CA CDTFA-401-EZ (formerly BOE-401-EZ) 2023 free printable template

Show details

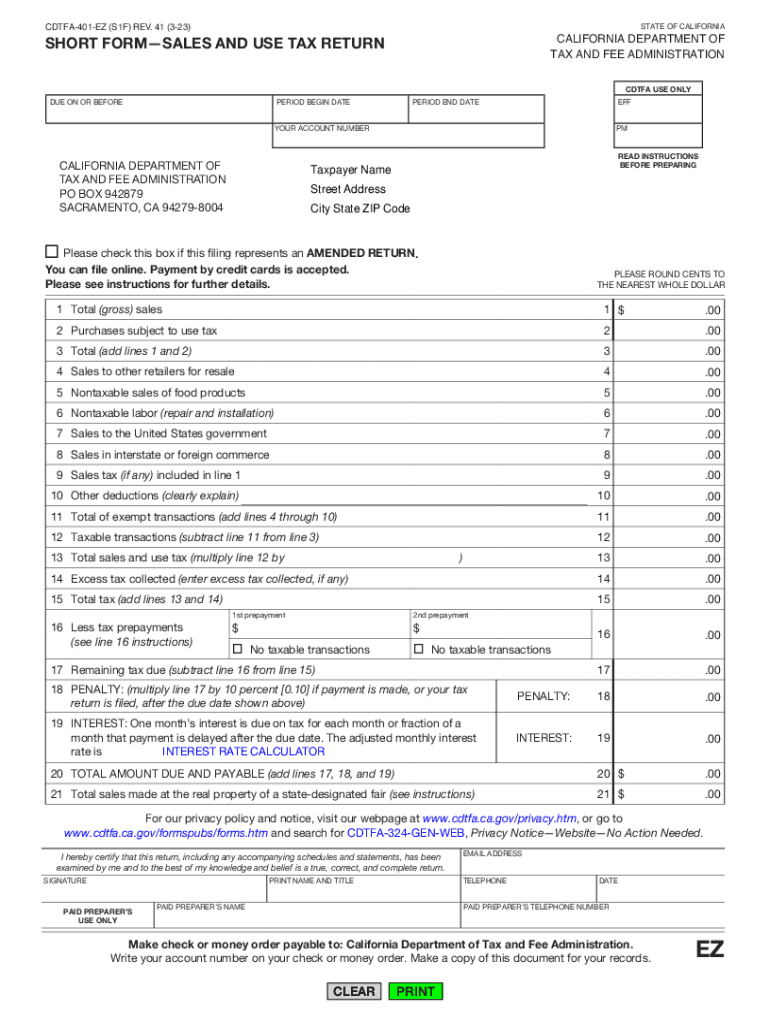

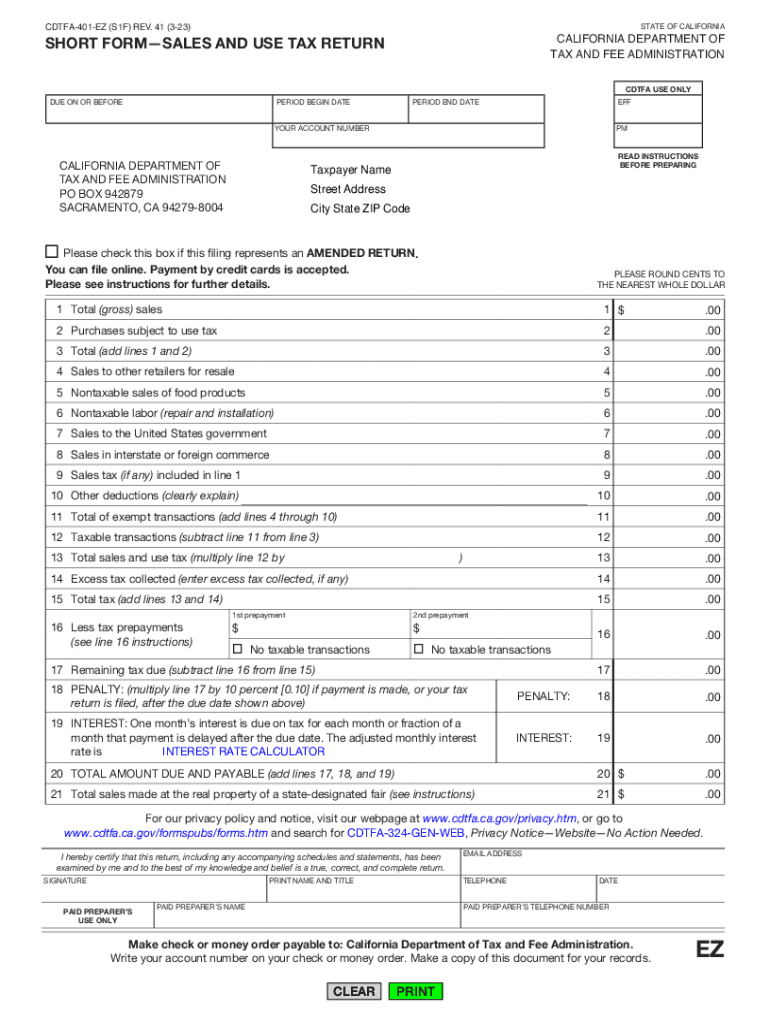

CDTFA401EZ (S1F) REV. 41 (323)STATE OF CALIFORNIACALIFORNIA DEPARTMENT OF

TAX AND FEE ADMINISTRATIONSHORT FORMSALES AND USE TAX RETURNCDTFA USE ONLY

DUE ON OR BEFOREPERIOD BEGIN DATEPERIOD END DATEEFFYOUR

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-401-EZ formerly BOE-401-EZ

Edit your CA CDTFA-401-EZ formerly BOE-401-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-401-EZ formerly BOE-401-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-401-EZ formerly BOE-401-EZ online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA CDTFA-401-EZ formerly BOE-401-EZ. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-401-EZ (formerly BOE-401-EZ) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-401-EZ formerly BOE-401-EZ

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)

01

Obtain the CA CDTFA-401-EZ form from the California Department of Tax and Fee Administration website.

02

Fill in your name, address, and account number at the top of the form.

03

Indicate the reporting period for the taxes you are filing.

04

Accurately report your total sales, exempt sales, and any deductions.

05

Calculate the sales tax due using the rates applicable to your sales.

06

Enter any prepayments or credits you may have.

07

Total the amounts to determine your balance due or refund.

08

Sign and date the form to certify accuracy.

09

Submit the completed form by the due date, either online, by mail, or in person as instructed.

Who needs CA CDTFA-401-EZ (formerly BOE-401-EZ)?

01

Businesses in California that have made sales and are registered for a seller's permit.

02

Some individuals and organizations that need to report sales tax collected from customers.

03

Those who qualify to use the simplified CA CDTFA-401-EZ form for sales and use tax reporting.

04

Entities that have total taxable sales under a certain threshold, allowing them to file this shorter form.

Instructions and Help about CA CDTFA-401-EZ formerly BOE-401-EZ

Fill

form

: Try Risk Free

People Also Ask about

Does California refund sales tax to foreign visitors?

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government - the same way that Value Added Tax (VAT) is paid in many countries.

How often do you file sales tax returns in California?

In California, you will be required to file and remit sales tax either monthly (in special cases), quarterly, semiannually or annually (calendar annual or fiscal annual). California sales tax returns are always due the last day of the month following the reporting period.

How do I claim my California Tax refund?

Provide us a written statement with supporting documents listing the facts to support your claim. Use one of the following forms to file a reasonable cause claim for refund: Reasonable Cause - Individual and Fiduciary Claim for Refund (FTB 2917) Reasonable Cause - Business Entity Claim for Refund (FTB 2924)

Can I get a refund on sales tax California?

You may also file a claim for refund using a CDTFA-101, Claim for Refund or Credit, or by sending us a letter. Your claim must state all of the following: The specific reasons you paid too much tax. The amount of tax you overpaid.

Do sales taxes get refunded?

If you bought something and paid sales tax for it, then you should receive that same sales tax back if you return the item.

Who must file sales tax return in California?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Can I claim tax back at LAX airport?

Refund Locations: Both US Citizens and non-US citizens can claim tax refunds at all major international airport terminals, they would have a Tax refund desk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in CA CDTFA-401-EZ formerly BOE-401-EZ?

The editing procedure is simple with pdfFiller. Open your CA CDTFA-401-EZ formerly BOE-401-EZ in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I create an electronic signature for signing my CA CDTFA-401-EZ formerly BOE-401-EZ in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your CA CDTFA-401-EZ formerly BOE-401-EZ right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

How do I complete CA CDTFA-401-EZ formerly BOE-401-EZ on an Android device?

Use the pdfFiller mobile app to complete your CA CDTFA-401-EZ formerly BOE-401-EZ on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CA CDTFA-401-EZ (formerly BOE-401-EZ)?

CA CDTFA-401-EZ is a simplified sales tax return form used by eligible small businesses in California to report and pay sales and use tax. It is designed for businesses with lower sales volumes to facilitate easier tax reporting.

Who is required to file CA CDTFA-401-EZ (formerly BOE-401-EZ)?

Businesses that meet specific criteria, such as having a total annual taxable sales of less than $100,000, and that are not required to pay use tax on out-of-state purchases, are eligible to file CA CDTFA-401-EZ.

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)?

To fill out CA CDTFA-401-EZ, you need to provide business identification information, report total sales, calculate total tax due based on the applicable rate, and submit the form with the payment. Detailed instructions are available on the CDTFA website.

What is the purpose of CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The purpose of CA CDTFA-401-EZ is to simplify the process of sales tax reporting for small businesses in California, ensuring compliance while reducing the complexity often associated with tax filings.

What information must be reported on CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The information required includes the business name, address, seller's permit number, total sales amount, taxable sales, and the total tax due for the reporting period.

Fill out your CA CDTFA-401-EZ formerly BOE-401-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-401-EZ Formerly BOE-401-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.