Get the free PCC payroll deduction - pcc

Show details

PCC Foundation 2013 2014 Faculty, Staff & Retiree Campaign Yes! I will help students succeed! GIVING OPTIONS: 1. PCC PAYROLL DEDUCTION Recurring gift. Please deduct (monthly): $$$102542 3. DIRECT

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pcc payroll deduction

Edit your pcc payroll deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pcc payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pcc payroll deduction online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit pcc payroll deduction. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pcc payroll deduction

How to fill out pcc payroll deduction:

01

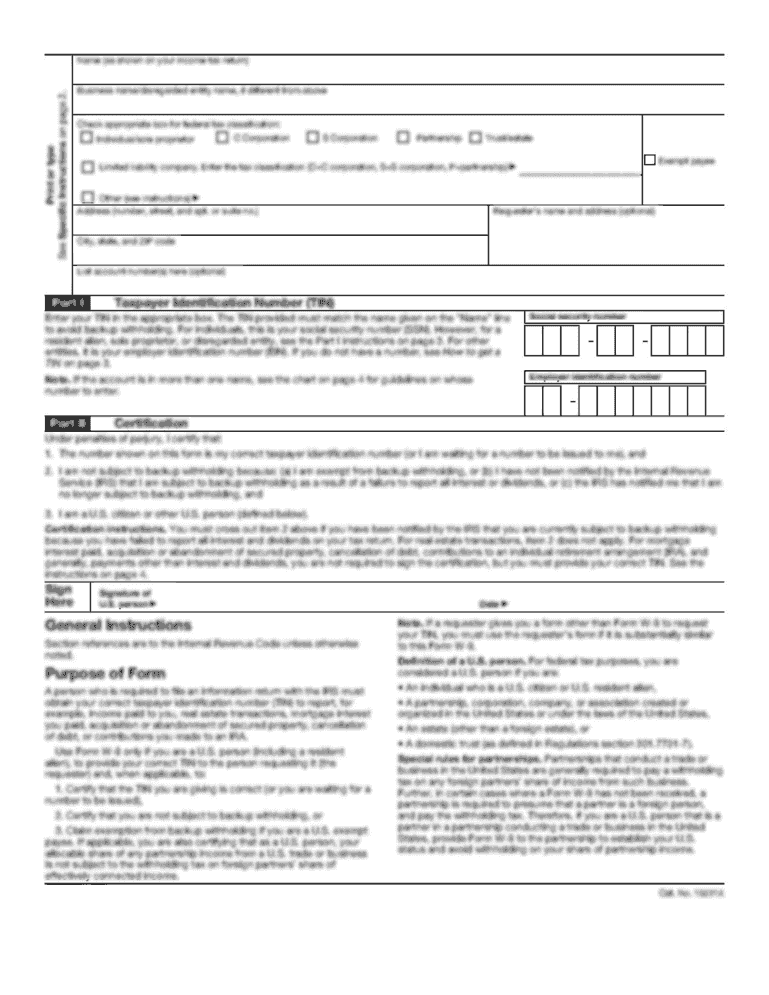

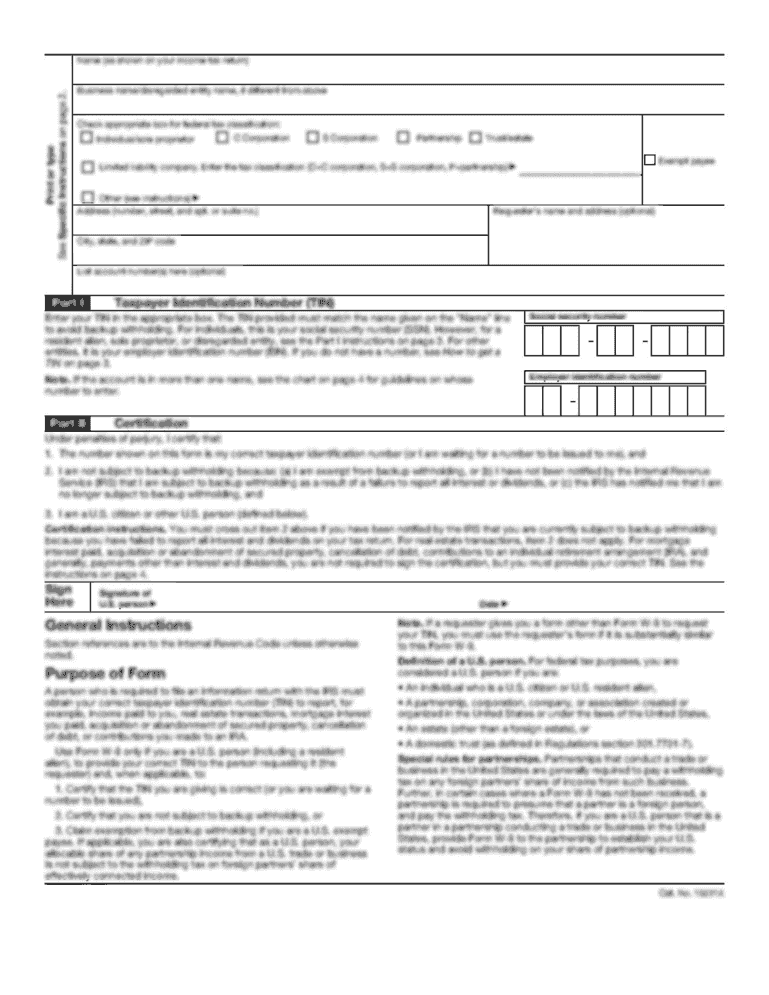

Obtain the necessary forms: To begin the process of filling out a pcc payroll deduction, obtain the required forms from your employer or human resources department. These forms typically include a payroll deduction authorization form and a detailed explanation of the deductions available.

02

Review the available deductions: Before filling out the form, familiarize yourself with the different types of pcc payroll deductions that are available. These can include retirement contributions, health insurance premiums, flexible spending accounts, or charitable contributions, among others. Understanding your options will help you make informed decisions.

03

Provide personal information: The payroll deduction form will require you to provide personal information, such as your name, employee identification number, and contact details. Ensure that this information is accurate and up to date.

04

Specify the deductions: Indicate the specific deductions you wish to enroll in on the form. This may require you to specify the percentage or amount to be deducted from each paycheck, as well as the start date for each deduction.

05

Fill out financial details: If applicable, provide financial information required for certain deductions. For example, if enrolling in a retirement savings plan, you might need to supply your bank account information or specify the investment options you prefer.

06

Seek assistance if needed: If you have any questions or concerns while filling out the pcc payroll deduction form, do not hesitate to seek assistance from your employer or human resources department. They can provide guidance and clarify any uncertainties you may have.

Who needs pcc payroll deduction:

01

Employees with workplace benefits: Pcc payroll deduction is typically relevant for employees who have access to various workplace benefits such as retirement savings plans, health insurance, or flexible spending accounts. These deductions allow employees to make automatic contributions towards these benefits, making it easier to manage their finances and plan for the future.

02

Those seeking tax advantages: Pcc payroll deductions can provide tax advantages for certain types of deductions. For example, contributions towards retirement savings plans may be eligible for tax deductions or be made with pre-tax dollars. Individuals who are looking to reduce their taxable income or take advantage of tax-friendly benefits may opt for pcc payroll deduction.

03

Individuals with specific financial goals: Pcc payroll deductions can help individuals save for specific financial goals, such as buying a home or paying off student loans. By automatically deducting a portion of their paycheck, individuals can steadily work towards their goals without requiring frequent manual contributions.

Overall, pcc payroll deduction is beneficial for employees who want to streamline their financial planning, take advantage of workplace benefits, enjoy potential tax advantages, or save for specific financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is pcc payroll deduction?

PCC payroll deduction is a process where a certain amount of money is deducted from an employee's paycheck to cover expenses such as insurance premiums, retirement contributions, or other benefits.

Who is required to file pcc payroll deduction?

Employers are required to file PCC payroll deduction for their employees who have agreed to have deductions taken from their paychecks.

How to fill out pcc payroll deduction?

To fill out PCC payroll deduction, employers need to accurately track and document the deductions taken from each employee's paycheck and report this information to the appropriate authorities.

What is the purpose of pcc payroll deduction?

The purpose of PCC payroll deduction is to ensure that employees' deductions are accurately tracked and processed in compliance with legal requirements and to facilitate the payment of benefits or other expenses.

What information must be reported on pcc payroll deduction?

The information reported on PCC payroll deduction includes the employee's name, identification number, amount of deduction, type of deduction, and any other relevant details.

How can I edit pcc payroll deduction on a smartphone?

The pdfFiller mobile applications for iOS and Android are the easiest way to edit documents on the go. You may get them from the Apple Store and Google Play. More info about the applications here. Install and log in to edit pcc payroll deduction.

How do I fill out the pcc payroll deduction form on my smartphone?

Use the pdfFiller mobile app to fill out and sign pcc payroll deduction on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

Can I edit pcc payroll deduction on an Android device?

You can make any changes to PDF files, like pcc payroll deduction, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

Fill out your pcc payroll deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pcc Payroll Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.