This Notice of Assignment of Contract for Deed is used by a Seller to provide notice to the Buyer(s) that the Seller has assigned a contract for deed to a third party and to make future payments to the third party. This form must be signed by the Seller and notarized.

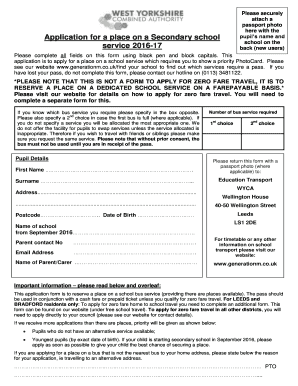

Get the free Connecticut Notice of Assignment of Contract for Deed

Show details

NOTICE OF ASSIGNMENT OF CONTRACT FOR DEED TO: PLEASE TAKE NOTICE that, Seller(s), assigned and transferred unto, Assign e”, all right, title and interest in and to that certain Contract for Deed

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your connecticut notice of assignment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your connecticut notice of assignment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to fill out connecticut notice of assignment

How to fill out Connecticut notice of assignment:

01

Begin by obtaining a copy of the Connecticut notice of assignment form. This form is typically available online or through the Connecticut Department of Revenue Services.

02

Fill in the document header with your personal information, including your name, address, and contact information. Make sure to accurately enter this information as it will be used for correspondence and communication purposes.

03

Specify the type of notice being filed by checking the appropriate box. This could include notices related to wage deductions, bank levies, property seizures, or other forms of debt collection.

04

Provide details about the taxpayer or debtor that the notice of assignment is intended for. This generally includes their name, address, and contact information. Ensure that all information is accurate and up-to-date.

05

Indicate the assigned obligations or debts that the notice is pertaining to. List the specific type of debt, such as income tax, sales tax, or other types of fees or charges owed.

06

Include any relevant documentation or supporting evidence of the assigned obligations. This could include copies of tax returns, invoices, or other financial documents.

07

Sign and date the notice of assignment form to certify its accuracy and completeness.

08

Submit the completed form to the appropriate authority, typically the Connecticut Department of Revenue Services or the designated office responsible for handling the specific type of notice being filed.

09

Keep a copy of the completed form and any accompanying documentation for your records.

Who needs Connecticut notice of assignment?

01

Any individual or entity that is owed a debt or obligation by a taxpayer or debtor in Connecticut may require a notice of assignment. This includes government agencies, businesses, or individuals.

02

The notice of assignment is typically used for debt collection purposes, allowing the creditor to inform the debtor and other relevant parties of the assigned debt and their rights and obligations.

03

It is important to consult with legal or financial professionals to determine whether the use of a notice of assignment is appropriate and necessary in your particular situation.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is connecticut notice of assignment?

Connecticut notice of assignment is a legal document used to officially notify an individual or entity that a debt or obligation has been assigned to a third party.

Who is required to file connecticut notice of assignment?

The party who has assigned the debt or obligation to a third party is required to file the Connecticut notice of assignment.

How to fill out connecticut notice of assignment?

To fill out the Connecticut notice of assignment, you will need to include details such as the name and contact information of the assignor and assignee, the date of assignment, a description of the debt or obligation, and any relevant supporting documentation.

What is the purpose of connecticut notice of assignment?

The purpose of the Connecticut notice of assignment is to provide formal notice to the debtor that their debt or obligation has been transferred to another party and that they should direct any future payments or communication to the new assignee.

What information must be reported on connecticut notice of assignment?

The Connecticut notice of assignment typically includes information such as the names and contact information of the assignor and assignee, the date of assignment, a description of the debt or obligation, and any relevant supporting documentation.

When is the deadline to file connecticut notice of assignment in 2023?

The deadline to file the Connecticut notice of assignment in 2023 may vary depending on the specific circumstances and the applicable laws. It is recommended to consult with a legal professional or refer to the relevant statutes for the accurate deadline.

What is the penalty for the late filing of connecticut notice of assignment?

The penalty for the late filing of the Connecticut notice of assignment can also vary depending on the specific circumstances and the applicable laws. It is advised to consult with a legal professional or refer to the relevant statutes for information regarding the penalties for late filing.

Fill out your connecticut notice of assignment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.