Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

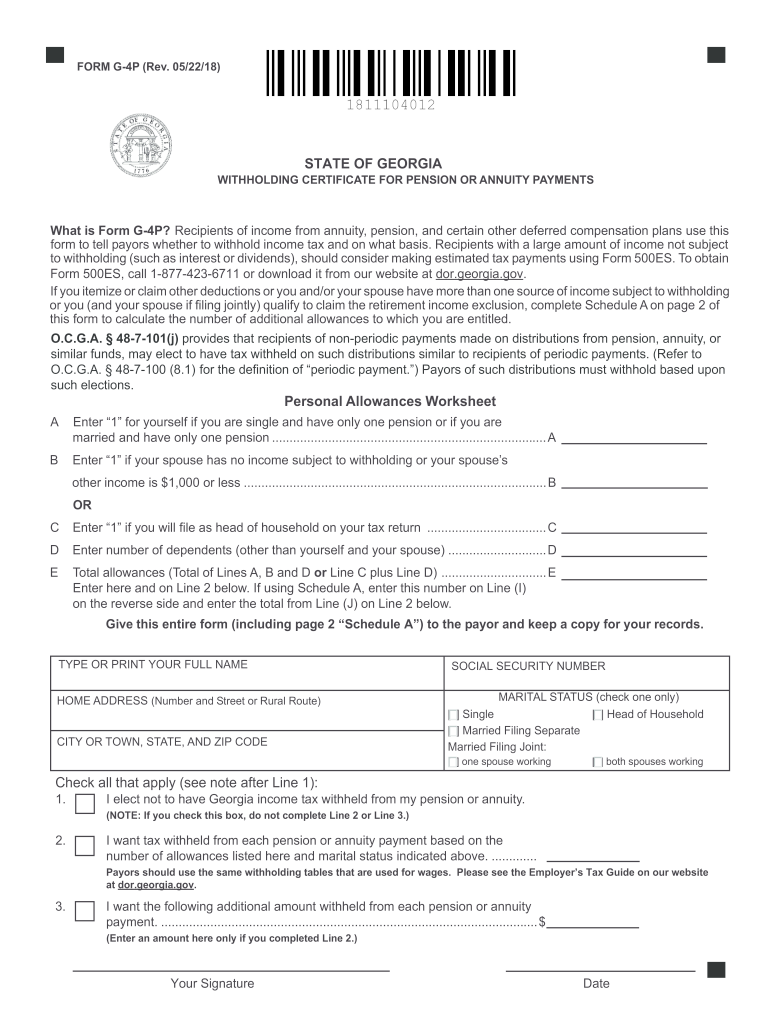

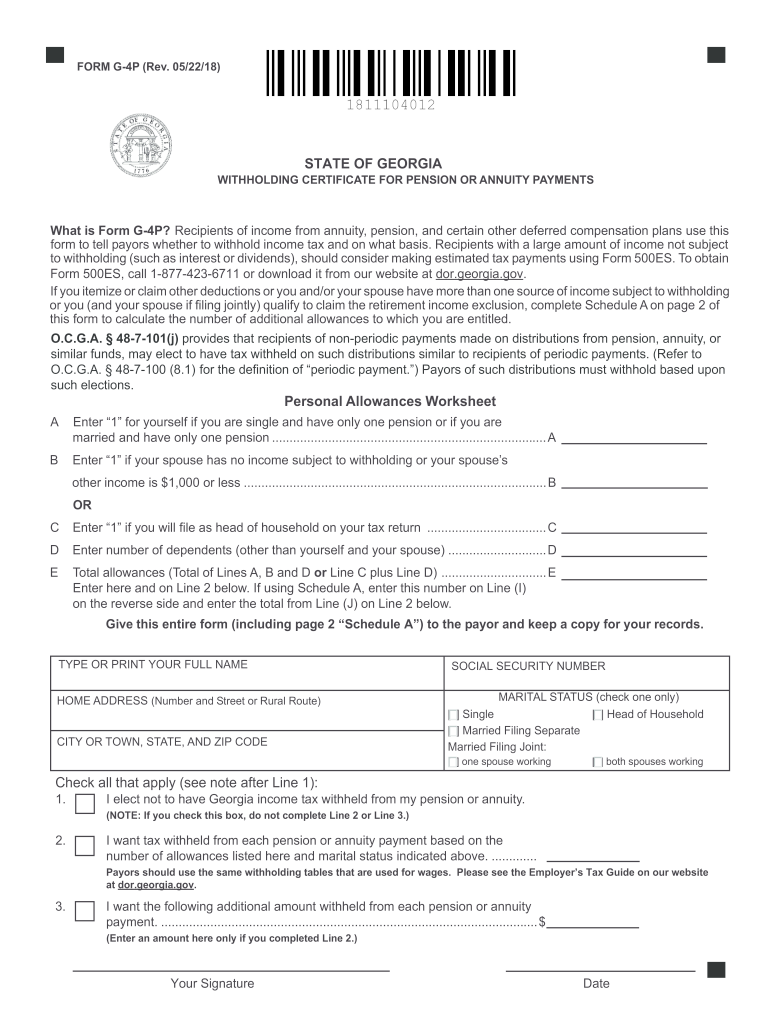

What is g 4p certificate payments?

G4P Certificate Payments is an online payment service provided by Global Payments Direct, Inc. that allows businesses to securely accept payments from customers and clients. The G4P Certificate Payments service allows businesses to accept payments via credit cards, debit cards, prepaid cards, ACH payments, and wire transfers. The service also allows businesses to quickly and easily set up recurring payments and accept payments from international customers.

What is the purpose of g 4p certificate payments?

G 4P Certificate Payments are an electronic payment system issued by the Australian Government to make payments to people receiving certain social security payments, such as family tax benefits, age pension and disability pension. The payments are issued as a certificate, which can then be used to make purchases online or as a direct deposit into a bank account. The purpose of G 4P Certificate Payments is to provide a secure and convenient way for people to receive their social security payments.

When is the deadline to file g 4p certificate payments in 2023?

The deadline for filing G-4P Certificate Payments in 2023 is typically April 15th.

What is the penalty for the late filing of g 4p certificate payments?

The penalty for late filing of G-4P certificate payments is an initial penalty of $30 per month or part of a month for which the certificate is late, up to a maximum penalty of $150.

Who is required to file g 4p certificate payments?

The G 4P certificate is a form used by an employer to report the wages paid to an employee along with the taxes withheld from those wages. Therefore, it is the responsibility of the employer to file the G 4P certificate and make the necessary tax payments.

How to fill out g 4p certificate payments?

To fill out a G-4P Certificate Payments form, follow these steps:

1. Obtain the G-4P form: You can get a copy of the G-4P Certificate Payments form from your employer, or you can download it from the appropriate government website.

2. Provide personal information: Fill out your personal information, including your name, address, and Social Security number. Ensure that all the information provided is accurate and up to date.

3. Determine payment options: Check the appropriate box to indicate if you want your payment to be issued as a paper check or if you want it to be directly deposited into your bank account.

4. Specify the payment frequency and amount: Indicate how often you want to receive the payments and the amount to be deducted from your salary for each payment. Double-check that the numbers are correct to avoid any discrepancies.

5. Calculate exemptions and allowances: Use the worksheet provided on the form or follow the instructions to calculate the appropriate exemptions and allowances based on your tax situation.

6. Deduct additional amounts: If you want to have extra amounts withheld from your paycheck to cover taxes or other deductions, specify the additional amounts in Section 5.

7. Sign and date the form: After completing the form, sign and date it at the bottom.

8. Submit the form: Submit the filled-out form to your employer according to their instructions. They will then use this information to determine the correct tax withholdings from your paycheck.

Note: It is always a good idea to consult with a tax professional or refer to the instructions provided with the form if you have any specific questions or concerns about filling out the G-4P Certificate Payments form correctly.

What information must be reported on g 4p certificate payments?

The G-4P Certificate Payments, or the Form 1099-MISC, is used to report miscellaneous income to both the IRS and the recipient of the payment. The following information must be reported on the form:

1. Payer's (business or individual who made the payment) name, address, and identification number (typically the social security number or employer identification number).

2. Recipient's (the individual or business who received the payment) name, address, and identification number.

3. Date the payment was made.

4. Amount of payment made (if the total is at least $600).

5. If the payment was made to an individual, their social security number or taxpayer identification number must be provided.

6. Description of the payment made, such as "rent," "services performed," or "royalties."

7. If tax was withheld from the payment, the amount of tax withheld should be included.

It is important to note that the specific reporting requirements may vary depending on the purpose of the payment and the nature of the income being reported. It is advisable to consult the official IRS guidelines or a tax professional for accurate and up-to-date information.

How can I edit g 4p certificate payments from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including g4 form, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in g 4p form without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your g 4p, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I edit g 4p form fill on an iOS device?

You certainly can. You can quickly edit, distribute, and sign g 4p form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.