Get the free form it 196 pdf

Show details

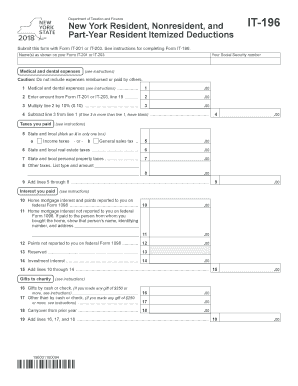

Department of Taxation and FinanceInstructions for Form IT196New York Resident, Nonresident, and

Part Year Resident Itemized Deductions

New for 2018Beginning with tax year 2018, you can choose to

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your form it 196 pdf form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form it 196 pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing form it 196 pdf online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit it 196 form 2021. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

How to fill out form it 196 pdf

01

To fill out form IT 196 in PDF format, you will need a device with internet access and a PDF reader installed.

02

Start by downloading the form IT 196 PDF from the official website of the relevant organization or agency that requires it.

03

Open the downloaded IT 196 form PDF using your PDF reader.

04

Read the instructions carefully. They should provide guidance on how to fill out each section of the form.

05

Begin filling out the form by entering your personal information, such as your name, address, and contact details.

06

Move on to the next section of the form, which may require you to provide details about your financial information, income, or tax obligations. Fill in these fields accurately and honestly.

07

If any sections of the form require attachments or supporting documents, make sure to gather those beforehand and attach them to the form as instructed.

08

Double-check all the information you have entered to ensure accuracy and completeness.

09

Once you have filled out all the necessary sections of the form, save a copy of the completed IT 196 PDF form on your device for your records.

10

If required by the organization or agency, submit the filled-out IT 196 form as instructed, either by mail or online.

Who needs form IT 196 PDF?

01

The form IT 196 is typically required by individuals or businesses that need to report specific financial information or tax obligations to the relevant tax authority or organization.

02

It may be needed by taxpayers who have certain accounts, assets, or financial activities that need to be disclosed for tax purposes.

03

The exact requirements for who needs to fill out form IT 196 will vary depending on the specific jurisdiction and regulations in place. Therefore, it is important to consult the appropriate tax authority or seek professional advice to determine whether you need to fill out this form.

Fill it 196 2020 pdf : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How to fill out form it 196 pdf?

The form IT-196 requires you to provide information about your income, deductions, and credits. To fill out this form, you need to have your tax documents and other financial information handy. Start by filling in the identifying information at the top of the form. Then, move on to the income section, which includes wages, unemployment income, dividends, interest, and other types of income. After that, move on to the deductions and credits section, which includes items like itemized deductions, education credits, and other credits. Finally, you need to provide information about any estimated tax payments you have made. Once you have filled out all the sections, double-check your work and sign the form.

What information must be reported on form it 196 pdf?

Form IT-196 is the New York State Tax Exempt Organization Registration Form. The information required on this form includes the organization’s legal name, address, employer identification number (EIN), date of formation, type of organization, and purpose of the organization. Additionally, this form requires the name, address, and telephone number of the organization’s primary contact person. The form also requires the organization to provide financial information, such as its gross income and total assets. Finally, the form requires the organization to provide a list of any related organizations.

What is the penalty for the late filing of form it 196 pdf?

The penalty for the late filing of Form IT-196 is 5% of the amount of taxes due plus an additional 5% for each month the filing is late, up to a maximum of 25%. Any unpaid taxes after the due date are subject to interest charges. In addition, criminal penalties may be imposed for willfully failing to file a return or paying taxes due.

Who is required to file form it 196 pdf?

The Form IT-196 is used by individuals who are residents of New York State but are not New York City residents, and who have certain types of income not subject to tax withholding. This includes income from sources such as partnerships, S corporations, estates, trusts, and rental properties. Therefore, individuals meeting these criteria would be required to file Form IT-196 PDF.

What is the purpose of form it 196 pdf?

Form IT-196 is a tax form used by residents of New York State to report and calculate their nonresident and part-year resident income tax liability. The form is used to determine the income tax owed by individuals who were not full-year residents of New York State or who moved in or out of the state during the tax year. It includes information about the individual's income, deductions, and credits to calculate the final tax owed to the state.

When is the deadline to file form it 196 pdf in 2023?

The deadline to file Form IT-196 PDF in 2023 is typically April 15th. However, please note that tax deadlines may vary depending on your specific circumstances and any extensions that may be granted by the tax authorities. It is recommended to check with the relevant tax authorities or consult a tax professional to verify the exact deadline for filing your Form IT-196 in 2023.

How do I modify my form it 196 pdf in Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your it 196 form 2021 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

Where do I find form it 196?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific form it 196 2021 and other forms. Find the template you need and change it using powerful tools.

Can I sign the it 196 electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your it 196 form.

Fill out your form it 196 pdf online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form It 196 is not the form you're looking for?Search for another form here.

Keywords relevant to it 196 fillable form

Related to it 196 form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.