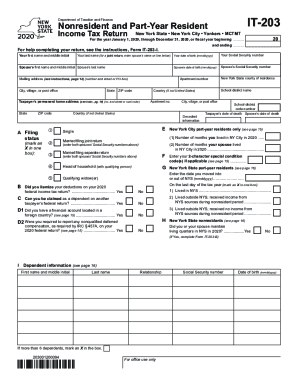

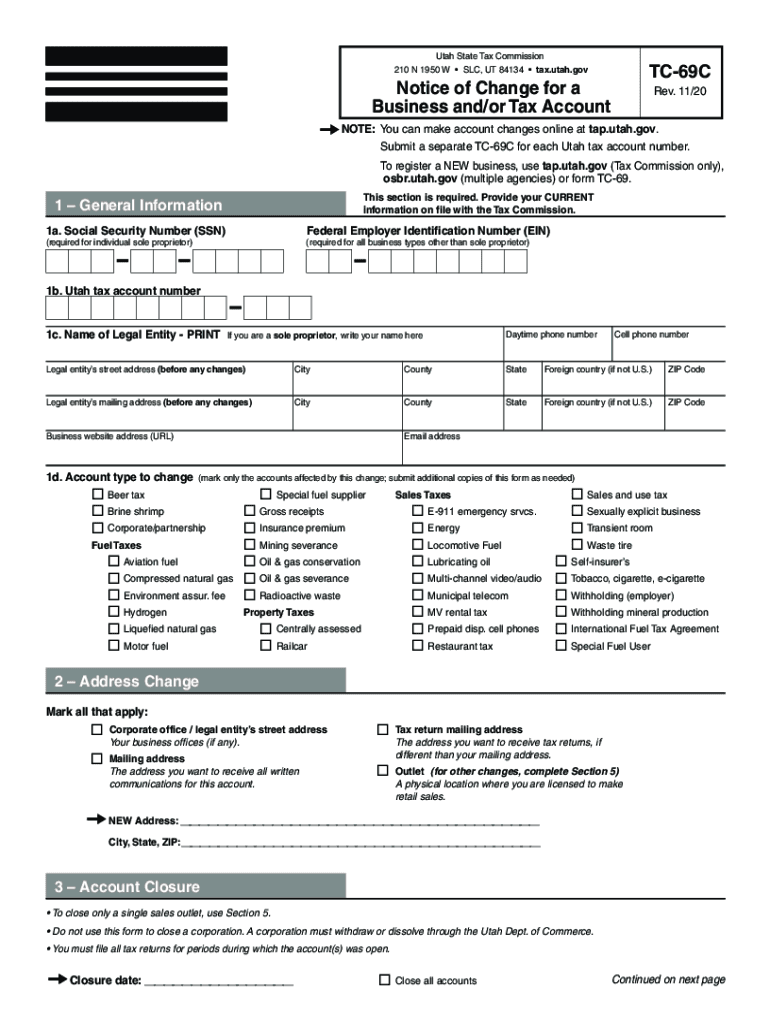

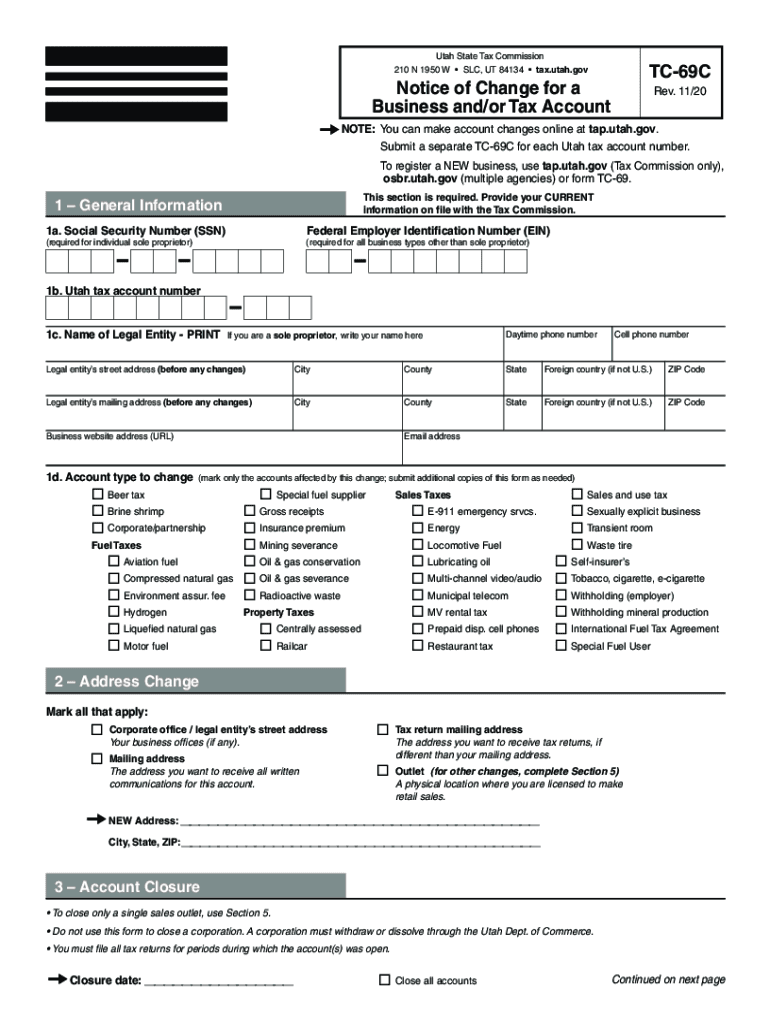

UT TC-69C 2020 free printable template

Show details

Clear footprint Form Utah State Tax Commission 210 N 1950 W SLC, UT 84134 tax. Utah.govTC69CNotice of Change for a Business and/or Tax Account Rev. 11/20can make account changes online at tap.Utah.gov.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign ut tc of tax

Edit your ut tc of tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ut tc of tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ut tc of tax online

To use the professional PDF editor, follow these steps below:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit ut tc of tax. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out ut tc of tax

How to fill out UT TC-69C

01

Obtain the UT TC-69C form from the designated authority or online.

02

Read the instructions on the form carefully before you start filling it out.

03

Provide your personal information in the designated fields, including name, address, and contact details.

04

Fill in the specific section that requests information related to the purpose of the form.

05

Double-check all entered information for accuracy.

06

Sign and date the form where indicated.

07

Submit the completed form to the appropriate office or department as instructed.

Who needs UT TC-69C?

01

Individuals applying for a specific permit or license requiring UT TC-69C.

02

Businesses or organizations needing to report certain activities in compliance with regulations.

03

Anyone seeking a record or certification that necessitates the completion of this form.

Instructions and Help about ut tc of tax

Go to the go on to innovative research go to the go on to an exceptional education go to the go on to higher starting salaries sound good then get going on your application apply by November 1st for automatic scholarship consideration go to the go on to big things Music

Fill

form

: Try Risk Free

People Also Ask about

What is UT pass-through entity tax?

How does a passthrough entity work? Here's how it works when you authorize a PTE to pay a tax on behalf of pass-through entity taxpayers who are individuals. Pass-through entities in Utah pay the standard state income tax rate which is 4.95%, which is the same as the individual state income rate.

What is the explanation of pass-through entity tax?

A pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates.

Is freight taxable in UT?

Utah sales tax may apply to charges for shipping, handling, delivery, freight, and postage. If shipping is included in the price of a taxable sale, the shipping is taxable as well. If the shipping is separately stated from the sales price, the shipping charges are tax exempt.

What is the TC 40W?

Utah Withholding Tax Schedule (TC-40W) – Tax Commission Government Form in Utah – Formalu.

What is the tax for UT?

How does Utah's tax code compare? Utah has a flat 4.85 percent individual income tax rate. Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent.

What is a tcw40?

TC40W is Utah TC-40 Withholding Schedule. You must report Utah withholding tax from the following forms on the TC-40W, Part 1: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

What is a tc40 W?

You must claim Utah withholding tax credits by completing form TC-40W and attaching it to your return. Do not send W-2s, 1099s, etc. with your return. Keep all these forms with your tax records — we may ask you to provide the documents at a later time.

What is UT local sales tax rate?

The Utah (UT) state sales tax rate is 4.7%. Depending on local jurisdictions, the total tax rate can be as high as 8.7%. Local-level tax rates may include a local option (up to 1% allowed by law), mass transit, rural hospital, arts and zoo, highway, county option (up to .

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my ut tc of tax directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your ut tc of tax and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How do I make edits in ut tc of tax without leaving Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your ut tc of tax, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I edit ut tc of tax on an Android device?

You can make any changes to PDF files, like ut tc of tax, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is UT TC-69C?

UT TC-69C is a form used in the state of Utah for reporting certain tax-related information.

Who is required to file UT TC-69C?

Taxpayers who have specific tax obligations as defined by the Utah State Tax Commission are required to file UT TC-69C.

How to fill out UT TC-69C?

To fill out UT TC-69C, individuals must provide accurate details regarding their tax situation, including personal information, income sources, and any applicable deductions or credits.

What is the purpose of UT TC-69C?

The purpose of UT TC-69C is to ensure that taxpayers provide the State of Utah with required tax information for compliance and assessment purposes.

What information must be reported on UT TC-69C?

Information that must be reported on UT TC-69C includes taxpayer identification information, income details, tax deductions, and tax credits claimed.

Fill out your ut tc of tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ut Tc Of Tax is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.