Get the free LOAN STATUS REPORT ("LSR") S 1n VL E - Phoenix Real Estate

Show details

M REALTOR /cuff!blurs by'TL(f G:r LOAN STATUS REPORT (SSR”) The printed portion of this form has been approved by the Arizona Association EQUAL HOUSING OPPORTUNITY of REAL TOR. BUYER'S LOAN INFORMATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your loan status report quotlsrquot form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your loan status report quotlsrquot form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing loan status report quotlsrquot online

To use the services of a skilled PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit loan status report quotlsrquot. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. You may try it out for yourself by signing up for an account.

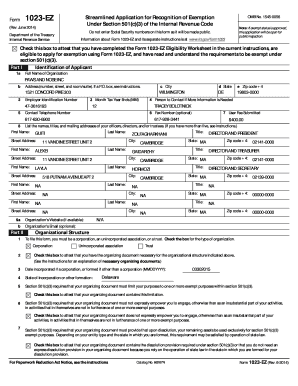

How to fill out loan status report quotlsrquot

How to fill out loan status report "LSR":

01

Begin by gathering all the necessary information and documents related to the loan. This may include loan agreements, payment schedules, and any other relevant paperwork.

02

Start filling out the LSR form by providing the basic details such as the borrower's name, loan account number, and contact information.

03

Proceed to describe the current status of the loan by indicating the outstanding balance, the amount paid till date, and any pending payments.

04

Provide a brief summary of the loan's payment history, including any late or missed payments, if applicable.

05

Specify the loan's interest rate and any other relevant terms or conditions.

06

If the loan has any collaterals or guarantees attached to it, mention them in the appropriate section of the report.

07

Include any additional remarks or comments about the loan, such as any changes in the borrower's financial situation or any potential risks.

08

Finally, review the completed LSR form for accuracy and completeness before submitting it to the appropriate party.

Who needs loan status report "LSR":

01

Lenders or financial institutions that have provided the loan typically require the LSR to keep track of the loan's progress and status.

02

Borrowers may also need the LSR to understand the current status of their loan, track their payments, and plan their finances accordingly.

03

Government agencies or regulatory bodies may request LSRs for oversight and monitoring purposes.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is loan status report quotlsrquot?

Loan status report quotlsrquot is a report that provides information on the current status of loans held by a financial institution.

Who is required to file loan status report quotlsrquot?

Financial institutions are required to file loan status report quotlsrquot with the relevant regulatory authorities.

How to fill out loan status report quotlsrquot?

To fill out the loan status report quotlsrquot, financial institutions must provide detailed information about their loan portfolios as per the reporting guidelines provided by regulatory authorities.

What is the purpose of loan status report quotlsrquot?

The purpose of loan status report quotlsrquot is to monitor and assess the financial health of financial institutions by analyzing their loan portfolios.

What information must be reported on loan status report quotlsrquot?

Information such as the outstanding balance, delinquency status, and collateral details of loans must be reported on loan status report quotlsrquot.

When is the deadline to file loan status report quotlsrquot in 2023?

The deadline to file loan status report quotlsrquot in 2023 is on the 15th of February.

What is the penalty for the late filing of loan status report quotlsrquot?

The penalty for the late filing of loan status report quotlsrquot includes fines and possible regulatory actions against the financial institution.

Can I create an electronic signature for the loan status report quotlsrquot in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your loan status report quotlsrquot in minutes.

Can I create an electronic signature for signing my loan status report quotlsrquot in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your loan status report quotlsrquot directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit loan status report quotlsrquot straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing loan status report quotlsrquot.

Fill out your loan status report quotlsrquot online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.