CA CDTFA-401-EZ (formerly BOE-401-EZ) 2013 free printable template

Show details

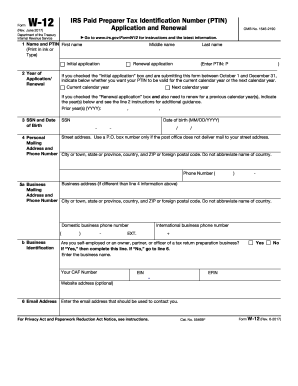

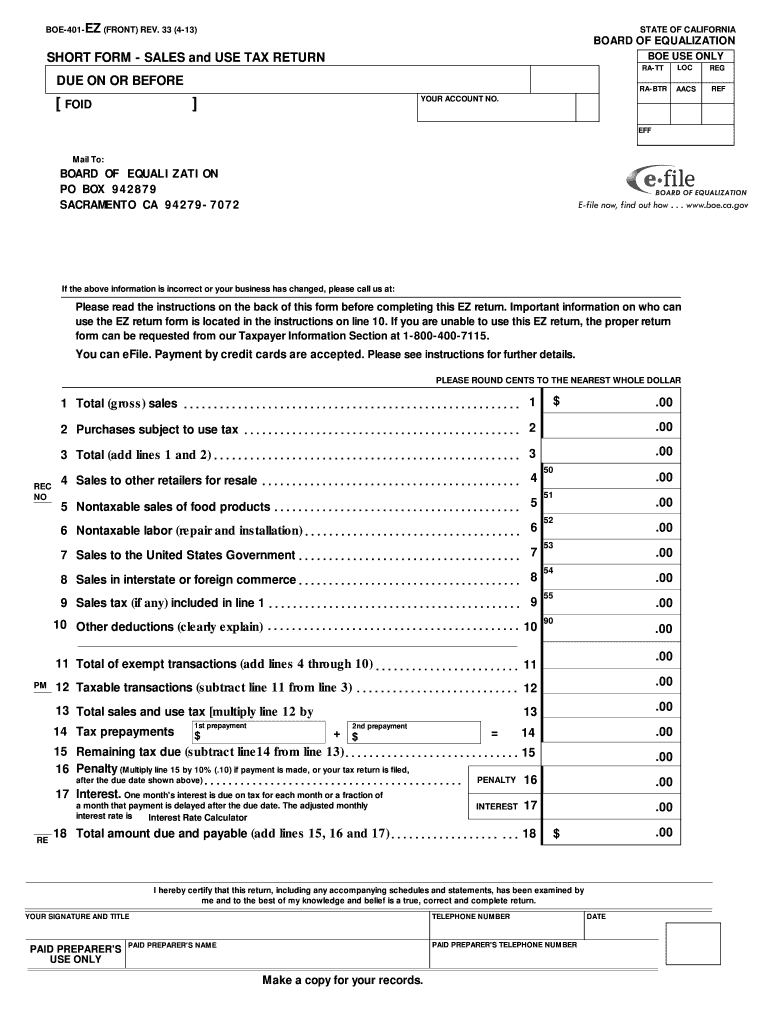

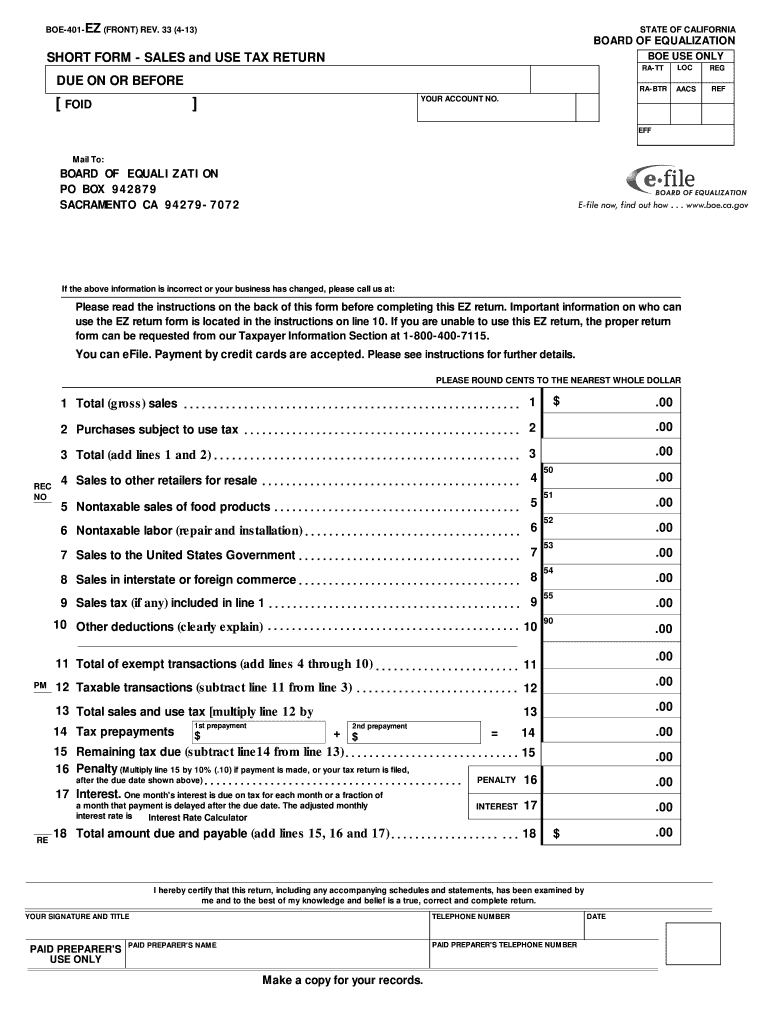

BOE-401-EZ FRONT REV. 33 4-13 STATE OF CALIFORNIA BOARD OF EQUALIZATION BOE USE ONLY SHORT FORM - SALES and USE TAX RETURN RA-TT FOID LOC REG RA-BTR DUE ON OR BEFORE AACS REF YOUR ACCOUNT NO. CLEAR PRINT DATE BOE-401-EZ BACK REV. 33 4-13 INSTRUCTIONS - STATE LOCAL AND DISTRICT SALES AND USE TAX RETURN BOE-401-EZ eFiling. If you are unable to use this EZ return the proper return form can be requested from our Taxpayer Information Section at 1-800-400-7115. You can eFile. Payment by credit...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-401-EZ formerly BOE-401-EZ

Edit your CA CDTFA-401-EZ formerly BOE-401-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-401-EZ formerly BOE-401-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-401-EZ formerly BOE-401-EZ online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit CA CDTFA-401-EZ formerly BOE-401-EZ. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-401-EZ (formerly BOE-401-EZ) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-401-EZ formerly BOE-401-EZ

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)

01

Obtain the CA CDTFA-401-EZ form from the California Department of Tax and Fee Administration (CDTFA) website.

02

Begin by filling out your name, business name (if applicable), and your California seller's permit number.

03

Enter the reporting period for which you are filing the return.

04

Calculate the total sales, noting any deductions for exempt sales or returns.

05

Enter the amount of sales tax collected and/or due.

06

Complete the section for prepayments if applicable.

07

Determine any penalty or interest charges if you are filing late.

08

Sign and date the form to certify that the information is accurate.

09

Submit the completed form by the due date, either online or by mail to the CDTFA.

Who needs CA CDTFA-401-EZ (formerly BOE-401-EZ)?

01

Businesses operating in California that make sales of tangible personal property.

02

Individuals or entities required to report and pay sales tax to the state of California.

03

Companies eligible to use the simplified filing method provided by the CDTFA.

Instructions and Help about CA CDTFA-401-EZ formerly BOE-401-EZ

Fill

form

: Try Risk Free

People Also Ask about

Does California refund sales tax to foreign visitors?

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government - the same way that Value Added Tax (VAT) is paid in many countries.

How often do you file sales tax returns in California?

In California, you will be required to file and remit sales tax either monthly (in special cases), quarterly, semiannually or annually (calendar annual or fiscal annual). California sales tax returns are always due the last day of the month following the reporting period.

How do I claim my California Tax refund?

Provide us a written statement with supporting documents listing the facts to support your claim. Use one of the following forms to file a reasonable cause claim for refund: Reasonable Cause - Individual and Fiduciary Claim for Refund (FTB 2917) Reasonable Cause - Business Entity Claim for Refund (FTB 2924)

Can I get a refund on sales tax California?

You may also file a claim for refund using a CDTFA-101, Claim for Refund or Credit, or by sending us a letter. Your claim must state all of the following: The specific reasons you paid too much tax. The amount of tax you overpaid.

Do sales taxes get refunded?

If you bought something and paid sales tax for it, then you should receive that same sales tax back if you return the item.

Who must file sales tax return in California?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Can I claim tax back at LAX airport?

Refund Locations: Both US Citizens and non-US citizens can claim tax refunds at all major international airport terminals, they would have a Tax refund desk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send CA CDTFA-401-EZ formerly BOE-401-EZ for eSignature?

To distribute your CA CDTFA-401-EZ formerly BOE-401-EZ, simply send it to others and receive the eSigned document back instantly. Post or email a PDF that you've notarized online. Doing so requires never leaving your account.

How do I make changes in CA CDTFA-401-EZ formerly BOE-401-EZ?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your CA CDTFA-401-EZ formerly BOE-401-EZ to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I fill out the CA CDTFA-401-EZ formerly BOE-401-EZ form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign CA CDTFA-401-EZ formerly BOE-401-EZ and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is CA CDTFA-401-EZ (formerly BOE-401-EZ)?

CA CDTFA-401-EZ is a simplified tax return form used by businesses in California to report their sales and use tax obligations to the California Department of Tax and Fee Administration.

Who is required to file CA CDTFA-401-EZ (formerly BOE-401-EZ)?

Businesses with a small amount of taxable sales, typically those with annual taxable sales of $100,000 or less, are required to file the CA CDTFA-401-EZ form.

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)?

To fill out the CA CDTFA-401-EZ, a filer must provide detailed information about their gross sales, purchases subject to use tax, deductions, and compute the amount of sales tax owed. Clear instructions are provided on the form.

What is the purpose of CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The purpose of the CA CDTFA-401-EZ form is to offer a streamlined option for eligible businesses to report their sales and use tax liabilities in an efficient manner.

What information must be reported on CA CDTFA-401-EZ (formerly BOE-401-EZ)?

Information that must be reported includes total gross sales, total use tax due, deductions for exempt sales, and the calculated balance due for the tax reporting period.

Fill out your CA CDTFA-401-EZ formerly BOE-401-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-401-EZ Formerly BOE-401-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.