UT TC-69C 2019 free printable template

Show details

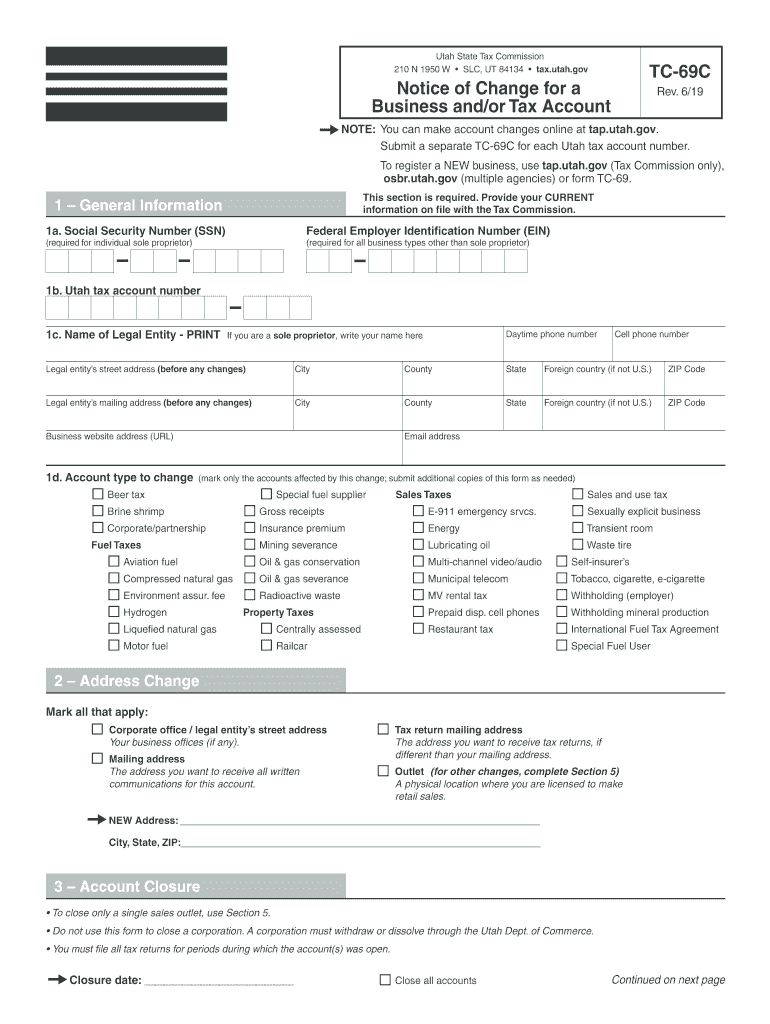

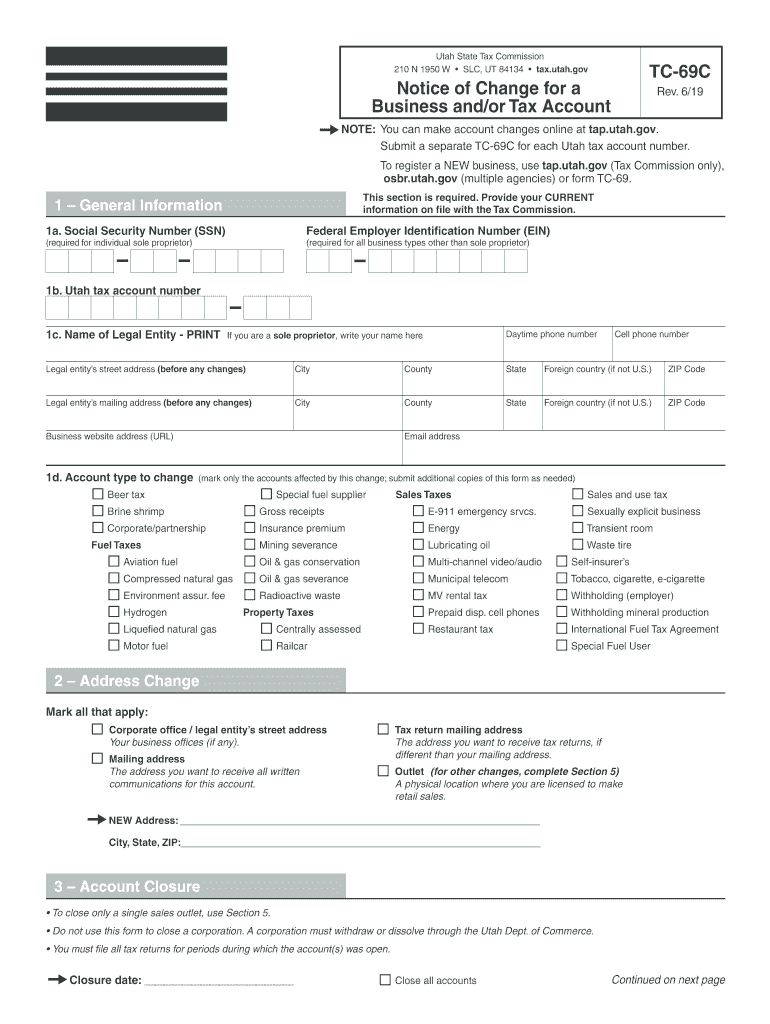

Clear footprint Form Utah State Tax Commission 210 N 1950 W SLC, UT 84134 tax. Utah.govTC69CNotice of Change for a Business and/or Tax Account Rev. 6/19can make account changes online at tap.Utah.gov.

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tc69c - tax utah

Edit your tc69c - tax utah form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tc69c - tax utah form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tc69c - tax utah online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit tc69c - tax utah. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UT TC-69C Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tc69c - tax utah

How to fill out UT TC-69C

01

Obtain the UT TC-69C form from the official website or relevant office.

02

Fill in your personal information in the designated fields, including name, address, and contact details.

03

Provide relevant details about the transaction or service that the form pertains to.

04

Ensure you include any required identification numbers or reference codes, if applicable.

05

Review all entered information for accuracy and completeness.

06

Sign and date the form where required.

07

Submit the completed form as instructed, either online or in person.

Who needs UT TC-69C?

01

Individuals or businesses that are engaging in specific transactions that require this form.

02

Anyone who is applying for a license or permit that necessitates submission of UT TC-69C.

03

Entities that need to report certain information to the relevant authority as mandated.

Instructions and Help about tc69c - tax utah

Go to the go on to innovative research go to the go on to an exceptional education go to the go on to higher starting salaries sound good then get going on your application apply by November 1st for automatic scholarship consideration go to the go on to big things Music

Fill

form

: Try Risk Free

People Also Ask about

How do I close my sales and use tax account in Utah?

3 – Account Closure A corporation must withdraw or dissolve through the Utah Dept. of Commerce. You must file all tax returns for periods during which the account(s) was open.

Is there a Utah withholding form?

Report Utah withholding tax from the following forms: Federal form W-2, Wage and Tax Statement. Federal form 1099 (with Utah withholding), including 1099-R, 1099-MISC, 1099-G, etc.

Is there a Utah w4 form?

Is there a Utah w4 form? All new employees for your business must complete a federal Form W-4. Unlike many other states, Utah does not have a separate state equivalent to Form W-4, but instead relies on the federal form.

Does Utah require a state tax form?

ing to Utah Instructions for Form TC-40, you must file a Utah income tax return if: You were a resident or part year resident of Utah that must file a federal return.

What is the Utah withholding account number?

The Utah withholding account number is a 14-character number. The first eleven characters are numeric and the last three are “WTH.” Do not enter hyphens. Example: 12345678901WTH. If form W-2 or 1099 does not include this number, contact the employer or payer to get the correct number to enter on TC-40W, Part 1.

How do I get a Utah employer registration number?

You can find your Employer Registration Number on any mail you have received from the Department of Workforce Services. If you're unsure, contact the agency at (801) 526-9235.

How do I register for work in Utah?

Submit an application online or in-person at a local Employment Center. Click here to find an Employment Center near you. Or click "Apply Now" to apply online. If you do not have a Utah ID account, you will have to create one.

How do I register for payroll in Utah?

Complete the combined withholding/employment registration form at the OneStop Online Business Registration portal to receive an Employer Registration Number, or apply separately at the UT Department of Workforce Services (DWS) portal. The number is issued immediately upon application completion in both cases.

What is TC 69 in Utah?

TC-69, Utah State Business and Tax Registration.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find tc69c - tax utah?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the tc69c - tax utah. Open it immediately and start altering it with sophisticated capabilities.

How do I edit tc69c - tax utah in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your tc69c - tax utah, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit tc69c - tax utah on an iOS device?

Create, edit, and share tc69c - tax utah from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

What is UT TC-69C?

UT TC-69C is a tax form used in the state of Utah for reporting certain tax-related information.

Who is required to file UT TC-69C?

Businesses and individuals in Utah who have specific tax obligations, such as those dealing with sales tax, may be required to file UT TC-69C.

How to fill out UT TC-69C?

To fill out UT TC-69C, one needs to provide personal or business information, report income and deductions, and specify any tax credits or liabilities.

What is the purpose of UT TC-69C?

The purpose of UT TC-69C is to ensure compliance with tax laws in Utah by collecting necessary tax information from filers.

What information must be reported on UT TC-69C?

Information that must be reported on UT TC-69C includes the taxpayer's identification details, income details, deductions, and any applicable tax credits.

Fill out your tc69c - tax utah online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

tc69c - Tax Utah is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.