CA CDTFA-401-EZ (formerly BOE-401-EZ) 2007 free printable template

Show details

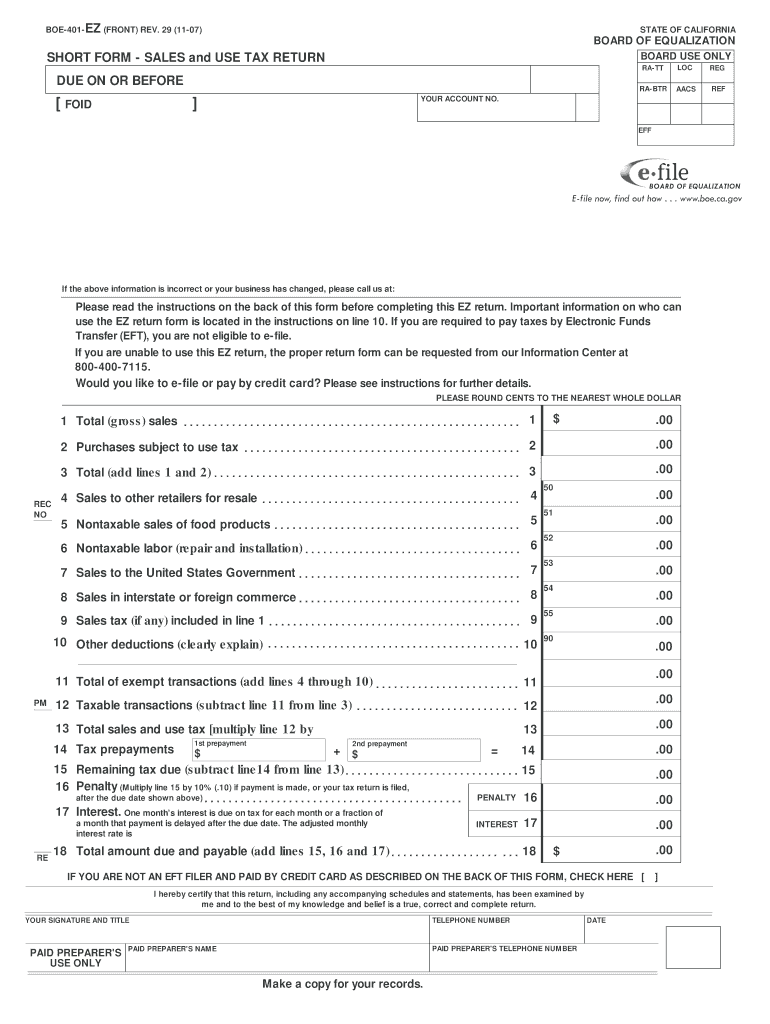

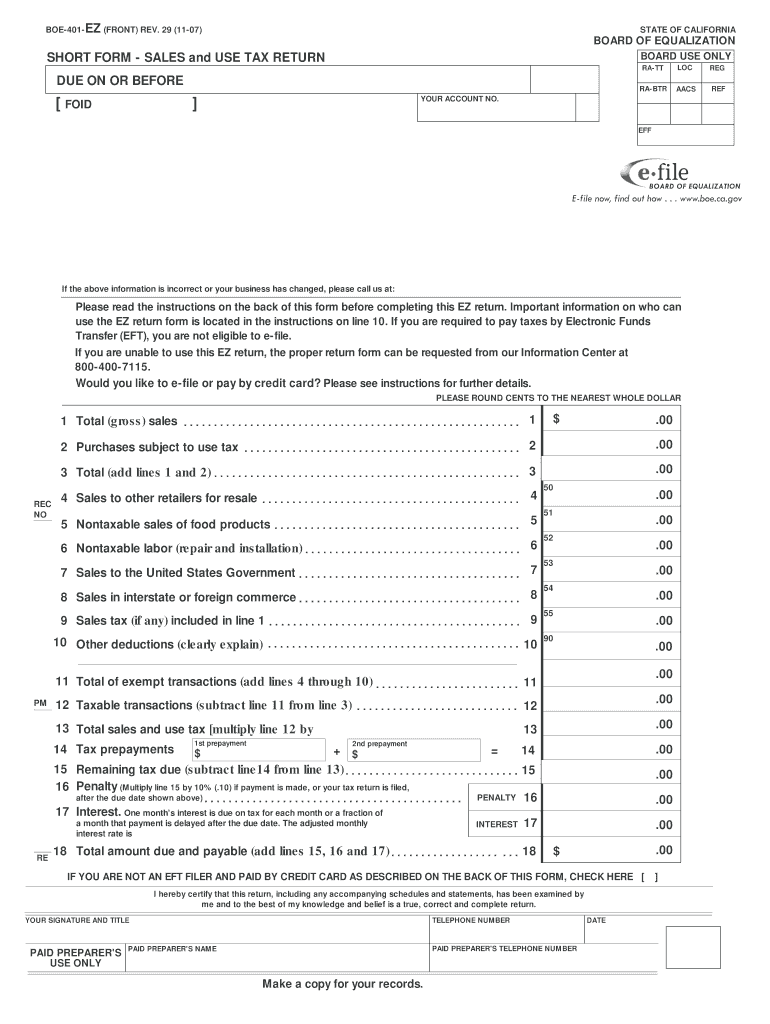

BOE-401-EZ (FRONT) REV. 29 (11-07) STATE OF CALIFORNIA BOARD OF EQUALIZATION BOARD USE ONLY SHORT FORM SALES and USE TAX RETURN RA-TFOODID LOC REG RA-BTR DUE ON OR BEFORE ACS REF YOUR ACCOUNT NO.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-401-EZ formerly BOE-401-EZ

Edit your CA CDTFA-401-EZ formerly BOE-401-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-401-EZ formerly BOE-401-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing CA CDTFA-401-EZ formerly BOE-401-EZ online

Follow the steps down below to take advantage of the professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CA CDTFA-401-EZ formerly BOE-401-EZ. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-401-EZ (formerly BOE-401-EZ) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-401-EZ formerly BOE-401-EZ

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)

01

Gather all necessary documents, including your sales and use tax records.

02

Begin filling out the form by entering your business information, including name, address, and account number.

03

Report your total gross sales for the reporting period in the appropriate section.

04

Calculate the total amount of tax due by applying the current sales tax rates to your gross sales.

05

Deduct any allowable deductions, such as returns and allowances, from your gross sales.

06

Ensure all calculations are accurate and check for any discrepancies.

07

Complete any additional sections related to specific tax exemptions or special circumstances.

08

Review the form for completeness and accuracy before signing.

09

Submit the completed form by the due date, either online through the CDTFA website or via mail.

Who needs CA CDTFA-401-EZ (formerly BOE-401-EZ)?

01

Businesses in California that are required to report their sales and use tax obligations.

02

Retailers and other sellers who make taxable sales and need to remit tax to the state.

03

Taxpayers who qualify for simplified reporting options based on their sales volume and other criteria.

Fill

form

: Try Risk Free

People Also Ask about

What is a 401 EZ form?

Short Form - Sales and Use Tax Return (CDTFA-401-EZ2) – Department of Tax and Fee Administration Government Form in California – Formalu. Locations. United States.

What is form 540 used for?

The most common California income tax form is the CA 540. This form is used by California residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

Do I file 540 or 540ez?

Form 540 is used by California residents to file their state income tax every April. This form should be completed after filing your federal taxes, such as Form 1040, Form 1040A, or Form 1040EZ, because information from your federal taxes will be used to help fill out Form 540.

What is the tax exemption form for California?

Steps To Getting A California Franchise Tax Exemption To apply for California tax exemption status, use form FTB 3500, Exemption Application. This is a long detailed form, much like the IRS form 1023. If you have already received your 501c3 status from the IRS, use form FTB 3500A, Submission of Exemption Request.

What is the form number for California sales and use tax?

CDTFA-401-E State, Local, and District Consumer Use Tax Return. CDTFA-401-EZ Short Form—Sales and Use Tax Return.

Is California use tax the same as sales tax?

California's sales tax generally applies to the sale of merchandise, including vehicles, in the state. California's use tax applies to the use, storage, or other consumption of those same kinds of items in the state.

How is use tax calculated in California?

Consumer. The sales and use tax rate varies depending where the item is bought or will be used. A base sales and use tax rate of 7.25 percent is applied statewide. In addition to the statewide sales and use tax rate, some cities and counties have voter- or local government-approved district taxes.

How do I calculate California use tax?

This table can only be used to report use tax on your 2022 California Income Tax Return.Make Online Purchases? You May Owe Use Tax. Adjusted Gross Income RangeUse Tax Liability$150,000 to $174,999$15$175,000 to $199,999$17More Than $199,999Multiply by 0.009% (0.00009)12 more rows

What is 401 EZ?

CDTFA 401-EZ, Short Form-Sales and Use Tax Return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit CA CDTFA-401-EZ formerly BOE-401-EZ online?

The editing procedure is simple with pdfFiller. Open your CA CDTFA-401-EZ formerly BOE-401-EZ in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Can I sign the CA CDTFA-401-EZ formerly BOE-401-EZ electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your CA CDTFA-401-EZ formerly BOE-401-EZ.

Can I edit CA CDTFA-401-EZ formerly BOE-401-EZ on an Android device?

You can make any changes to PDF files, such as CA CDTFA-401-EZ formerly BOE-401-EZ, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is CA CDTFA-401-EZ (formerly BOE-401-EZ)?

CA CDTFA-401-EZ is a form used for reporting sales and use tax in California, designed for small businesses with simple tax situations.

Who is required to file CA CDTFA-401-EZ (formerly BOE-401-EZ)?

Businesses with gross receipts of less than $1 million and those that meet specific eligibility criteria are required to file CA CDTFA-401-EZ.

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)?

To fill out CA CDTFA-401-EZ, taxpayers must provide their gross sales, allowable deductions, and calculate the tax due, following the instructions provided by the California Department of Tax and Fee Administration.

What is the purpose of CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The purpose of CA CDTFA-401-EZ is to simplify the sales and use tax reporting process for eligible small businesses in California.

What information must be reported on CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The information that must be reported includes total gross sales, deductions, taxable sales, and the amount of sales tax owed.

Fill out your CA CDTFA-401-EZ formerly BOE-401-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-401-EZ Formerly BOE-401-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.