UT TC-69C 2018 free printable template

Show details

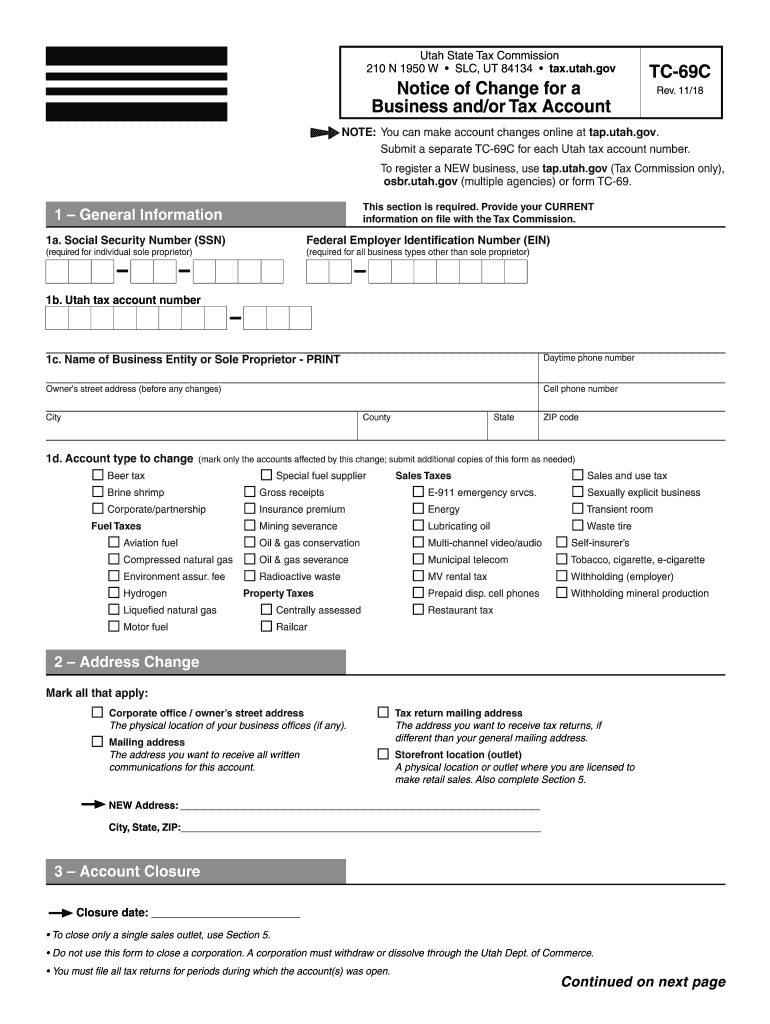

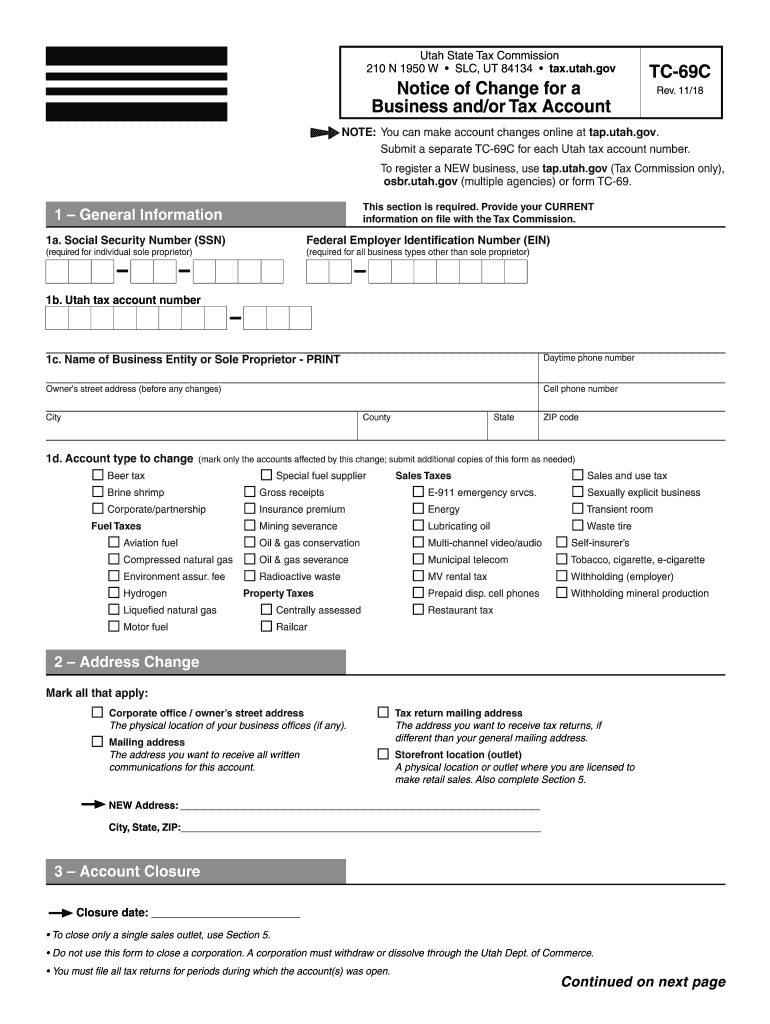

Clear footprint Form Utah State Tax Commission 210 N 1950 W SLC, UT 84134 tax. Utah.notice of Change for a Business and/or Tax AccountTC69C Rev. 11/18NOTE: You can make account changes online at tap.Utah.gov.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tc 69c utah

Edit your tc 69c utah form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

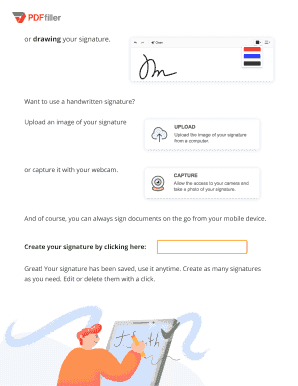

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc 69c utah form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc 69c utah online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit tc 69c utah. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tc 69c utah

How to fill out UT TC-69C

01

Obtain the UT TC-69C form from the appropriate authority or website.

02

Fill in the date at the top of the form.

03

Enter your personal details including name, address, and contact information.

04

Provide details relevant to the transaction or request, including any required references.

05

If applicable, attach supporting documents as specified on the form.

06

Review the form for accuracy and completeness.

07

Sign and date the form where indicated.

08

Submit the completed form to the required department or agency.

Who needs UT TC-69C?

01

Individuals or businesses undergoing a specific transaction or process that requires the UT TC-69C form.

02

Applicants seeking certain permits or permissions related to property or business operations.

03

Entities needing to formalize a request or declaration for compliance with local regulations.

Instructions and Help about tc 69c utah

Go to the go on to innovative research go to the go on to an exceptional education go to the go on to higher starting salaries sound good then get going on your application apply by November 1st for automatic scholarship consideration go to the go on to big things Music

Fill

form

: Try Risk Free

People Also Ask about

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

What is the minimum franchise tax in Utah?

Franchise Tax Every corporation that files form TC-20 must pay a minimum tax (privilege tax) of $100, regardless of whether or not the corporation exercises its right to do business.

What is the Utah transient room tax rate?

Utah counties may impose a 4.25% TRT tax on the rental of rooms in hotels, motels, inns, trailer courts, campgrounds, tourist homes, and similar accommodations for stays of less than 30 consecutive days. TRT is not imposed on meeting room charges.

Does Utah have a franchise tax for LLC?

The State of Utah, like almost every other state, has a corporate income tax (more specifically called the corporation franchise and income tax). In Utah, the corporate income tax generally is calculated at a flat 5% of Utah taxable income with a minimum tax of $100.

What is the franchise tax in Utah?

Corporate Income Tax Domestic and foreign corporations are required to pay a 5% state income or franchise tax on income earned in Utah. The minimum tax for state banks and corporations is $100.

What is the Utah withholding account number?

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are “WTH.” Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

How do you calculate sales tax on a car in Utah?

All you need to do is enter your dealership's address and the price tag value of your vehicle. Key Takeaway To determine the car sales tax where you live, combine the statewide sales tax of 6.85% with your local or county sales tax.

What is the sales tax in Utah 2023?

The minimum combined 2023 sales tax rate for Price, Utah is 6.75%. This is the total of state, county and city sales tax rates. The Utah sales tax rate is currently 4.85%.

How do I close my sales and use tax account in Utah?

3 – Account Closure A corporation must withdraw or dissolve through the Utah Dept. of Commerce. You must file all tax returns for periods during which the account(s) was open.

What is TC 69 in Utah?

TC-69, Utah State Business and Tax Registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tc 69c utah without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tc 69c utah into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I edit tc 69c utah online?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your tc 69c utah to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

Can I sign the tc 69c utah electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is UT TC-69C?

UT TC-69C is a tax form used in Utah for reporting certain kinds of income, deductions, or credits relevant to taxpayers.

Who is required to file UT TC-69C?

Taxpayers who have specific types of income or qualify for certain tax credits are required to file UT TC-69C.

How to fill out UT TC-69C?

To fill out UT TC-69C, taxpayers need to provide their personal information, income details, deductions, and any applicable tax credits as outlined in the instructions accompanying the form.

What is the purpose of UT TC-69C?

The purpose of UT TC-69C is to assist the Utah State Tax Commission in collecting accurate tax information to ensure proper assessment of taxes owed.

What information must be reported on UT TC-69C?

The information that must be reported on UT TC-69C includes taxpayer identification details, types of income, specific deductions, and any tax credits claimed.

Fill out your tc 69c utah online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tc 69c Utah is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.