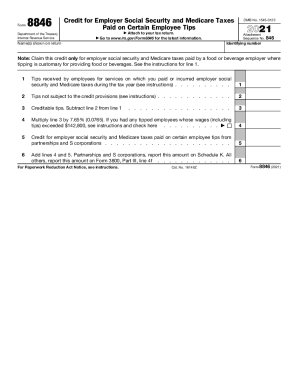

CA CDTFA-401-EZ (formerly BOE-401-EZ) 2018 free printable template

Show details

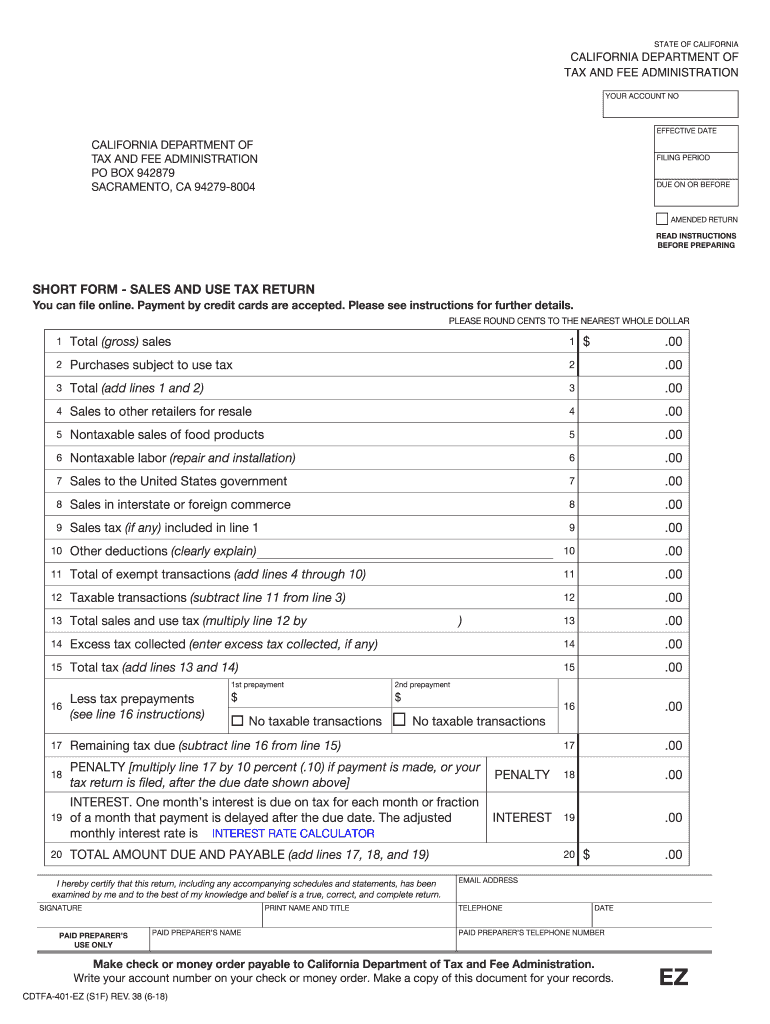

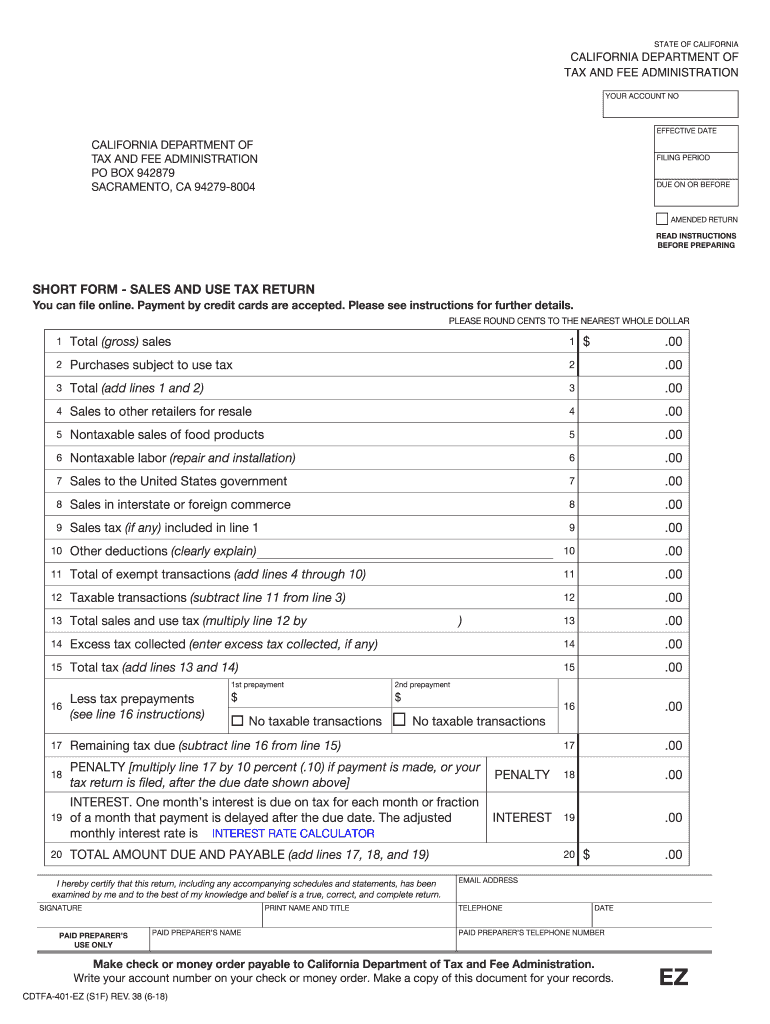

STATE OF CALIFORNIACALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION YOUR ACCOUNT NONEFFECTIVE DATECALIFORNIA DEPARTMENT OF TAX AND FEE ADMINISTRATION PO BOX 942879 SACRAMENTO, CA 942798004FILING

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-401-EZ formerly BOE-401-EZ

Edit your CA CDTFA-401-EZ formerly BOE-401-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-401-EZ formerly BOE-401-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-401-EZ formerly BOE-401-EZ online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit CA CDTFA-401-EZ formerly BOE-401-EZ. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-401-EZ (formerly BOE-401-EZ) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-401-EZ formerly BOE-401-EZ

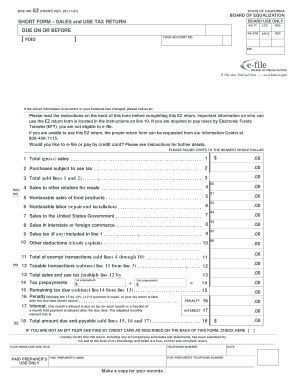

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)

01

Download the CA CDTFA-401-EZ form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Fill in your legal business name and any fictitious business name if you use one.

03

Provide your seller's permit number or the account number assigned by CDTFA.

04

Indicate the reporting period for which you are filing the return.

05

Enter your total sales for the period in Box 1.

06

Deduct any exempt sales in Box 2.

07

Calculate the taxable sales by subtracting exempt sales from total sales in Box 3.

08

Fill in the appropriate rate of tax in Box 4, depending on the location of your business.

09

Compute the total amount of tax owed by multiplying taxable sales by the tax rate in Box 5.

10

Include any applicable prepayments in Box 6 and calculate the net amount due in Box 7.

11

Review the form for accuracy, sign it, and submit it by the due date, either online or by mail.

Who needs CA CDTFA-401-EZ (formerly BOE-401-EZ)?

01

Businesses that have a seller's permit in California and have made sales subject to sales tax need to file CA CDTFA-401-EZ.

02

Small sellers with simple tax situations may qualify to use this simplified form instead of the more complex CDTFA-401.

Instructions and Help about CA CDTFA-401-EZ formerly BOE-401-EZ

Fill

form

: Try Risk Free

People Also Ask about

What is Form 401 EZ?

Short Form - Sales and Use Tax Return (CDTFA-401-EZ2) – Department of Tax and Fee Administration Government Form in California – Formalu.

Does California have a sales tax exemption certificate?

If you are selling to a customer who has an exempt status, you must collect a California Sales Tax Exemption certificate and keep it on file. If you are audited, you will be expected to produce this as proof that you sold an exempt item.

Why am I getting a letter from CDTFA?

Customs Pre-Notification Letter (CDTFA-400-USC) We received information from U.S. Customs and Border Protection (CBP) indicating that you imported items into California for storage, use, or other consumption in this state during the previous calendar year which may require you to pay use tax.

What does the CDTFA do?

The California Department of Tax and Fee Administration (CDTFA) administers California's sales and use, fuel, tobacco, alcohol, and cannabis taxes, as well as a variety of other taxes and fees that fund specific state programs.

What is 401 EZ?

Short Form - Sales and Use Tax Return (CDTFA-401-EZ2) – Department of Tax and Fee Administration Government Form in California – Formalu.

What is a Cdtfa form?

California Department of Tax and Fee Administration homepage File a return or make a payment online by logging into our secure site using your username and password.

Who has to make California sales tax prepayments?

(a) Upon written notification by the board, any person whose estimated measure of tax liability under this part averages seventeen thousand dollars ($17,000) or more per month, as determined by the board, shall, without regard to the measure of tax in any one month make prepayments as prescribed in this section.

Do I need to file CDTFA?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

What form do I use to file sales tax in California?

The filing process forces you to detail your total sales in the state, the amount of sales tax collected, and the location of each sale. Filing sales tax online is generally recommended, but businesses may also submit the State, Local, and District Sales and Use Tax Return paper form (CDTFA-401-A).

What do you report to CDTFA?

You should report all your taxable and nontaxable sales, including any sales made on a state-designated fairground, on the Total sales line. Reporting an amount on the state-designated fairgrounds line does not affect any other part of your return or the calculation of your tax liability.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my CA CDTFA-401-EZ formerly BOE-401-EZ in Gmail?

Create your eSignature using pdfFiller and then eSign your CA CDTFA-401-EZ formerly BOE-401-EZ immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit CA CDTFA-401-EZ formerly BOE-401-EZ on an iOS device?

Create, edit, and share CA CDTFA-401-EZ formerly BOE-401-EZ from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

Can I edit CA CDTFA-401-EZ formerly BOE-401-EZ on an Android device?

You can make any changes to PDF files, such as CA CDTFA-401-EZ formerly BOE-401-EZ, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is CA CDTFA-401-EZ (formerly BOE-401-EZ)?

CA CDTFA-401-EZ is a simplified sales tax return form used by qualified taxpayers in California to report their sales and use tax for a reporting period.

Who is required to file CA CDTFA-401-EZ (formerly BOE-401-EZ)?

Taxpayers with a sales tax permit who have a relatively low amount of taxable sales, typically under $1 million annually, may be eligible to file CA CDTFA-401-EZ.

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)?

To fill out CA CDTFA-401-EZ, taxpayers must provide basic business information, total sales, total taxable sales, any non-taxable sales, and the amount of tax due. Detailed instructions are provided on the form itself.

What is the purpose of CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The purpose of CA CDTFA-401-EZ is to streamline the sales tax reporting process for eligible small businesses, making it quicker and easier to report sales and remit tax.

What information must be reported on CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The information that must be reported includes total sales, total taxable sales, total non-taxable sales, any deductions, and the total amount of sales tax due.

Fill out your CA CDTFA-401-EZ formerly BOE-401-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-401-EZ Formerly BOE-401-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.