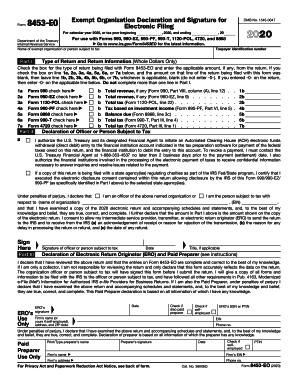

IRS 8453-EO 2018 free printable template

Instructions and Help about IRS 8453-EO

How to edit IRS 8453-EO

How to fill out IRS 8453-EO

About IRS 8453-EO 2018 previous version

What is IRS 8453-EO?

Who needs the form?

Components of the form

What information do you need when you file the form?

Where do I send the form?

What is the purpose of this form?

When am I exempt from filling out this form?

What are the penalties for not issuing the form?

Is the form accompanied by other forms?

FAQ about IRS 8453-EO

What should I do if I need to correct an error after submitting form 8453 eo?

If you discover an error after submitting form 8453 eo, you will need to prepare an amended version of the form. It is essential to clearly indicate the changes made, and submit this corrected form according to the procedures outlined by the IRS. Furthermore, ensure you retain proof of submission for your records.

How can I track the status of my submitted form 8453 eo?

To verify the receipt and processing of your form 8453 eo, you can use the IRS 'Where's My Return?' tool if you filed electronically. Additionally, common e-file rejection codes can help you identify reasons your submission may not have been processed correctly. Address any issues as soon as possible to avoid delays.

Are there any specific privacy or data security measures I should be aware of when filing form 8453 eo electronically?

When e-filing form 8453 eo, ensure that the software used complies with IRS standards to protect your privacy and secure your data. Data retention regulations also dictate how long you need to keep records of your e-filing. Always confirm that the e-filing platform you use implements strong data encryption.

What steps should I take if I receive an audit notice related to my form 8453 eo submission?

Upon receiving an audit notice regarding your filed form 8453 eo, first, read the notice carefully to understand what is being requested. Gather all relevant documentation that supports your submission and prepare a detailed response addressing each point raised by the IRS. Utilize the resources available for audit support to assist you in responding effectively.

What are the common errors associated with form 8453 eo, and how can I prevent them?

Common errors with form 8453 eo can include incorrect information on payees or mismatches with the IRS records. To prevent these mistakes, double-check the details before submitting and ensure you use reliable software that validates the information against IRS standards. Additionally, familiarize yourself with the key sections of the form to minimize submission discrepancies.