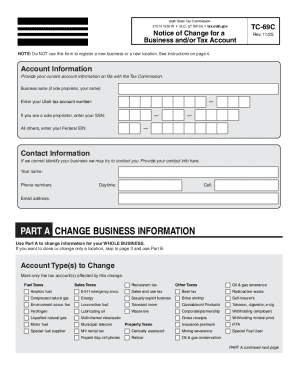

UT TC-69C 2024 free printable template

Show details

This form is used to report changes to an existing business already registered with the Utah State Tax Commission, including changes in business information, account closure, and outlet/location modifications.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tc 69c form utah

Edit your tc 69c form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc 69c utah form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tc 69c utah online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tc69c form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out utah tc 69c form

How to fill out UT TC-69C

01

Obtain the UT TC-69C form from the appropriate department or website.

02

Begin by filling out the applicant's name in the designated field.

03

Provide the accurate address, including city, state, and zip code.

04

Enter the contact information, including phone number and email address.

05

Complete any required sections regarding the purpose of the form.

06

Review the instructions to ensure any additional documentation is included.

07

Double-check for any errors or omissions before submission.

08

Submit the form through the specified method (mail, online, etc.).

Who needs UT TC-69C?

01

Individuals or entities applying for specific permits or licenses.

02

Businesses needing to demonstrate compliance with regulatory requirements.

03

Applicants seeking financial assistance or grants that require this form.

Fill

form tc 69c

: Try Risk Free

People Also Ask about utah state tax commission form tc 69c

What does TC-40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is form TC 546 for Utah?

Use this form to make individual income tax prepayments toward your tax liability prior to the due date of your return. Prepayments may not be necessary if taxes are withheld (W-2, TC-675R, etc.), the previous year's refund was applied to the current year, or you have credit carryovers.

What does TC 40 mean?

A TC40 data claim is simply a report of fraud. Although it does include useful information, this information is not enough to prevent chargebacks or to represent chargeback claims.

What is UT corporate income tax?

Utah also has a flat 4.85 percent corporate income tax. Utah has a 6.10 percent state sales tax rate, a max local sales tax rate of 2.95 percent, and an average combined state and local sales tax rate of 7.19 percent. Utah's tax system ranks 8th overall on our 2023 State Business Tax Climate Index.

What is UT TC 941?

Use a TC-941 to amend a previously filed return. Forms are available at . If you amend a return after filing the annual reconciliation, you must also file an amended reconciliation, form TC-941R. Make checks or money orders payable to the Utah State Tax Commission and mail with the original coupon.

Do you have Utah tax withholdings to report?

You must withhold Utah income tax (unless the employee has filed a withholding exemption certificate) if you: Pay wages to any employee for work done in Utah. Pay wages to Utah resident employees for work done outside Utah (you may reduce the Utah tax by any tax withheld by the other state)

What is the format for Utah withholding account number?

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are “WTH.” Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify tc 69c form without leaving Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your tc69c tax form into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How can I get tc 69 form utah?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the tc 69c utah fillable. Open it immediately and start altering it with sophisticated capabilities.

Can I create an electronic signature for the utah form tc 69c in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your ut tc of tax account form in seconds.

What is UT TC-69C?

UT TC-69C is a form used by taxpayers in Utah to report certain tax-related information and to claim refunds for overpaid taxes.

Who is required to file UT TC-69C?

Individuals or entities in Utah who believe they have overpaid their taxes or are eligible for a refund must file UT TC-69C.

How to fill out UT TC-69C?

To fill out UT TC-69C, provide your personal information, details of the tax payments made, the reason for the refund request, and any required supporting documentation.

What is the purpose of UT TC-69C?

The purpose of UT TC-69C is to facilitate the process of claiming tax refunds and ensuring that taxpayers receive any amounts overpaid.

What information must be reported on UT TC-69C?

The form requires reporting personal identification details, tax period information, amounts paid, and the reason for requesting the refund.

Fill out your UT TC-69C online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

tc69c Form is not the form you're looking for?Search for another form here.

Keywords relevant to ut tc 69c search

Related to utah tc 69

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.