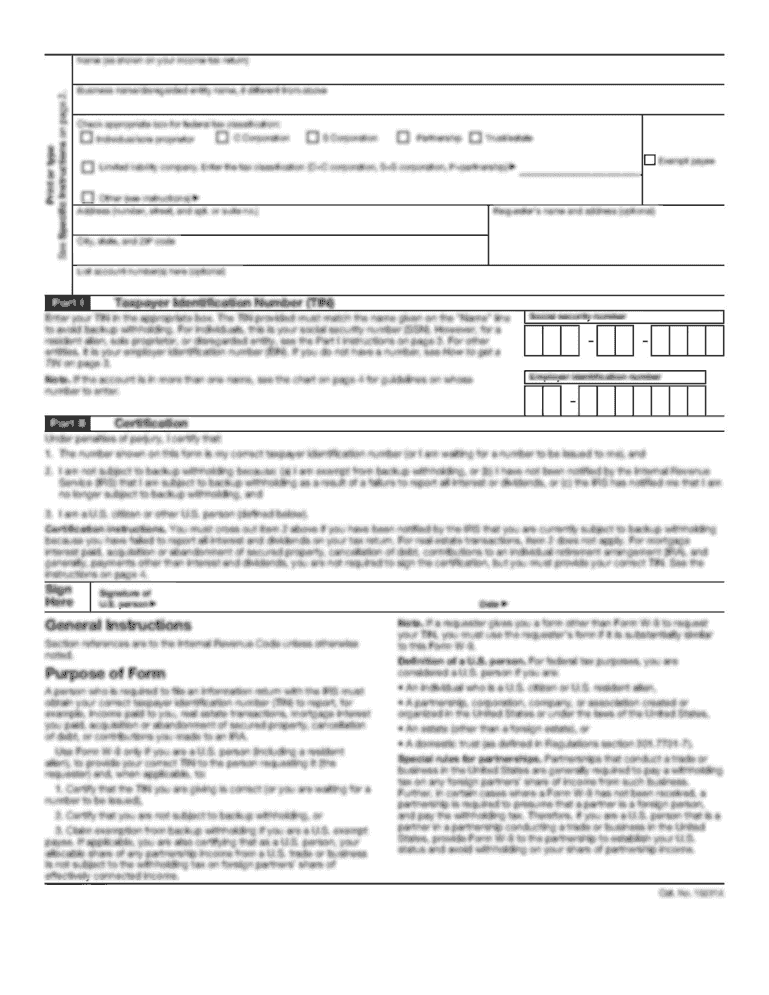

Editing tax compliance guide online

To use the professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tax compliance guide. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

How to fill out tax compliance guide

How to fill out tax compliance guide

01

Start by gathering all necessary financial documents, including income statements, expense receipts, and investment records.

02

Determine your tax filing status, whether you are filing as an individual, a business entity, or both.

03

Familiarize yourself with the tax compliance guide provided by the relevant tax authorities.

04

Follow the guide step by step, ensuring that you accurately fill out all required information.

05

Pay close attention to any specific instructions or guidelines pertaining to your particular situation or industry.

06

Use the appropriate forms and schedules to report your income, deductions, credits, and other relevant information.

07

Calculate your tax liability or refund accurately, taking into account any applicable deductions or credits.

08

Double-check all information before submitting your completed tax compliance guide to the tax authorities.

09

Keep copies of all documents and forms for your records, in case of future audits or inquiries.

10

Consider consulting a tax professional or accountant for expert advice and guidance throughout the process.

Who needs tax compliance guide?

01

Individuals who earn income from various sources, such as wages, investments, rental properties, self-employment, etc.

02

Business entities, including corporations, partnerships, and sole proprietors, who are required to report their income and expenses.

03

Non-profit organizations or institutions that are eligible for tax-exempt status but need to comply with certain tax regulations.

04

Employers who are responsible for withholding and reporting taxes on behalf of their employees.

05

Anyone who wants to ensure compliance with tax laws and avoid penalties or legal consequences.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tax compliance guide online?

With pdfFiller, you may easily complete and sign tax compliance guide online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my tax compliance guide in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your tax compliance guide and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How can I edit tax compliance guide on a smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing tax compliance guide.

Fill out your tax compliance guide online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.