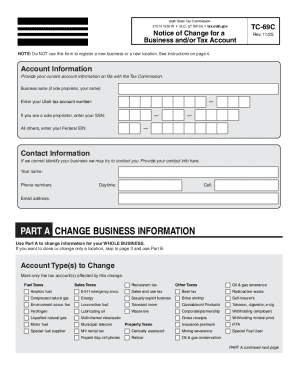

UT TC-69C 2010 free printable template

Show details

Clear form Utah State Tax Commission 210 N 1950 W SLC, UT 84134 www.tax.utah.gov Print Form Notice of Change for a Tax Account Read the instructions at the bottom of page 2 before filling out this

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign UT TC-69C

Edit your UT TC-69C form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UT TC-69C form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UT TC-69C online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit UT TC-69C. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UT TC-69C

How to fill out UT TC-69C

01

Gather the required personal and vehicle information.

02

Obtain the UT TC-69C form from the appropriate local authority or website.

03

Fill in the applicant's name, address, and contact information in the designated fields.

04

Provide details about the vehicle, including make, model, year, and Vehicle Identification Number (VIN).

05

Indicate the purpose of the application or any specific requests.

06

Attach any required documents, such as proof of ownership or identification.

07

Review the completed form for accuracy and ensure all necessary fields are filled out.

08

Sign and date the application as required.

09

Submit the form through the specified submission method, whether it be in person, mail, or online.

Who needs UT TC-69C?

01

Individuals applying for vehicle registration in Utah.

02

Vehicle owners needing to request specific title information.

03

Those who need to update vehicle title records or ownership details.

Fill

form

: Try Risk Free

People Also Ask about

What does TC-40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is form TC 546 for Utah?

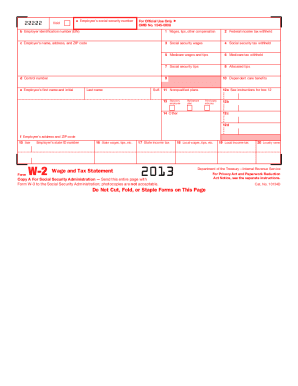

Use this form to make individual income tax prepayments toward your tax liability prior to the due date of your return. Prepayments may not be necessary if taxes are withheld (W-2, TC-675R, etc.), the previous year's refund was applied to the current year, or you have credit carryovers.

What does TC 40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is UT corporate income tax?

Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent. Utah's tax system ranks 8th overall on our 2023 State Business Tax Climate Index.

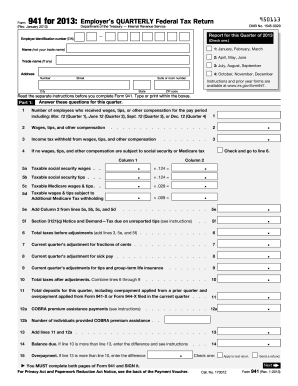

What is UT TC 941?

Use a TC-941 to amend a previously filed return. Forms are available at . If you amend a return after filing the annual reconciliation, you must also file an amended reconciliation, form TC-941R. Make checks or money orders payable to the Utah State Tax Commission and mail with the original coupon.

Do you have Utah tax withholdings to report?

You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

What is the format for Utah withholding account number?

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are “WTH.” Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify UT TC-69C without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including UT TC-69C, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I make changes in UT TC-69C?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your UT TC-69C to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

Can I create an electronic signature for the UT TC-69C in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

What is UT TC-69C?

UT TC-69C is a tax form used by individuals or businesses in Utah to report and calculate various tax liabilities, deductions, or credits.

Who is required to file UT TC-69C?

Taxpayers who have specific tax situations, such as certain types of income, deductions, or credits, are required to file UT TC-69C.

How to fill out UT TC-69C?

To fill out UT TC-69C, taxpayers must provide accurate financial information, including income, expenses, and applicable tax credits, following the instructions outlined in the form.

What is the purpose of UT TC-69C?

The purpose of UT TC-69C is to ensure that taxpayers report their financial activities accurately and to determine the amount of tax owed or the credits available.

What information must be reported on UT TC-69C?

The information that must be reported on UT TC-69C includes income, deductions, tax credits, and any other pertinent financial details relevant to the taxpayer's situation.

Fill out your UT TC-69C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UT TC-69c is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.