UT TC-69C 2023 free printable template

Show details

Clear formPrint Form

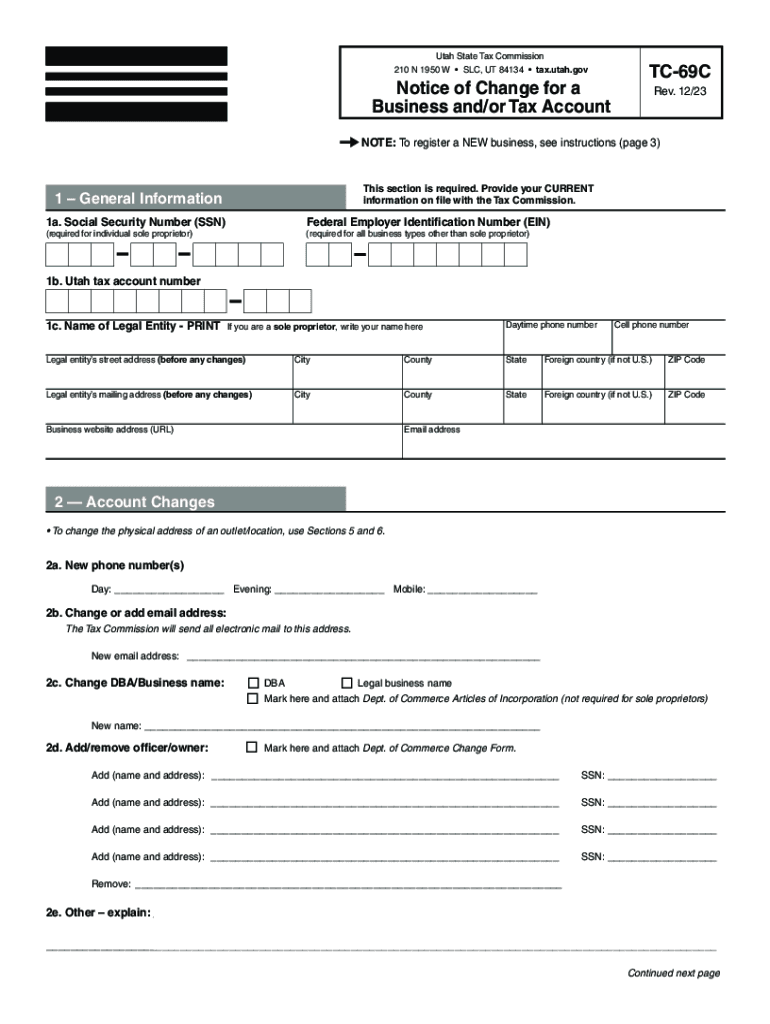

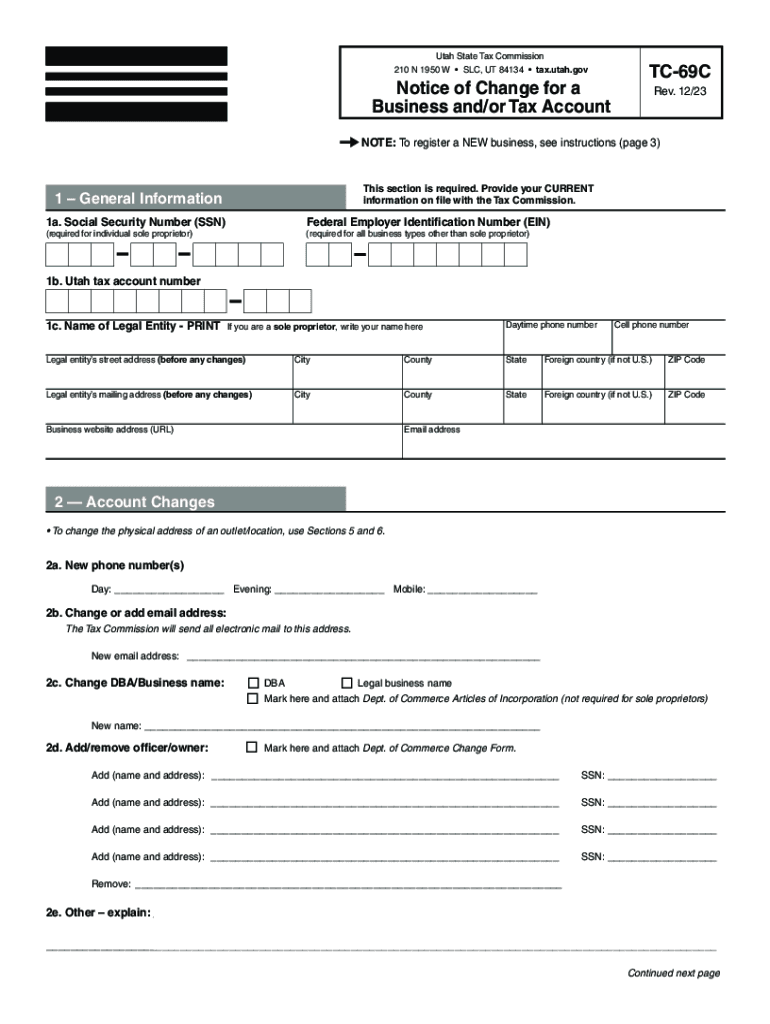

Utah State Tax Commission

210 N 1950 W SLC, UT 84134 tax.utah.govNotice of Change for a

Business and/or Tax AccountTC69C

Rev. 12/23NOTE: To register a NEW business, see instructions

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tc 69c - tax

Edit your tc 69c - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc 69c - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tc 69c - tax online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tc 69c - tax. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tc 69c - tax

How to fill out UT TC-69C

01

Gather necessary personal information, including name, address, and taxpayer identification number.

02

Obtain details about the tax year for which you are filing the form.

03

Complete the income section, detailing all sources of income for the year.

04

Fill out deductions and credits applicable to your situation based on IRS guidelines.

05

Review the refund or payment section to determine any amounts owed or due.

06

Sign and date the form at the designated section.

07

Submit the completed UT TC-69C to the appropriate tax authority by the deadline.

Who needs UT TC-69C?

01

Individuals and businesses required to report their income and claim credits or deductions for tax purposes.

02

Taxpayers seeking a refund for overpaid taxes.

03

Persons or entities meeting specific eligibility criteria outlined by the tax authority.

Instructions and Help about tc 69c - tax

Go to the go on to innovative research go to the go on to an exceptional education go to the go on to higher starting salaries sound good then get going on your application apply by November 1st for automatic scholarship consideration go to the go on to big things Music

Fill

form

: Try Risk Free

People Also Ask about

What does TC-40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is form TC 546 for Utah?

Use this form to make individual income tax prepayments toward your tax liability prior to the due date of your return. Prepayments may not be necessary if taxes are withheld (W-2, TC-675R, etc.), the previous year's refund was applied to the current year, or you have credit carryovers.

What does TC 40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is UT corporate income tax?

Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent. Utah's tax system ranks 8th overall on our 2023 State Business Tax Climate Index.

What is UT TC 941?

Use a TC-941 to amend a previously filed return. Forms are available at . If you amend a return after filing the annual reconciliation, you must also file an amended reconciliation, form TC-941R. Make checks or money orders payable to the Utah State Tax Commission and mail with the original coupon.

Do you have Utah tax withholdings to report?

You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

What is the format for Utah withholding account number?

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are “WTH.” Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tc 69c - tax directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your tc 69c - tax and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit tc 69c - tax in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tc 69c - tax, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

How can I fill out tc 69c - tax on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your tc 69c - tax, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is UT TC-69C?

UT TC-69C is a form used in Utah for reporting the withholding of state income taxes from wages or other payments.

Who is required to file UT TC-69C?

Employers and businesses that withhold state income taxes from employees' wages or payments are required to file UT TC-69C.

How to fill out UT TC-69C?

To fill out UT TC-69C, you need to provide information such as the payer's identification details, the amount withheld, and the period covered.

What is the purpose of UT TC-69C?

The purpose of UT TC-69C is to ensure proper reporting and remittance of state income tax withholdings to the Utah state tax authorities.

What information must be reported on UT TC-69C?

UT TC-69C must report information including the payer's name, address, tax identification number, payments made, amounts withheld, and the period of withholding.

Fill out your tc 69c - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tc 69c - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.