CA CDTFA-401-EZ (formerly BOE-401-EZ) 2013 free printable template

Show details

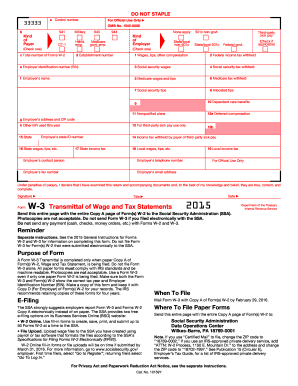

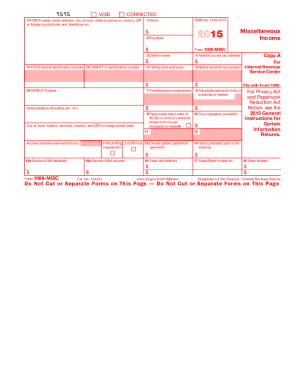

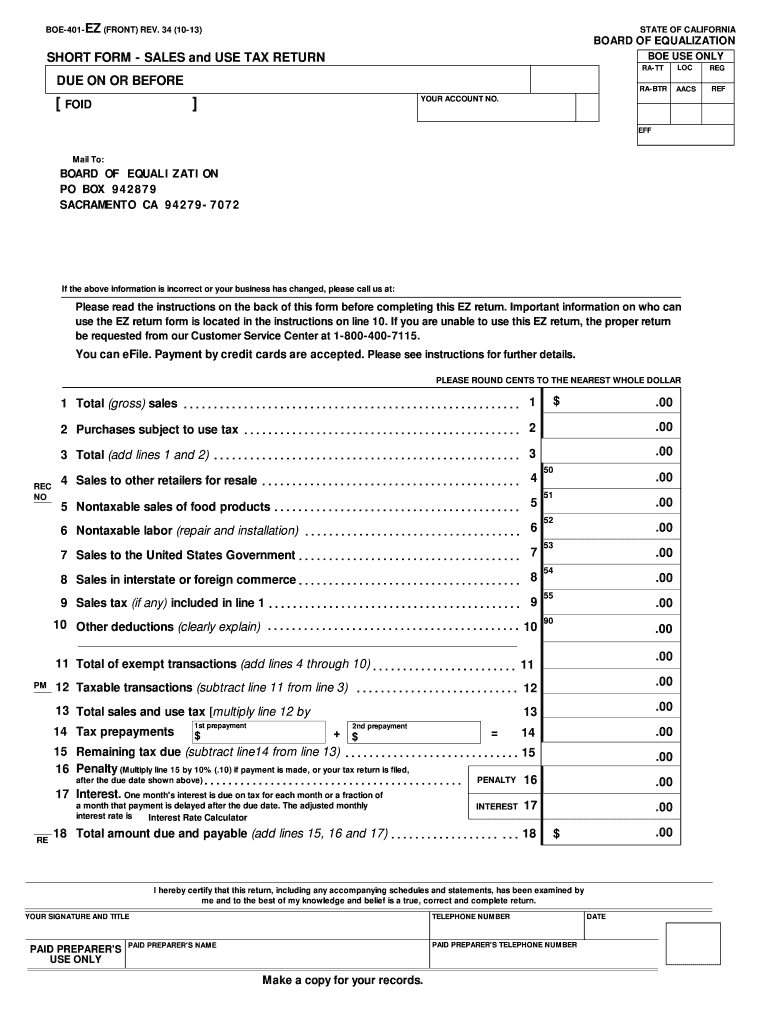

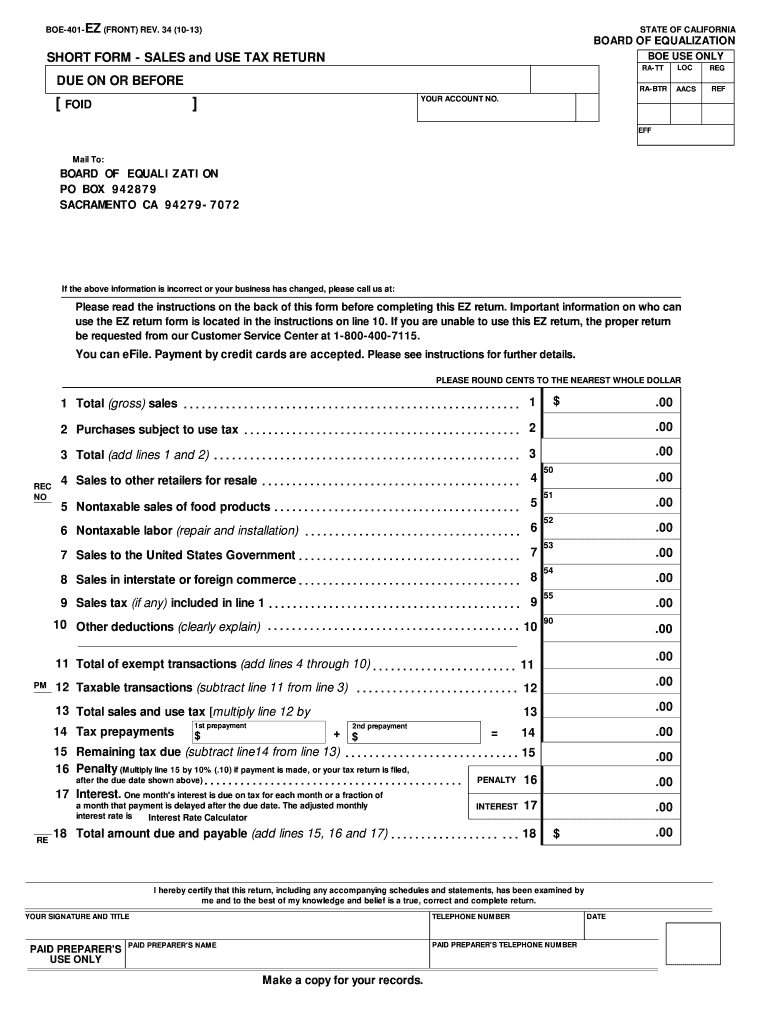

CLEAR PRINT DATE BOE-401-EZ BACK REV. 34 10-13 INSTRUCTIONS - STATE LOCAL AND DISTRICT SALES AND USE TAX RETURN BOE-401-EZ You can file your return online by going to www. BOE-401-EZ FRONT REV. 34 10-13 STATE OF CALIFORNIA BOARD OF EQUALIZATION BOE USE ONLY SHORT FORM - SALES and USE TAX RETURN RA-TT FOID LOC REG RA-BTR DUE ON OR BEFORE AACS REF YOUR ACCOUNT NO. EFF Mail To PO BOX 942879 SACRAMENTO CA 94279-7072 If the above information is incorrect or your business has changed please call us...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CA CDTFA-401-EZ formerly BOE-401-EZ

Edit your CA CDTFA-401-EZ formerly BOE-401-EZ form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CA CDTFA-401-EZ formerly BOE-401-EZ form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CA CDTFA-401-EZ formerly BOE-401-EZ online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit CA CDTFA-401-EZ formerly BOE-401-EZ. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA CDTFA-401-EZ (formerly BOE-401-EZ) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CA CDTFA-401-EZ formerly BOE-401-EZ

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)

01

Gather your business information including your seller's permit number.

02

Access the CA CDTFA-401-EZ form online or obtain a paper copy.

03

Fill in the periods covered by the return, which will typically be the reporting period specified.

04

Enter total sales for the period in the designated field.

05

Report any exempt sales, if applicable.

06

Calculate the taxable sales by subtracting exempt sales from total sales.

07

Enter the total use tax you owe.

08

Sign and date the form to certify the accuracy of the information provided.

09

Submit the form by the required deadline via mail or online.

Who needs CA CDTFA-401-EZ (formerly BOE-401-EZ)?

01

Businesses operating in California that have sales and use tax obligations.

02

Retailers who need to report their sales and remit use tax collected.

03

Small businesses with straightforward sales tax situations that qualify to use the simplified form instead of the more complex CA CDTFA-401.

Instructions and Help about CA CDTFA-401-EZ formerly BOE-401-EZ

Fill

form

: Try Risk Free

People Also Ask about

Does California refund sales tax to foreign visitors?

The United States Government does not refund sales tax to foreign visitors. Sales tax charged in the United States is paid to individual states, not the Federal government - the same way that Value Added Tax (VAT) is paid in many countries.

How often do you file sales tax returns in California?

In California, you will be required to file and remit sales tax either monthly (in special cases), quarterly, semiannually or annually (calendar annual or fiscal annual). California sales tax returns are always due the last day of the month following the reporting period.

How do I claim my California Tax refund?

Provide us a written statement with supporting documents listing the facts to support your claim. Use one of the following forms to file a reasonable cause claim for refund: Reasonable Cause - Individual and Fiduciary Claim for Refund (FTB 2917) Reasonable Cause - Business Entity Claim for Refund (FTB 2924)

Can I get a refund on sales tax California?

You may also file a claim for refund using a CDTFA-101, Claim for Refund or Credit, or by sending us a letter. Your claim must state all of the following: The specific reasons you paid too much tax. The amount of tax you overpaid.

Do sales taxes get refunded?

If you bought something and paid sales tax for it, then you should receive that same sales tax back if you return the item.

Who must file sales tax return in California?

Retailers engaged in business in California must register with the California Department of Tax and Fee Administration (CDTFA) and pay the state's sales tax, which applies to all retail sales of goods and merchandise except those sales specifically exempted by law.

Can I claim tax back at LAX airport?

Refund Locations: Both US Citizens and non-US citizens can claim tax refunds at all major international airport terminals, they would have a Tax refund desk.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CA CDTFA-401-EZ formerly BOE-401-EZ without leaving Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your CA CDTFA-401-EZ formerly BOE-401-EZ into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete CA CDTFA-401-EZ formerly BOE-401-EZ online?

pdfFiller has made it easy to fill out and sign CA CDTFA-401-EZ formerly BOE-401-EZ. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

Can I edit CA CDTFA-401-EZ formerly BOE-401-EZ on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share CA CDTFA-401-EZ formerly BOE-401-EZ from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is CA CDTFA-401-EZ (formerly BOE-401-EZ)?

CA CDTFA-401-EZ is a simplified sales and use tax return form used by qualified small businesses in California to report their sales and use tax liability.

Who is required to file CA CDTFA-401-EZ (formerly BOE-401-EZ)?

Businesses with taxable sales of up to $100,000 in the previous calendar year and that meet other specific criteria are required to file CA CDTFA-401-EZ.

How to fill out CA CDTFA-401-EZ (formerly BOE-401-EZ)?

To fill out CA CDTFA-401-EZ, businesses need to provide their total sales, any exemptions, and calculate the total tax due by following the instructions outlined in the form.

What is the purpose of CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The purpose of CA CDTFA-401-EZ is to facilitate a straightforward method for eligible small businesses to report and pay their sales and use taxes to the state of California.

What information must be reported on CA CDTFA-401-EZ (formerly BOE-401-EZ)?

The information that must be reported includes total sales, exempt sales, total tax due, and any applicable penalties or interest.

Fill out your CA CDTFA-401-EZ formerly BOE-401-EZ online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CA CDTFA-401-EZ Formerly BOE-401-EZ is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.