Get the free AUTHORIZATION FOR PRE-TAX PAYROLL REDUCTION Cafeteria Plan Advisors, Inc

Show details

AUTHORIZATION FOR PRE-TAX PAYROLL REDUCTION Cafeteria Plan Advisors, Inc. 420 Washington St. Suite 100 Braintree, MA 02184 Phone 781.848.9848 www.CPA125.com Form must be returned to Cafeteria Plan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your authorization for pre-tax payroll form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your authorization for pre-tax payroll form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing authorization for pre-tax payroll online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit authorization for pre-tax payroll. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

How to fill out authorization for pre-tax payroll

How to fill out authorization for pre-tax payroll?

01

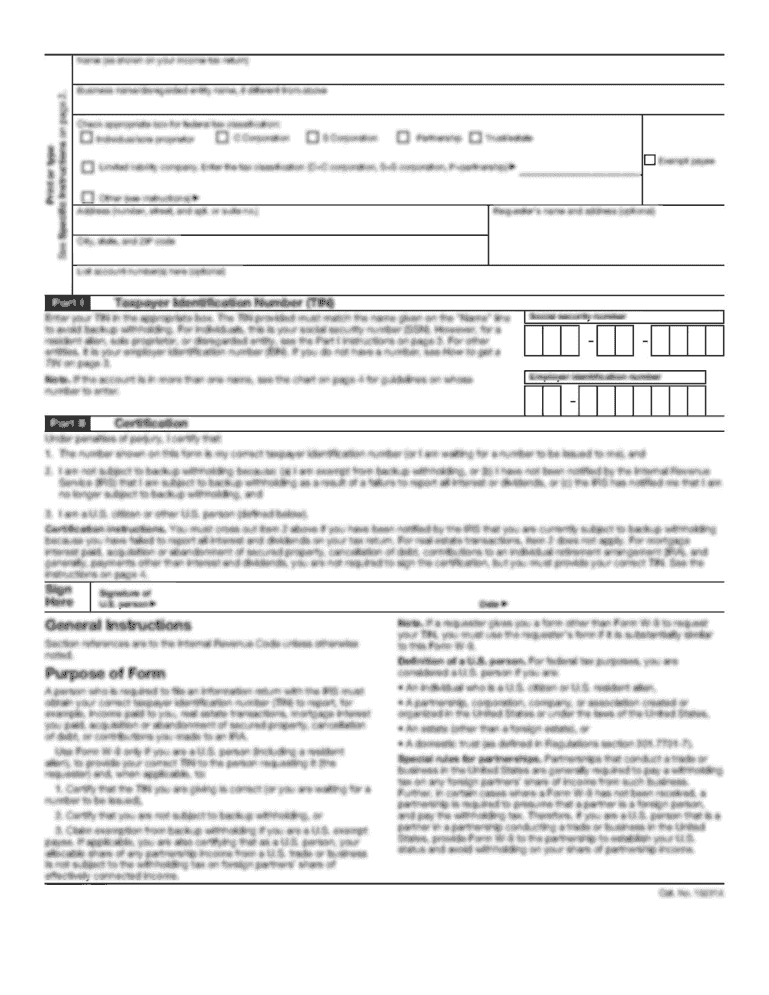

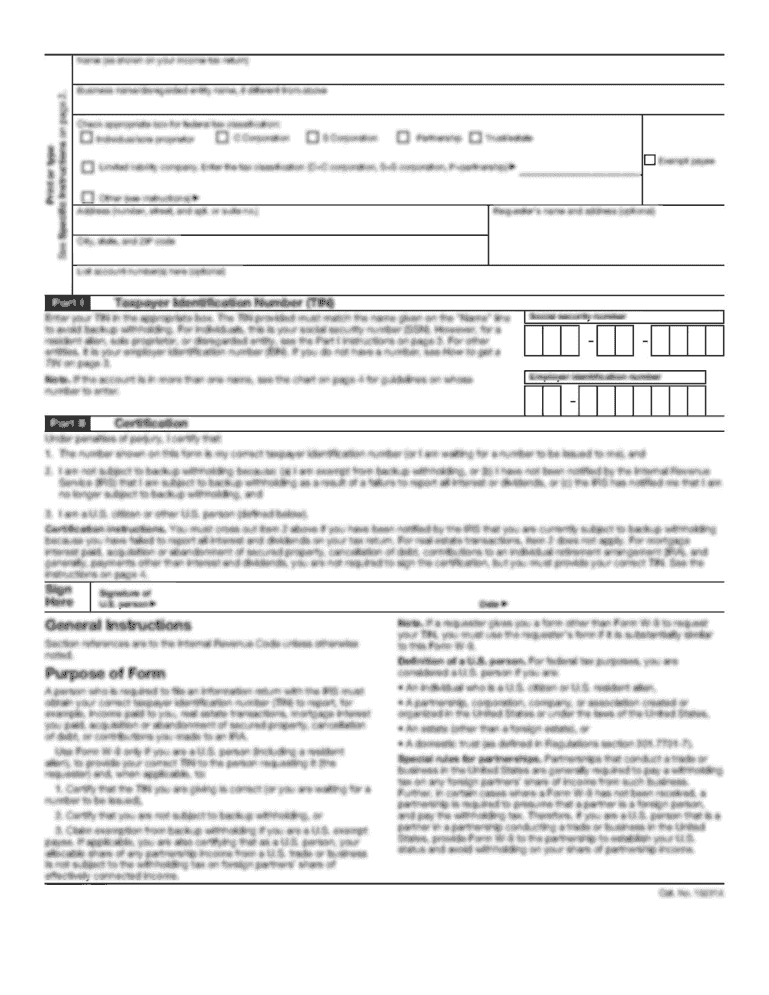

Gather necessary information: Before filling out the authorization for pre-tax payroll, collect all the required information such as your employee identification number, social security number, and any relevant tax forms.

02

Obtain the correct form: Contact your human resources department or payroll provider to obtain the specific authorization form for pre-tax payroll. This form may vary depending on your employer or the regulations of your country.

03

Employee details: Begin by filling out your personal information, including your name, address, and contact details. Provide your employee identification number and social security number accurately.

04

Tax exemptions and deductions: Indicate whether you have any tax exemptions or deductions that you want to apply to your pre-tax payroll. This includes items like dependent care expenses or contributions to retirement accounts.

05

Signature and date: Once you have completed all the necessary sections of the authorization form, sign and date the document. This verifies that you are providing accurate information and authorizing the deduction of pre-tax amounts from your payroll.

Who needs authorization for pre-tax payroll?

01

Employees: Any employee who wishes to take advantage of pre-tax payroll deductions must provide authorization. This is particularly relevant for employees who want to contribute to retirement plans, flexible spending accounts, or any other tax-advantaged programs offered by their employer.

02

Employers: Employers also have a role in the authorization process. They must ensure that the authorization forms are available to employees and properly updated. Employers may also need to review and confirm the accuracy of the information provided by employees before implementing pre-tax deductions.

03

Government or tax authorities: While not directly involved in the authorization process, government or tax authorities may require employers to have proper authorization forms on file. They may audit or review these forms to ensure compliance with tax regulations and determine the accuracy of pre-tax deductions.

Overall, both employees and employers play a crucial role in the authorization process for pre-tax payroll. By following the appropriate steps and submitting the necessary information, individuals can take advantage of the tax benefits associated with pre-tax payroll deductions.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is authorization for pre-tax payroll?

Authorization for pre-tax payroll is a form that allows employees to elect to have certain deductions taken out of their pay before taxes are calculated, which can result in lower taxable income and potentially lower tax liability.

Who is required to file authorization for pre-tax payroll?

Employees who wish to have pre-tax deductions taken out of their pay are required to file authorization for pre-tax payroll.

How to fill out authorization for pre-tax payroll?

Employees can fill out authorization for pre-tax payroll by providing their personal information, selecting the deductions they wish to have taken out before taxes, and signing the form.

What is the purpose of authorization for pre-tax payroll?

The purpose of authorization for pre-tax payroll is to allow employees to take advantage of tax benefits by having certain deductions taken out of their pay before taxes are calculated.

What information must be reported on authorization for pre-tax payroll?

Information such as employee's personal details, selected deductions, and employee signature must be reported on authorization for pre-tax payroll.

When is the deadline to file authorization for pre-tax payroll in 2023?

The deadline to file authorization for pre-tax payroll in 2023 is typically before the start of the new year or during the open enrollment period for benefits.

What is the penalty for the late filing of authorization for pre-tax payroll?

The penalty for late filing of authorization for pre-tax payroll can vary, but may result in missed opportunities for tax savings and potential delays in processing deductions.

Can I create an electronic signature for the authorization for pre-tax payroll in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

Can I create an eSignature for the authorization for pre-tax payroll in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your authorization for pre-tax payroll right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

How do I fill out authorization for pre-tax payroll on an Android device?

Use the pdfFiller Android app to finish your authorization for pre-tax payroll and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

Fill out your authorization for pre-tax payroll online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.